Market Participants Recognise 1957 & Co. (Hospitality) Limited's (HKG:8495) Revenues Pushing Shares 34% Higher

Despite an already strong run, 1957 & Co. (Hospitality) Limited (HKG:8495) shares have been powering on, with a gain of 34% in the last thirty days. The annual gain comes to 135% following the latest surge, making investors sit up and take notice.

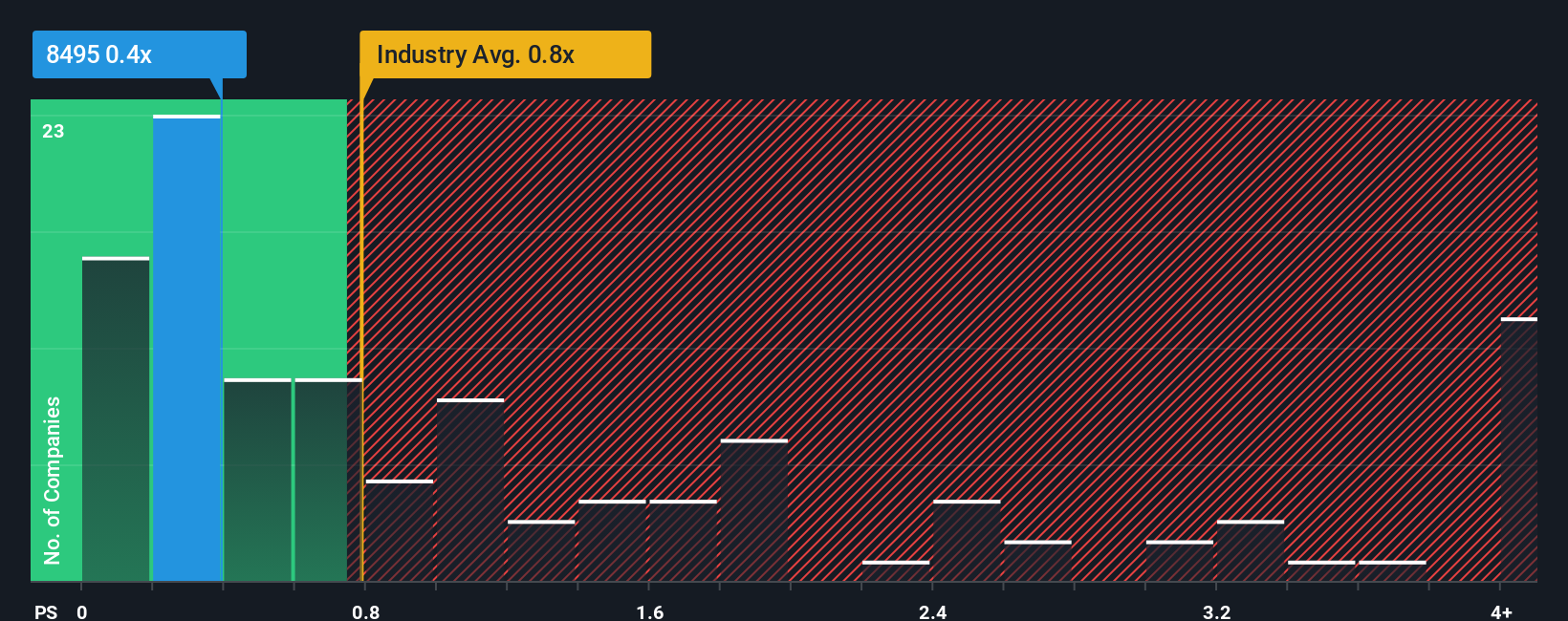

Even after such a large jump in price, there still wouldn't be many who think 1957 (Hospitality)'s price-to-sales (or "P/S") ratio of 0.4x is worth a mention when the median P/S in Hong Kong's Hospitality industry is similar at about 0.8x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for 1957 (Hospitality)

How Has 1957 (Hospitality) Performed Recently?

For instance, 1957 (Hospitality)'s receding revenue in recent times would have to be some food for thought. It might be that many expect the company to put the disappointing revenue performance behind them over the coming period, which has kept the P/S from falling. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on 1957 (Hospitality) will help you shine a light on its historical performance.Is There Some Revenue Growth Forecasted For 1957 (Hospitality)?

The only time you'd be comfortable seeing a P/S like 1957 (Hospitality)'s is when the company's growth is tracking the industry closely.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 3.7%. Even so, admirably revenue has lifted 37% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Weighing that recent medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 13% shows it's about the same on an annualised basis.

With this information, we can see why 1957 (Hospitality) is trading at a fairly similar P/S to the industry. It seems most investors are expecting to see average growth rates continue into the future and are only willing to pay a moderate amount for the stock.

What We Can Learn From 1957 (Hospitality)'s P/S?

Its shares have lifted substantially and now 1957 (Hospitality)'s P/S is back within range of the industry median. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

It appears to us that 1957 (Hospitality) maintains its moderate P/S off the back of its recent three-year growth being in line with the wider industry forecast. Currently, with a past revenue trend that aligns closely wit the industry outlook, shareholders are confident the company's future revenue outlook won't contain any major surprises. Unless the recent medium-term conditions change, they will continue to support the share price at these levels.

Having said that, be aware 1957 (Hospitality) is showing 3 warning signs in our investment analysis, you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.