Undiscovered Gems In Asia Featuring Three Promising Small Caps

As the Asian markets navigate a complex landscape marked by Japan's highest interest rates in three decades and China's mixed economic signals, small-cap stocks are drawing attention for their potential resilience and growth opportunities. In this environment, identifying promising small caps involves looking for companies with strong fundamentals that can capitalize on regional economic shifts and evolving market dynamics.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sinopower Semiconductor | NA | 0.10% | -10.24% | ★★★★★★ |

| Woori Technology Investment | NA | 8.42% | -4.10% | ★★★★★★ |

| Natural Food International Holding | NA | 8.04% | 37.71% | ★★★★★★ |

| Central Forest Group | NA | 5.20% | 24.71% | ★★★★★★ |

| Synergy Innovation | 11.47% | 14.41% | 54.74% | ★★★★★★ |

| Tibet Rhodiola Pharmaceutical Holding | 24.54% | 12.67% | 25.39% | ★★★★★☆ |

| Apacer Technology | 9.82% | 1.89% | 0.97% | ★★★★☆☆ |

| Shenzhen Leaguer | 64.21% | -0.72% | -21.33% | ★★★★☆☆ |

| Hospital Corporation of China | 138.30% | 28.23% | 50.13% | ★★★★☆☆ |

| Shenzhen LiantronicsLtd | 218.35% | -12.53% | 83.11% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Consun Pharmaceutical Group (SEHK:1681)

Simply Wall St Value Rating: ★★★★★★

Overview: Consun Pharmaceutical Group Limited engages in the research, development, manufacturing, and sale of Chinese medicines and medical contrast medium products in China, with a market cap of approximately HK$13.38 billion.

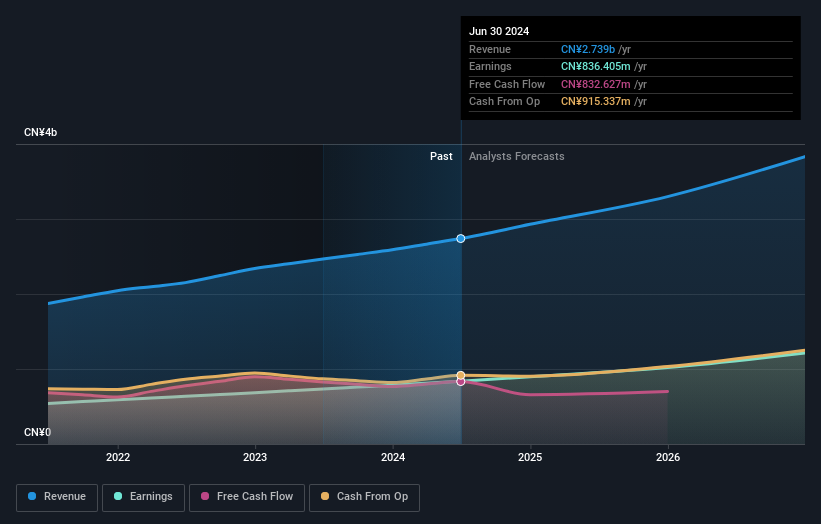

Operations: The company's revenue primarily comes from the Consun Pharmaceutical Segment, generating CN¥2.82 billion, followed by the Yulin Pharmaceutical Segment with CN¥469.22 million. The business incurs a segment adjustment of -CN¥21.36 million impacting overall financial results.

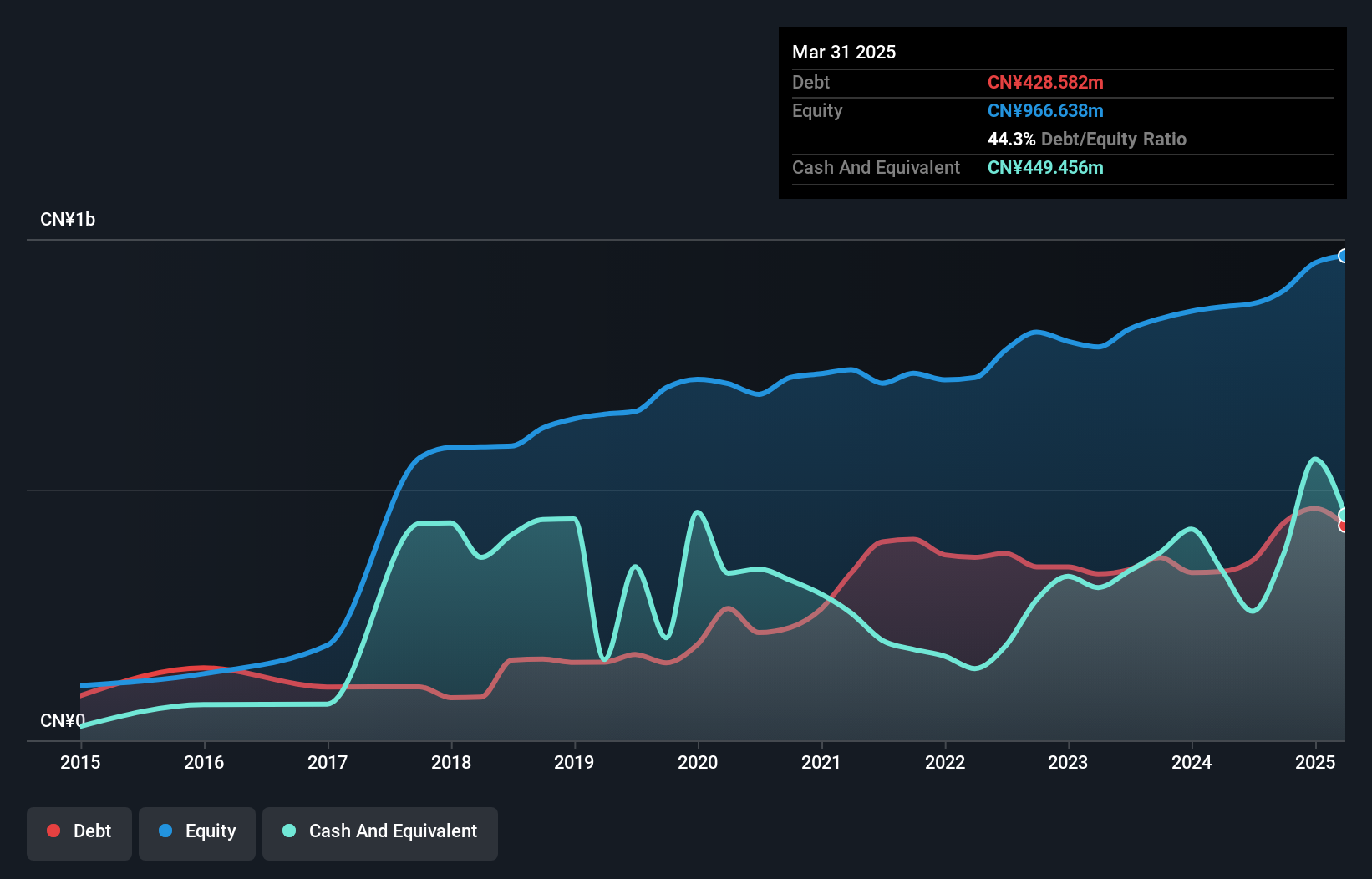

Consun Pharmaceutical Group, a prominent player in the pharmaceutical sector, is trading at 37.9% below its estimated fair value, indicating potential undervaluation. The company has demonstrated robust earnings growth of 20.6% over the past year, significantly outpacing the industry average of -9.1%. With a debt-to-equity ratio reduced from 25.1% to 5.1% over five years and more cash than total debt, financial stability seems assured. Recent changes include proposed amendments to their memorandum and articles for handling treasury shares as per Cayman Islands laws, reflecting strategic alignment with regulatory updates for future flexibility in share management.

- Click here and access our complete health analysis report to understand the dynamics of Consun Pharmaceutical Group.

Understand Consun Pharmaceutical Group's track record by examining our Past report.

Cre8 Direct (NingBo) (SZSE:300703)

Simply Wall St Value Rating: ★★★★★☆

Overview: Cre8 Direct (NingBo) Co., Ltd. operates in the design, production, processing, and sale of paper products primarily in North America and has a market capitalization of approximately CN¥5.09 billion.

Operations: Cre8 Direct (NingBo) generates its revenue primarily from the sale of paper and paper products, amounting to approximately CN¥2.16 billion. The company's financial performance is influenced by factors affecting its gross profit margin, which reflects the efficiency of production and sales operations.

Cre8 Direct (NingBo) has shown impressive growth with earnings surging 83.3% over the past year, outpacing the Forestry industry. Their net debt to equity ratio stands at 3.3%, considered satisfactory, while their interest payments are well-covered by EBIT at 128 times coverage. The company recently repurchased 3.67 million shares for CNY 110 million, representing a strategic move under its buyback program announced in September 2025. Recent financial results show sales of CNY 1.60 billion and net income of CNY 79.65 million for the nine months ending September, reflecting solid performance amidst market volatility.

- Delve into the full analysis health report here for a deeper understanding of Cre8 Direct (NingBo).

Evaluate Cre8 Direct (NingBo)'s historical performance by accessing our past performance report.

GKG Precision Machine (SZSE:301338)

Simply Wall St Value Rating: ★★★★★★

Overview: GKG Precision Machine Co., Ltd. specializes in providing precision automation equipment both in China and internationally, with a market cap of CN¥7.72 billion.

Operations: GKG Precision Machine generates revenue primarily from its precision automation equipment business. The company has reported a gross profit margin of 45% in the latest period, reflecting its efficiency in managing production costs relative to revenue.

GKG Precision Machine, a nimble player in the machinery sector, has shown impressive financial performance with earnings growth of 169.4% over the past year, outpacing the industry average of 6.1%. The company reported sales of CNY 774.92 million for nine months ending September 2025, up from CNY 577.38 million a year prior, while net income rose to CNY 121.26 million from CNY 44.04 million. With no debt on its books compared to a debt-to-equity ratio of 9% five years ago and high-quality earnings, GKG appears poised for sustainable growth amidst recent executive board changes and strategic project adjustments.

- Navigate through the intricacies of GKG Precision Machine with our comprehensive health report here.

Summing It All Up

- Unlock more gems! Our Asian Undiscovered Gems With Strong Fundamentals screener has unearthed 2489 more companies for you to explore.Click here to unveil our expertly curated list of 2492 Asian Undiscovered Gems With Strong Fundamentals.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com