Reassessing Lineage (LINE) Valuation After Baird Downgrade and Cautious Analyst Sentiment

Baird’s downgrade of Lineage (LINE) to Neutral has put fresh pressure on a stock already down sharply this year, crystallizing growing concerns about near term performance and investor patience.

See our latest analysis for Lineage.

That downgrade lands after a tough stretch, with a year to date share price return of minus 41.5% and a 1 year total shareholder return of minus 39.1%. This shows momentum has clearly been fading despite Lineage’s scale and growth profile.

If this shift in sentiment has you reassessing opportunities, it could be worth exploring fast growing stocks with high insider ownership for other names where confidence and ownership are more clearly aligned.

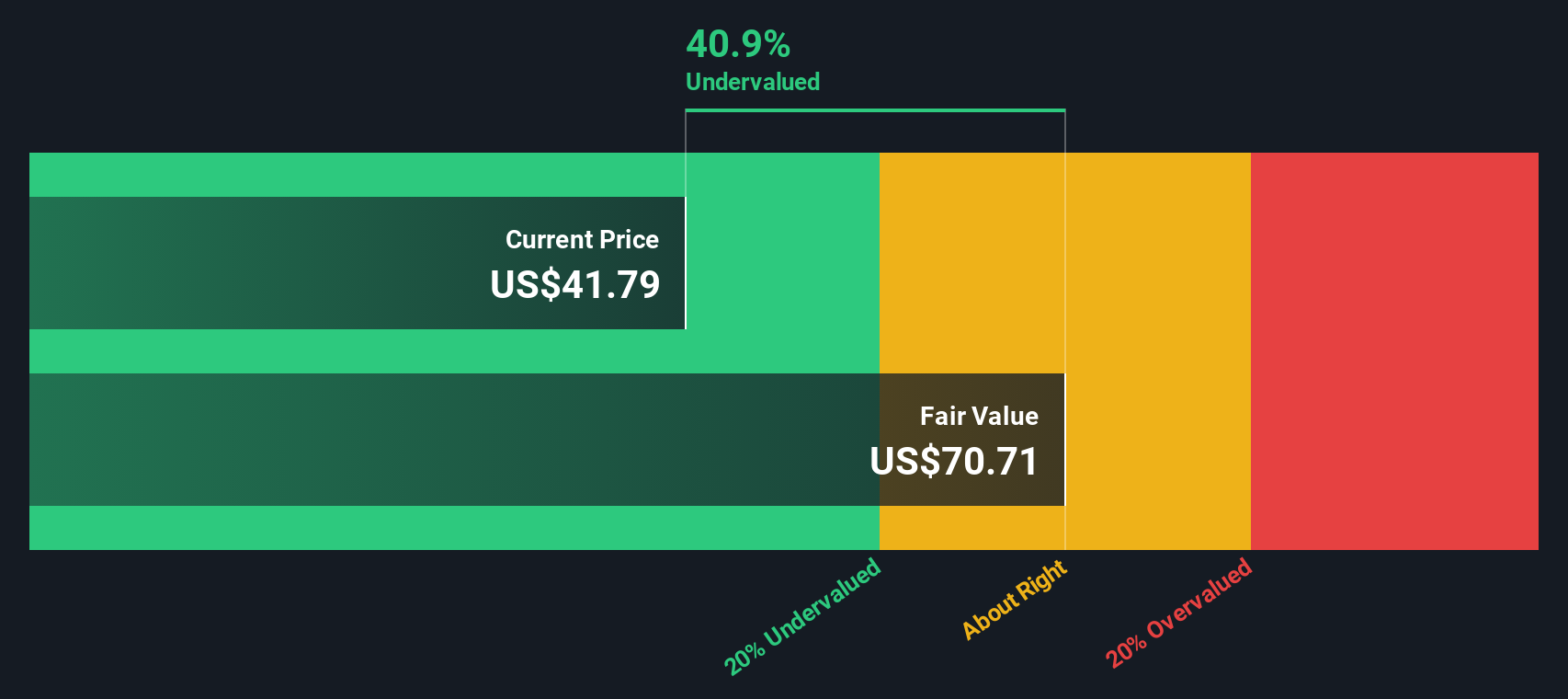

With the stock trading well below both its analyst price target and some estimates of intrinsic value, yet still posting losses and facing cautious ratings, is this punishment overdone, or is the market simply anticipating slower growth from here?

Price-to-Sales of 1.5x, Is it justified?

On a price-to-sales ratio of 1.5x and a last close of $34.13, Lineage screens as materially undervalued versus both peers and broad Industrial REIT benchmarks.

The price-to-sales multiple compares the company’s market value to its annual revenue, a useful gauge for a business that is currently loss making but still generating substantial top line. For a global temperature controlled warehouse REIT with a scaled footprint and steady, though modest, revenue growth, this lens highlights how much investors are paying for each dollar of sales despite the absence of profitability.

Lineage’s 1.5x price-to-sales sits far below the estimated fair price-to-sales ratio of 2.3x, implying the market is assigning a heavy discount relative to what our model suggests revenue could justify over time. The gap is even starker when compared with the peer average of 10.7x and the Global Industrial REITs industry average of 8.8x, underscoring how harshly this stock is being marked down despite its scale and positioning.

Explore the SWS fair ratio for Lineage

Result: Price-to-Sales of 1.5x (UNDERVALUED)

However, investor skepticism may persist if losses remain entrenched and revenue growth, while positive, continues to lag expectations for a premium Industrial REIT multiple.

Find out about the key risks to this Lineage narrative.

Another View, What Does Our DCF Say?

While the price to sales ratio indicates potential value, our DCF model is more generous, suggesting Lineage’s fair value sits at $61.85 versus the current $34.13. That represents a steep implied discount. The key question is whether a business expected to stay unprofitable can realistically close that gap over time.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Lineage for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 903 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Lineage Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalized view in just a few minutes: Do it your way.

A great starting point for your Lineage research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investing move?

Before you move on, consider using the Simply Wall Street Screener to uncover focused ideas tailored to what you want your portfolio to achieve.

- Explore potential growth at accessible prices by scanning these 3632 penny stocks with strong financials that combine smaller market caps with solid fundamentals.

- Position yourself for developments in technology by filtering for these 24 AI penny stocks involved in automation, data intelligence, and real-world AI adoption.

- Review these 12 dividend stocks with yields > 3% with yields above 3% while still considering overall financial quality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com