ConnectOne Bancorp (CNOB) Valuation Check as Risk Leadership Transitions to New Chief Risk Officer

ConnectOne Bancorp (CNOB) is reshuffling a key seat at the risk table, with longtime Chief Risk Officer Michael O’Malley set to depart at year end and veteran risk executive Mark Pappas stepping into the role.

See our latest analysis for ConnectOne Bancorp.

The reshuffle in ConnectOne’s risk leadership comes as investors have been warming to the story. A 30 day share price return of 12.99 percent has helped extend its year to date share price gain of 22.41 percent and a 1 year total shareholder return of 22.11 percent, suggesting momentum is building as markets reassess both growth prospects and risk controls.

If you are weighing how this kind of leadership change might play out elsewhere in your portfolio, it could be a good moment to explore fast growing stocks with high insider ownership.

With earnings growing faster than revenue, a sizeable intrinsic discount and only a modest gap to Wall Street targets, investors now face a key question: is ConnectOne still mispriced, or already reflecting its next leg of growth?

Most Popular Narrative: 9.9% Undervalued

Based on the most followed narrative, ConnectOne Bancorp’s fair value of $30.60 sits above the recent $27.58 close. This frames a modest upside grounded in aggressive growth and margin assumptions.

The pipeline for commercial, SBA, construction, and residential loans is described as "strong," with loan growth opportunities and high current loan yields, highlighting potential for future revenue growth and improved earnings as the expanded footprint leverages secular economic and population growth in the New York and New Jersey regions.

Behind this valuation sits a bold playbook that hinges on rapid top line expansion, surging margins and a future earnings multiple that reshapes how a regional bank is priced. Curious what powers that forecast path?

Result: Fair Value of $30.60 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising commercial real estate exposure and the challenge of integrating recent acquisitions could quickly upend optimistic expectations for margins and earnings.

Find out about the key risks to this ConnectOne Bancorp narrative.

Another Lens on Value

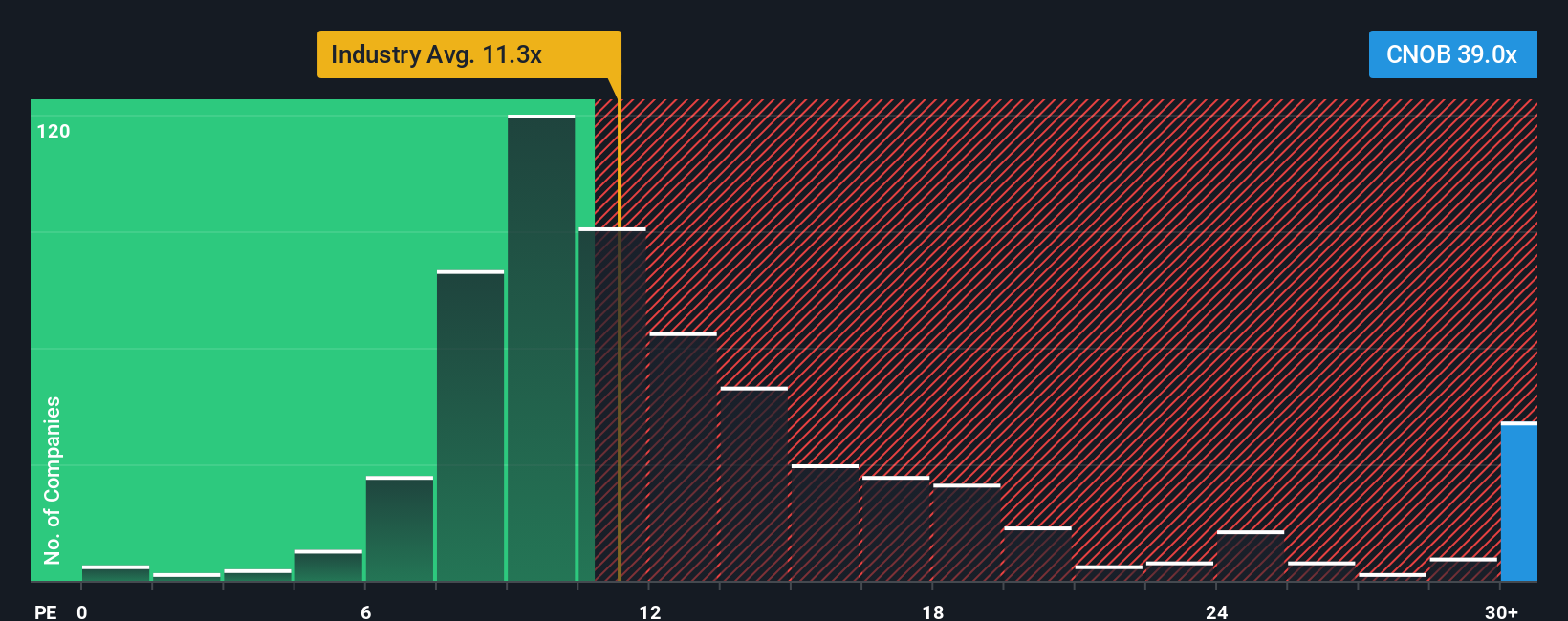

On earnings, the picture looks very different. ConnectOne trades on a P/E of about 25.1 times, versus a fair ratio of 22.8 times and roughly 11.9 times for the wider US banks sector and 17.6 times for peers, hinting at richer expectations and less margin for error. Are investors paying up too early?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own ConnectOne Bancorp Narrative

If you would rather dig into the numbers yourself and challenge these assumptions, you can craft a personalized view in just minutes using Do it your way.

A great starting point for your ConnectOne Bancorp research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Ready for more investing angles?

Stop waiting for the next idea to land in your lap. Use the Simply Wall Street Screener to uncover focused opportunities that other investors may be overlooking.

- Target income potential by screening for companies offering consistent payouts with these 12 dividend stocks with yields > 3% that match your yield goals.

- Capitalize on market mispricing by surfacing quality businesses trading below fair value through these 913 undervalued stocks based on cash flows tailored to your strategy.

- Position ahead of financial innovation by scanning for companies driving decentralized finance and blockchain adoption via these 79 cryptocurrency and blockchain stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com