How Investors May Respond To Glory (TSE:6457) Winning Waitrose Rollout For CI-100X Cash Recyclers

- In December 2025, Glory announced that UK supermarket chain Waitrose selected its CI-100X solution, with 285 back office cash recycling devices being rolled out across stores nationwide to streamline cash handling operations.

- This contract underlines how Glory’s cash automation technology is being adopted by a major international retailer, potentially reinforcing the company’s positioning in global cash management solutions.

- We’ll now examine how this large Waitrose rollout, centered on Glory’s CI-100X cash recyclers, could influence the company’s broader investment narrative.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

What Is Glory's Investment Narrative?

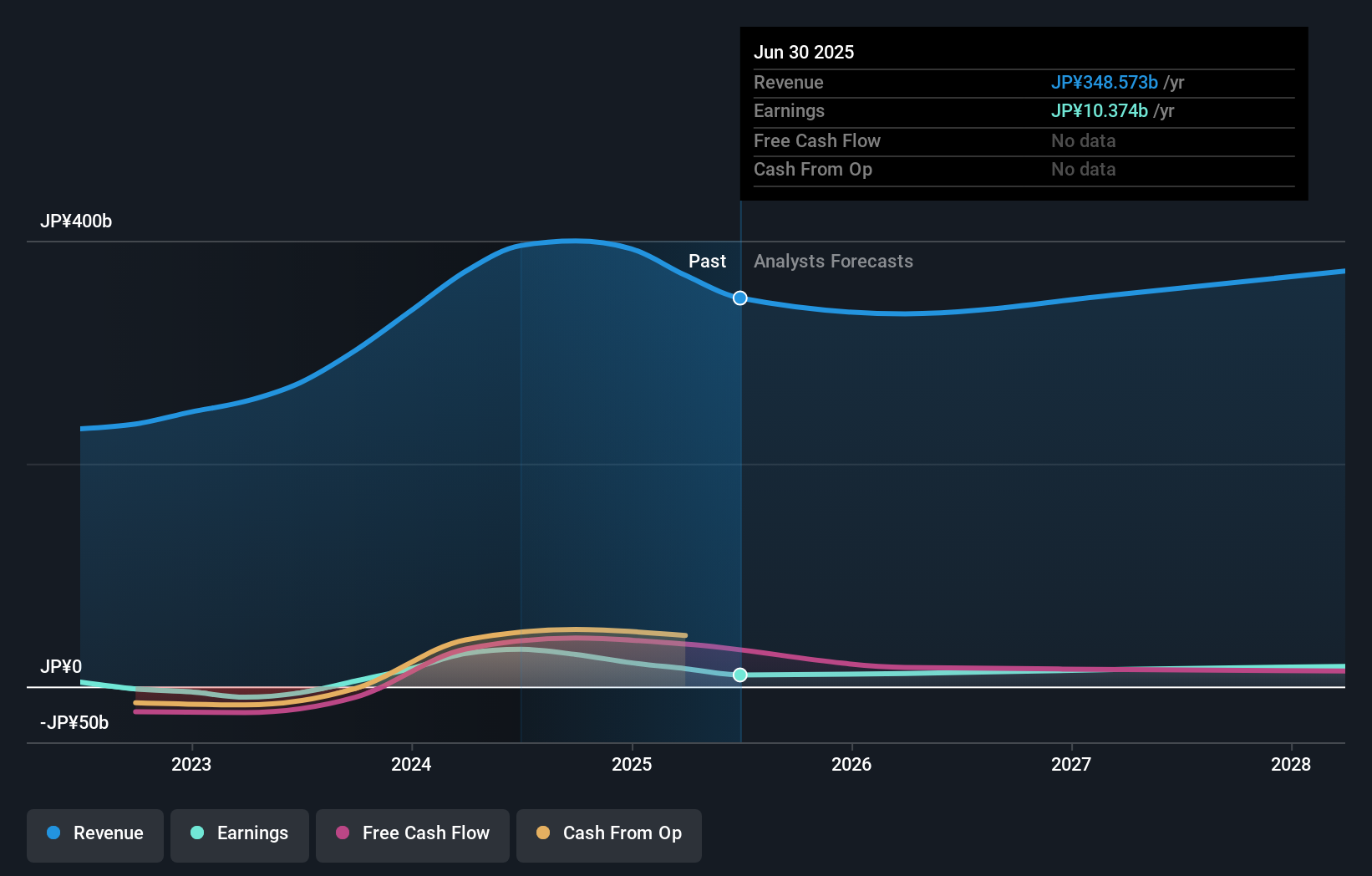

To own Glory, you have to believe its cash automation franchise can convert modest revenue growth into improving profitability while management balances shareholder returns with reinvestment. The Waitrose rollout reinforces the core equity story around resilient demand for back office cash recyclers in mature retail markets, but on its own it is unlikely to shift earnings guidance or valuation in a major way near term. The more immediate catalysts still sit with how effectively Glory can lift margins from today’s low levels, execute its sizeable share buyback, and deliver on upgraded FY2026 profit targets. At the same time, the stock’s premium earnings multiple and uneven recent margin trends remain front of mind. The Waitrose win helps the narrative, but it does not erase those risks.

However, one key operational risk remains that investors should not overlook. Despite retreating, Glory's shares might still be trading 21% above their fair value. Discover the potential downside here.Exploring Other Perspectives

The single Simply Wall St Community fair value view sits at ¥3,283.89, below both consensus and recent trading levels, reminding you that private investors can see less upside. Set against the premium valuation and pressure on margins discussed above, this kind of skepticism offers a useful counterweight and underlines why it is worth weighing multiple viewpoints before forming a view on Glory’s prospects.

Explore another fair value estimate on Glory - why the stock might be worth as much as ¥3284!

Build Your Own Glory Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Glory research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Glory research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Glory's overall financial health at a glance.

Curious About Other Options?

Our top stock finds are flying under the radar-for now. Get in early:

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 35 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com