ONEOK (OKE) Valuation Check as Rising Short Interest Signals Growing Market Caution

ONEOK (OKE) just saw its short interest jump roughly 15%, with about 3% of its float now sold short. This is a clear sign that some traders are leaning more cautiously on the stock.

See our latest analysis for ONEOK.

That shift in sentiment comes after a choppy stretch, with the latest share price at $72.82 and a year to date share price return firmly negative, even as the five year total shareholder return of 153.73% shows the longer term story is still intact.

If this kind of shifting sentiment has you thinking more broadly about opportunities, it might be a good moment to explore fast growing stocks with high insider ownership for other compelling ideas.

Yet with shares trading well below analyst targets and our model implying nearly a 50 percent discount to intrinsic value, investors now face a pivotal question: is ONEOK a mispriced opportunity, or is the market correctly baking in its future growth?

Most Popular Narrative Narrative: 17.8% Undervalued

With the narrative fair value sitting at $88.63 against a $72.82 close, the gap hinges on how confidently future growth and synergies play out.

Strong integration and synergy capture following recent acquisitions (e.g., EnLink, Magellan, Medallion) are driving operating leverage and margin expansion, with further cross asset optimization and record blending volumes anticipated to increase net margins and support double digit EBITDA growth in the near to medium term.

Curious how those integration wins and margin upgrades translate into a richer multiple and higher fair value. The narrative leans on ambitious growth, improving profitability, and a premium future earnings multiple. Want to see exactly how those pieces stack together in the model.

Result: Fair Value of $88.63 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upbeat outlook still hinges on volatile commodity spreads and successful integration of major deals, where missteps could quickly challenge the growth narrative.

Find out about the key risks to this ONEOK narrative.

Another Take on Value

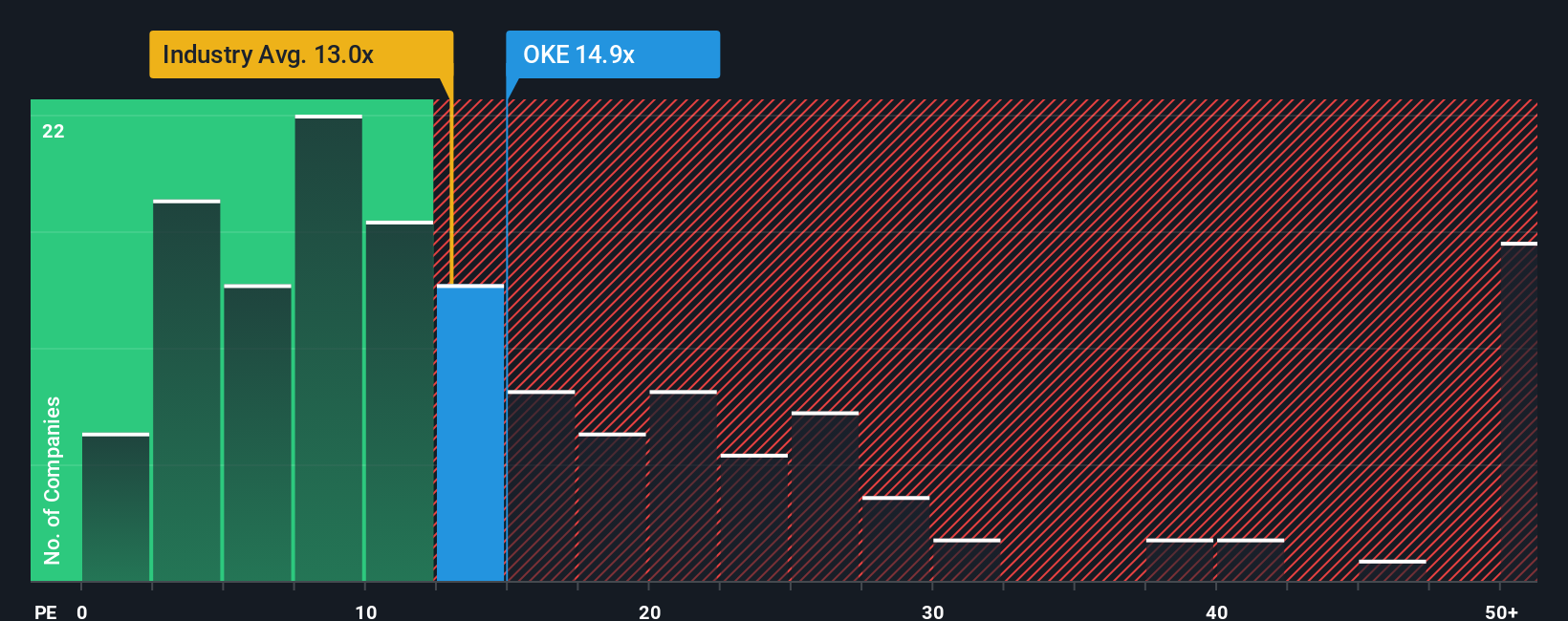

While the narrative suggests ONEOK is roughly 18 percent undervalued, our ratio view is more cautious. Its price to earnings of 13.7 times is above the US oil and gas average of 12.9 times, but below a 20 times fair ratio. This leaves investors to decide whether this gap is a safety margin or a warning.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own ONEOK Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom view in just a few minutes: Do it your way

A great starting point for your ONEOK research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Use the Simply Wall St Screener now to uncover focused opportunities beyond ONEOK, before other investors crowd in and the most compelling value stories move away.

- Capture potential price misalignments early by scanning these 898 undervalued stocks based on cash flows that the market may be overlooking right now.

- Position yourself for long term growth trends by zeroing in on these 29 healthcare AI stocks transforming care, diagnostics, and medical decision making.

- Strengthen your income strategy by targeting these 10 dividend stocks with yields > 3% that aim to balance yield with sustainable fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com