Is STAAR Surgical (STAA) Undervalued After Recent Share Price Pullback?

STAAR Surgical (STAA) has quietly turned into a contrarian idea, with the stock down over the past month and past 3 months even as revenue and net income growth look surprisingly strong on paper.

See our latest analysis for STAAR Surgical.

Zooming out, the recent pullback sits awkwardly against a modestly positive year to date 4.32 percent share price return and a slightly positive 1 year total shareholder return of 1.29 percent. However, the 3 year total shareholder return of negative 48.05 percent shows how long term momentum has clearly faded despite improving fundamentals.

If this kind of mixed setup has you rethinking your healthcare exposure, it could be worth exploring other potential opportunities across healthcare stocks to see how STAAR Surgical stacks up.

With revenue climbing and losses narrowing as the share price drifts, investors face a familiar tension: is STAAR Surgical now trading at a meaningful discount, or is the market already pricing in the next leg of growth?

Most Popular Narrative: 2.8% Undervalued

With the fair value estimate of $25.88 sitting slightly above the last close at $25.14, the prevailing narrative leans toward modest upside grounded in fundamentals.

STAAR Surgical has significant cash reserves and no debt, providing a strong financial base to navigate the current challenges, reduce production outputs temporarily, and invest selectively in growth initiatives, potentially stabilizing earnings and providing upside if conditions improve.

Curious how a debt free balance sheet, rising margins and ambitious long term earnings projections can still justify such a restrained upside signal? The full narrative unpacks the growth runway, the profit inflection, and the rich valuation multiple that must all line up perfectly for this price to make sense.

Result: Fair Value of $25.88 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering weakness in China and uncertainty around distributor inventory levels could easily derail the expected rebound and undermine today’s modest undervaluation case.

Find out about the key risks to this STAAR Surgical narrative.

Another View: Multiples Send a Different Signal

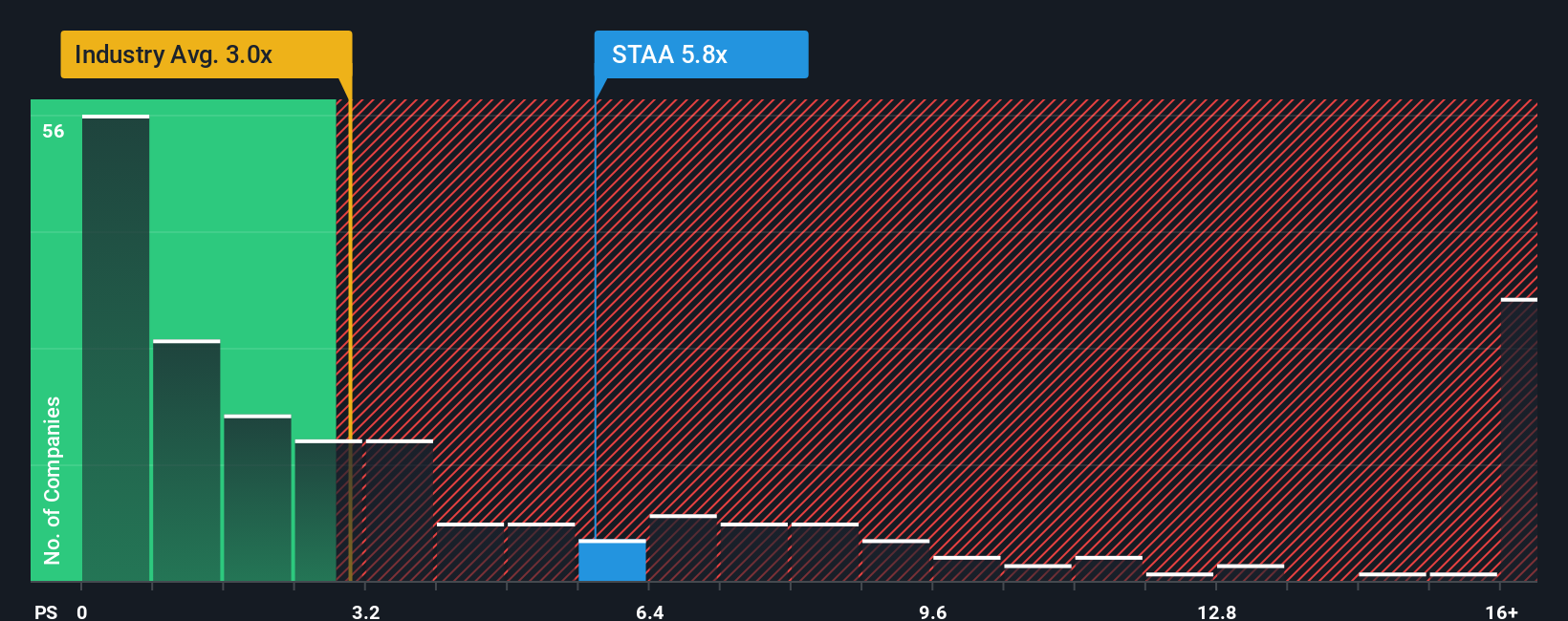

While the narrative and fair value estimate suggest modest upside, STAAR Surgical’s price to sales ratio of 5.4 times paints a richer picture than the numbers alone. It sits well above both peers at 3.6 times and the US Medical Equipment industry at 3.1 times, and even exceeds its own 3.8 times fair ratio, which implies that the market already bakes in a lot of future growth.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own STAAR Surgical Narrative

If you prefer to stress test these assumptions yourself and follow your own process, you can build a fresh STAAR Surgical view in under three minutes: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding STAAR Surgical.

Ready for your next investing move?

Put your research into action and strengthen your portfolio by scanning fresh ideas on Simply Wall St, so you never miss the next standout opportunity.

- Target reliable income streams by reviewing these 12 dividend stocks with yields > 3% that can potentially support long term returns and cushion market volatility.

- Capitalize on innovation by tracking these 24 AI penny stocks positioned to benefit from the accelerating adoption of artificial intelligence across industries.

- Sharpen your value strategy by filtering for these 913 undervalued stocks based on cash flows and spot pricing mismatches the market has not fully recognized yet.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com