Asian Dividend Stocks To Watch In December 2025

As the Bank of Japan raises its benchmark interest rate to a 30-year high and China's economic indicators show mixed signals, investors are closely monitoring how these developments might impact Asian markets. In this environment, dividend stocks can offer a stable income stream, making them an attractive option for those seeking reliable returns amidst fluctuating market conditions.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 3.76% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 5.20% | ★★★★★★ |

| Torigoe (TSE:2009) | 3.93% | ★★★★★★ |

| Kyoritsu Electric (TSE:6874) | 3.69% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.01% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.11% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.45% | ★★★★★★ |

| Changjiang Publishing & MediaLtd (SHSE:600757) | 4.59% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.74% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.28% | ★★★★★★ |

Click here to see the full list of 1019 stocks from our Top Asian Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

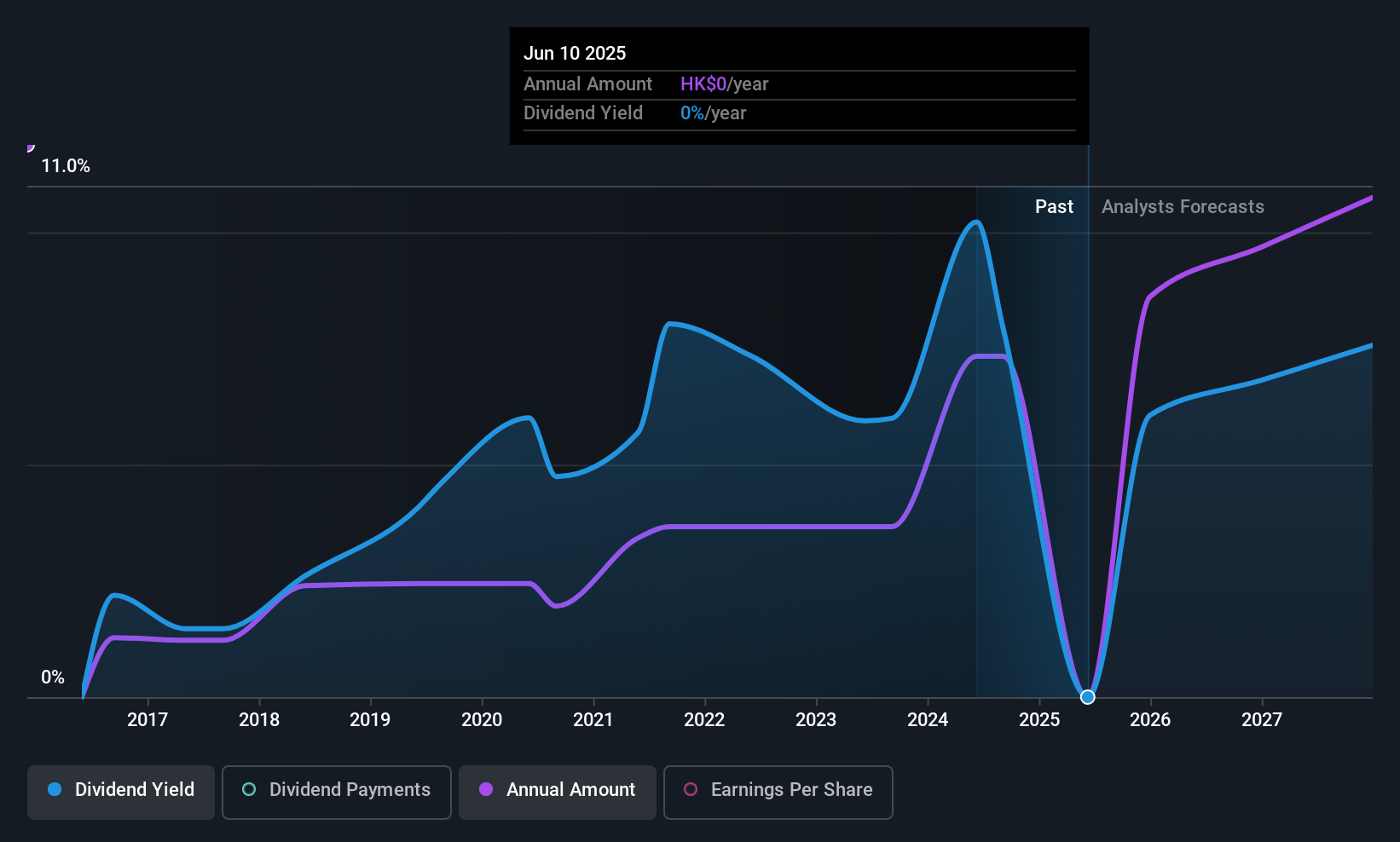

Consun Pharmaceutical Group (SEHK:1681)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Consun Pharmaceutical Group Limited operates in the People's Republic of China, focusing on the research, development, manufacture, and sale of Chinese medicines and medical contrast medium products with a market cap of HK$13.38 billion.

Operations: Consun Pharmaceutical Group Limited generates revenue from its Yulin Pharmaceutical Segment, amounting to CN¥469.22 million, and its Consun Pharmaceutical Segment, which accounts for CN¥2.82 billion.

Dividend Yield: 4.1%

Consun Pharmaceutical Group, trading at a significant discount to its estimated fair value and peers, presents both opportunities and challenges for dividend investors. While the company's dividends are well-covered by earnings (49.1% payout ratio) and cash flows (43.9% cash payout ratio), they have been volatile over the past decade despite recent growth. The dividend yield of 4.15% is lower than the top quartile in Hong Kong's market, reflecting potential limitations in income generation compared to leading dividend stocks.

- Take a closer look at Consun Pharmaceutical Group's potential here in our dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Consun Pharmaceutical Group shares in the market.

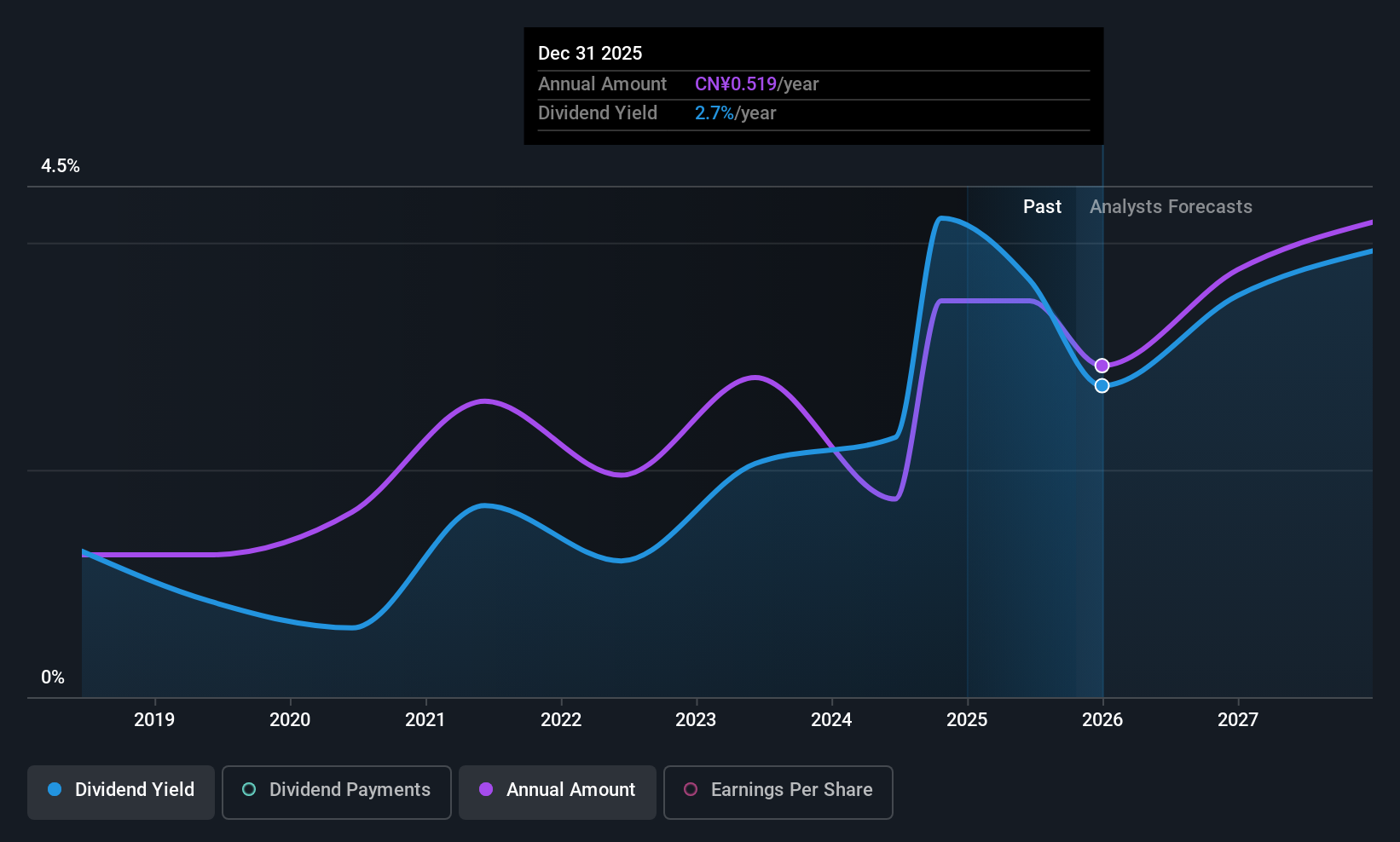

DaShenLin Pharmaceutical Group (SHSE:603233)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: DaShenLin Pharmaceutical Group Co., Ltd. engages in the manufacturing, distribution, and retailing of pharmaceutical products in China, with a market cap of CN¥21.01 billion.

Operations: DaShenLin Pharmaceutical Group Co., Ltd. generates revenue through its operations in manufacturing, distributing, and retailing pharmaceutical products within the Chinese market.

Dividend Yield: 3.7%

DaShenLin Pharmaceutical Group's dividend yield of 3.69% ranks among the top 25% in the Chinese market, yet its dividend history is marked by volatility and an unstable track record over eight years. Despite this, dividends are well-covered by earnings (64.3% payout ratio) and cash flows (19.7% cash payout ratio), supported by a robust earnings growth of 33.8%. Trading significantly below estimated fair value suggests potential capital appreciation alongside income prospects for investors.

- Navigate through the intricacies of DaShenLin Pharmaceutical Group with our comprehensive dividend report here.

- Our valuation report unveils the possibility DaShenLin Pharmaceutical Group's shares may be trading at a discount.

LiJiang YuLong Tourism (SZSE:002033)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: LiJiang YuLong Tourism Co., LTD. is involved in the development and operation of tourism businesses in China, with a market cap of CN¥5.23 billion.

Operations: LiJiang YuLong Tourism Co., LTD. generates its revenue from the development and operation of tourism-related activities within China.

Dividend Yield: 3.7%

LiJiang YuLong Tourism offers a dividend yield of 3.68%, placing it in the top 25% of Chinese dividend payers, yet its dividends have been inconsistent over the past decade. Despite a high payout ratio of 91.3%, indicating dividends are not well-covered by earnings, cash flows currently cover payouts with an 82.8% cash payout ratio. Recent earnings showed marginal growth, with net income nearly unchanged year-over-year at CNY 191.93 million for nine months ending September 2025.

- Click here to discover the nuances of LiJiang YuLong Tourism with our detailed analytical dividend report.

- Upon reviewing our latest valuation report, LiJiang YuLong Tourism's share price might be too optimistic.

Where To Now?

- Reveal the 1019 hidden gems among our Top Asian Dividend Stocks screener with a single click here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com