How Kamigumi’s Potential Presidential Transition At Kamigumi (TSE:9364) Has Changed Its Investment Story

- On December 12, 2025, Kamigumi Co., Ltd. held a board meeting to consider a change in its Representative Director (President), underscoring a potential leadership transition at the top of the company.

- This prospective shift in the presidency marks a meaningful corporate governance moment that could influence how investors interpret Kamigumi’s long-term direction and priorities.

- We will now examine how the potential change in Kamigumi’s Representative Director shapes the company’s investment narrative and leadership outlook.

These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is Kamigumi's Investment Narrative?

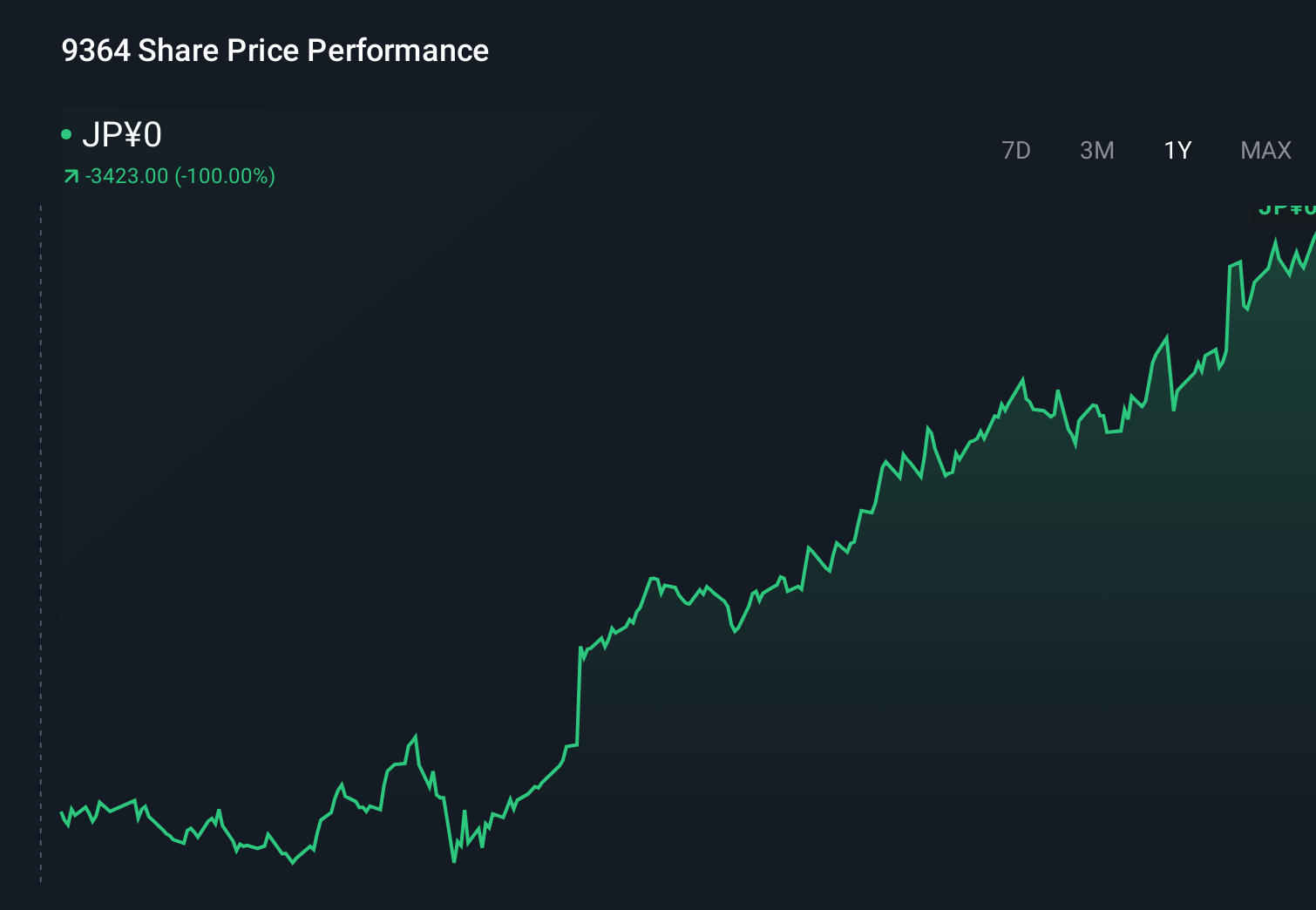

For someone considering Kamigumi, the core belief is that its port and logistics franchise can keep compounding steadily, with disciplined capital returns cushioning relatively modest growth. Recent guidance points to incremental revenue and earnings progress, paired with a materially higher dividend payout target and an active buyback, which have helped support strong multi‑year total returns despite a richer earnings multiple than peers. The December 12 board meeting to consider changing the Representative Director comes on top of an already “young” management team, so investors will be watching closely for continuity around the MTMP 2030 plan, the 70% payout ambition, and capital allocation discipline. At this stage, the announcement alone does not yet look like a thesis‑breaking event, but it could tilt how investors weigh governance quality against valuation and growth risks.

However, there is one governance‑related risk here that investors should not ignore. Kamigumi's share price has been on the slide but might be up to 5% below fair value. Find out if it's a bargain.Exploring Other Perspectives

Explore another fair value estimate on Kamigumi - why the stock might be worth as much as ¥5300!

Build Your Own Kamigumi Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kamigumi research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Kamigumi research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kamigumi's overall financial health at a glance.

Contemplating Other Strategies?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 34 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com