Lennar (LEN): Revisiting Valuation After Recent Share Price Slide

Lennar (LEN) has been sliding lately, with the stock down about 12% over the past month and roughly 19% year to date, prompting investors to revisit what they are actually paying for.

See our latest analysis for Lennar.

That slide reflects a clear shift in sentiment, with the share price now at $107.99 and negative short term share price returns contrasting with a still solid multi year total shareholder return. This suggests that longer term momentum is cooling rather than breaking.

If Lennar’s recent volatility has you rethinking where to find steadier growth stories, it could be a good moment to explore fast growing stocks with high insider ownership.

With Lennar still growing revenue and profits but trading below analyst targets and at a discount to some intrinsic value estimates, investors face a key question: is this a genuine buying opportunity, or has the market already priced in the future growth?

Most Popular Narrative Narrative: 15.1% Undervalued

With Lennar last closing at $107.99 against a narrative fair value of about $127.13, the valuation case leans on how margins and volumes evolve from here.

The analysts have a consensus price target of $124.0 for Lennar based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $159.0, and the most bearish reporting a price target of just $95.0.

Want to see what kind of revenue climb, margin reset, and future earnings multiple need to line up to support that higher valuation band? The full narrative lays out the playbook driving that fair value, from growth expectations to how long the market might reward Lennar with a richer earnings multiple.

Result: Fair Value of $127.13 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, stubbornly high mortgage rates and persistent affordability pressures could delay margin recovery and undermine the growth assumptions underpinning Lennar’s current fair value narrative.

Find out about the key risks to this Lennar narrative.

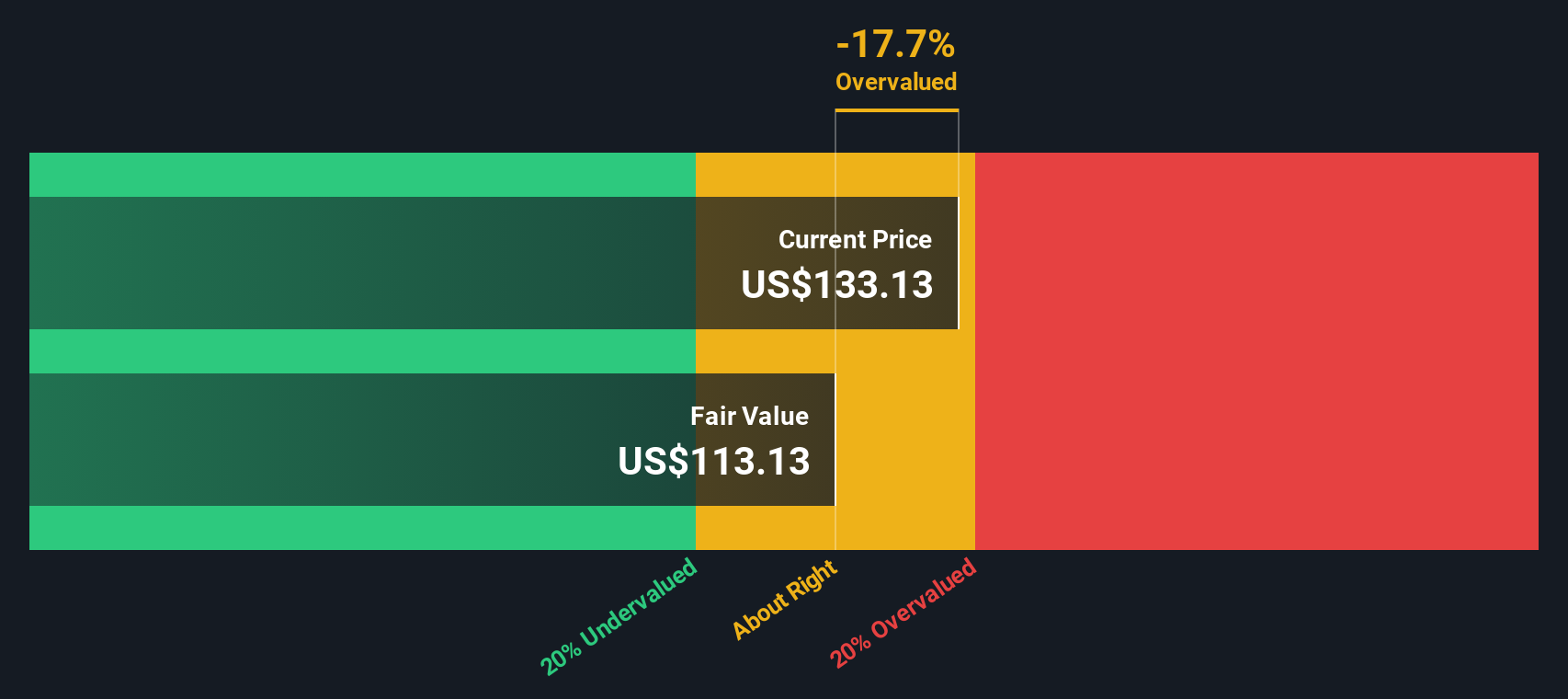

Another Angle on Valuation

Our DCF model tells a different story, suggesting Lennar’s fair value is closer to $91.05, which would make the current $107.99 share price look overvalued, not cheap. If cash flow assumptions are right and growth fades, is today’s pullback really a bargain or a value trap?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Lennar for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 913 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Lennar Narrative

If you want to challenge these assumptions or dig into the numbers yourself, you can build a complete, personalized view in minutes: Do it your way.

A great starting point for your Lennar research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investing move?

Before you log off, set yourself up for the next opportunity by lining up fresh ideas in minutes with these targeted, data driven stock screens.

- Capitalize on potential mispricings by reviewing these 913 undervalued stocks based on cash flows that could offer more upside for every dollar you commit.

- Strengthen your income stream by targeting these 12 dividend stocks with yields > 3% that aim to keep cash flowing into your account.

- Ride powerful innovation trends by focusing on these 24 AI penny stocks positioned at the forefront of artificial intelligence adoption.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com