IDC: Structural restructuring of AI-driven memory chip production capacity 2026 technology products may increase prices due to limited supply

The Zhitong Finance App learned that IDC published an article stating that the shortage of memory, which began with the AI infrastructure boom, has now had a ripple effect. The global semiconductor ecosystem is experiencing an unprecedented shortage of memory chips and reshaping the product strategies and pricing logic of consumer and enterprise devices. The smartphone and PC market will enter an adjustment period of “high costs, product roadmap adjustments, and slowing sales growth.” 2026 is likely to be a year where prices for technology products rise due to supply restrictions rather than increased demand.

At the end of 2025, as demand for AI data centers continued to exceed supply, causing an imbalance between supply and demand, DRAM prices had soared sharply. There is a shortage of memory chips, and its knock-on effect is likely to continue until 2027, affecting equipment manufacturers and end users.

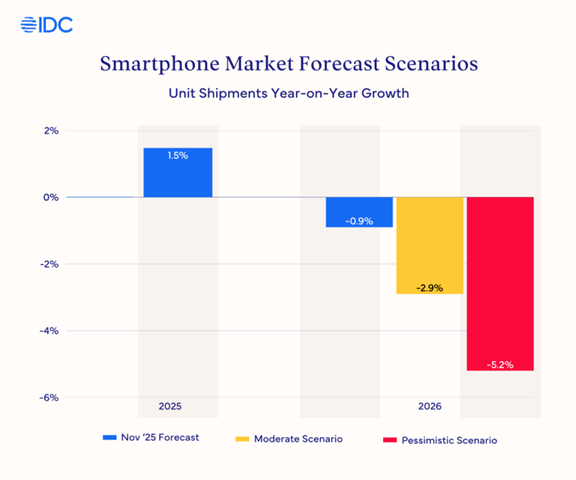

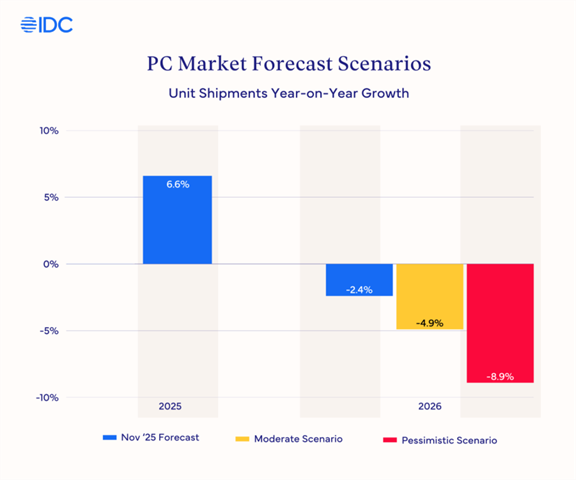

Since there is still uncertainty about the current situation, IDC has kept the original official forecast unchanged for the time being, but it proposes two possible downside risk scenarios for the two key markets of smartphones and personal computers.

I. Causes of Shortage: AI-Driven Structural Restructuring of Production Capacity

The memory market is at an unprecedented turning point, and demand is growing significantly faster than supply. For the semiconductor industry, which has long been dominated by a “boom-bust cycle,” this shortage is inherently unique: the rapid expansion of AI infrastructure and job requirements is putting tremendous pressure on the memory ecosystem. These AI jobs require massive memory support, and one of the core drivers of the shortage is that manufacturers are shifting production capacity from consumer electronics products to higher-margin AI-specific memory solutions — mainstream memory vendors are no longer expanding traditional DRAM and NAND production capacity used in consumer electronics such as smartphones and PCs, but instead focusing on high-bandwidth memory (HBM) and high-capacity fifth-generation DDR memory (DDR5) required for AI data centers. This shift has limited the supply of general-purpose memory modules, driving up the price of all types of memory.

The demand for single-system memory for AI servers and enterprise-grade devices far exceeds that of consumer-grade devices, so AI infrastructure construction is taking up most of the global memory production capacity, causing a shortage of supply. Suppliers prioritize orders from hyperscalers (hyperscalers) and AI server original equipment manufacturers (OEMs), leading to a sharp decline in the amount of DRAM available for consumer devices, further increasing price pressure in a tight market.

More importantly, this shortage is not simply a cyclical fluctuation caused by a mismatch between supply and demand, but rather a strategic and potentially permanent reallocation of global silicon wafer production capacity to high-value-added fields. For decades, DRAM and NAND used in smartphones and PCs have been the core drivers of semiconductor capacity expansion, but now this pattern has completely reversed. Massive demand for HBM from hyperscale technology companies such as Microsoft, Google, Meta, and Amazon has forced the three major memory manufacturers (Samsung Semiconductor, SK Hynix, and Micron Technology) to shift limited production capacity and capital expenditure to enterprise-grade components with higher profit margins. This is essentially a zero-sum game: every HBM silicon chip assigned to Nvidia's GPU means that the LPDDR5X memory of a mid-range smartphone or the solid-state drive (SSD) of a consumer-grade laptop will lose corresponding production capacity.

Based on this, IDC predicts that DRAM and NAND flash memory supply growth in 2026 will be lower than the historical average, increasing 16% and 17% year over year, respectively.

II. Equipment market crisis: soaring prices and limited supply

The imbalance between supply and demand has had two major direct effects: DRAM and NAND/SSD prices have risen sharply in recent months, and the supply of these core components has been limited, forcing manufacturers to cope with a dynamically changing market environment.

Potential impact on the smartphone market

In 2026, the global smartphone market (Android vendors in particular) will face serious challenges. The industry's decade-long trend of “democratizing high-end configurations” is being reversed — that is, the process of devolving the functionality of flagship models to affordable smartphones will be blocked.

The cost structure of smartphones is highly dependent on memory configuration: mid-range models account for 15% to 20% of BOM costs, while high-end flagship models account for about 10% to 15%. As memory prices continue to soar, OEMs may have to drastically raise prices, reduce configurations, or both

Vendor Influence Differentiation: Supply Chain Resilience Determines Victory or Loss

The impact brought about by the shortage is markedly asymmetrical, and supply chain resilience and vertical integration capabilities will be the key to competition among manufacturers:

Manufacturers focusing on the low-end market (such as TCL, Voice, Genuine Me, OPPO, Vivo, Honor, etc.) will be hit hard. The business model of these vendors is based on meager profits, and rising memory costs will seriously squeeze their profit margins, and eventually some or all of the costs will have to be passed on to end users.

Apple (AAPL.US) and Samsung in the high-end market are under pressure, but they have structural hedging advantages: sufficient cash reserves and long-term supply agreements enable them to lock in memory supply 12-24 months in advance. However, the new flagship model in 2026 may not upgrade the memory configuration (Pro version may maintain 12GB of RAM instead of increasing to 16GB), and the price reduction of the old model may also decrease after the new model is released.

Under the combination of multiple pressures, the global smartphone market will present a pattern of “scale contraction+average price increase”:

Moderate downside scenario: in 2026, the market size decreased by 2.9% year on year, and the average selling price (ASP) increased by 3%-5%;

Pessimistic downside scenario: market size decreased by 5.2% year on year, and ASP rose 6%-8%.

The price increase will be more significant in the lower end market (due to extremely low profit margins in this price segment, manufacturers lack space to absorb costs).

Regardless of the severity of the scenario, markets where rising costs lead to declining purchasing power will experience extended switching cycles; in mature markets, consumers may absorb price increases through financing and installment plans.

It is worth noting that despite significant downside risks in the market size in 2026, the smartphone market performance in the fourth quarter of 2025 may exceed IDC's previous forecasts as manufacturers prepare goods in advance to cope with subsequent price increases.

The impact of the PC market: disruptive impact under the superposition of multiple cycles

If the smartphone market is under pressure, the PC market is experiencing disruptive shocks. The time point of memory shortage is superimposed on the end of the Microsoft Windows 10 system life cycle (switching cycle) and the AI PC marketing cycle, creating a “perfect storm” for the PC industry.

Price increases and market share restructuring

As cost pressure intensified in the second half of 2026, PC manufacturers have released comprehensive price increases: Lenovo (00992), Dell (DELL.US), HP (HPQ.US), Acer, Asus, etc. have all issued early warnings to customers, confirming that the industry will generally raise prices by 15%-20% and restart contract negotiations.

PC vendors with larger shipments are better able to cope with current supply restrictions and are expected to seize market share from small to medium regional brands. Regardless of the extent to which the overall market size is impacted, leading manufacturers with inventory advantages and supplier bargaining power will further expand their market share.

In contrast, white-label vendors and low-end (usually local) vendors will be under the greatest pressure, including the DIY (DIY) market commonly used by gamers. This creates an opportunity for large OEMs to seize share from smaller game builders by positioning pre-installed models as “cost-effective options.”

The growth of AI PCs is being held back

Memory shortages could hamper the AI PC industry's growth narrative. IDC defines an AI PC as a personal computer equipped with a neural network processor (NPU), and this type of device usually requires more memory (the minimum memory requirement for a Microsoft Copilot+ certified PC is 16GB). As more small language models (SLM) and large language models (LLM) migrate to end devices, the importance of memory is further highlighted, and many high-end models are planning to upgrade to 32GB or more memory configurations. However, at a critical point in the industry where memory allocation needs to be increased, not only is the supply of memory tight, but the cost is also unattainable — this will cause AI PC prices to rise, manufacturer profit margins to decline, or forced to reduce the memory configuration of new models during the critical period of market promotion.

Market size and price prediction

IDC has yet to adjust its official PC market forecast, but proposes two downside scenarios for 2026:

Moderate downside scenario: market size fell 4.9% year on year (further increase from the 2.4% decline predicted in November), and ASP rose 4%-6%;

Pessimistic downside scenario: market size fell 8.9% year on year, and ASP rose 6%-8%.

The severity of the scenario depends largely on how long the 2026 supply restrictions last. Similar to the smartphone market, PC channel providers are preparing goods in advance to mitigate the impact of subsequent price increases, and it is expected that the PC market performance in the fourth quarter of 2025 will exceed the November forecast.