Gevo (GEVO): Reassessing Valuation After Strategic Leadership Transition to Dr. Paul Bloom

Gevo (GEVO) just kicked off a carefully managed leadership handoff, with Dr. Paul Bloom stepping in as President and director while long serving CEO Dr. Patrick Gruber moves into the Executive Chair role.

See our latest analysis for Gevo.

The leadership reshuffle lands as Gevo’s 1 month share price return of 12.37 percent and 3 month gain of 5.83 percent hint at improving sentiment, even though year to date share price performance is still negative, while the 1 year total shareholder return of 43.42 percent shows that longer term holders have already seen a meaningful rebound.

If this transition has you thinking about what else could be setting up for a rerating, it is worth scanning fast growing stocks with high insider ownership for other potential high conviction ideas.

With analysts’ price targets more than double the current share price and intrinsic value models implying a steep discount, investors now face a key question: is Gevo a mispriced growth story, or is the market already discounting its future?

Most Popular Narrative: 64.2% Undervalued

With Gevo last closing at $2.18 against a narrative fair value of $6.08, the story being told is of a deeply mispriced transition play.

Significant future revenue and margin expansion appear likely given surging demand for low carbon aviation fuel, driven by tighter emissions regulation and growing airline decarbonization mandates, with Gevo positioned to supply a rising addressable market via their modular ATJ plants and first mover advantage in cost competitive SAF production.

Want to see how ambitious growth, shifting margins, and a punchy future earnings multiple all fit together? The assumptions behind this fair value may surprise you.

Result: Fair Value of $6.08 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy dependence on government tax credits and large, long dated project financing needs could quickly undermine this mispriced growth narrative if conditions shift.

Find out about the key risks to this Gevo narrative.

Another View: Rich on Sales Despite DCF Upside

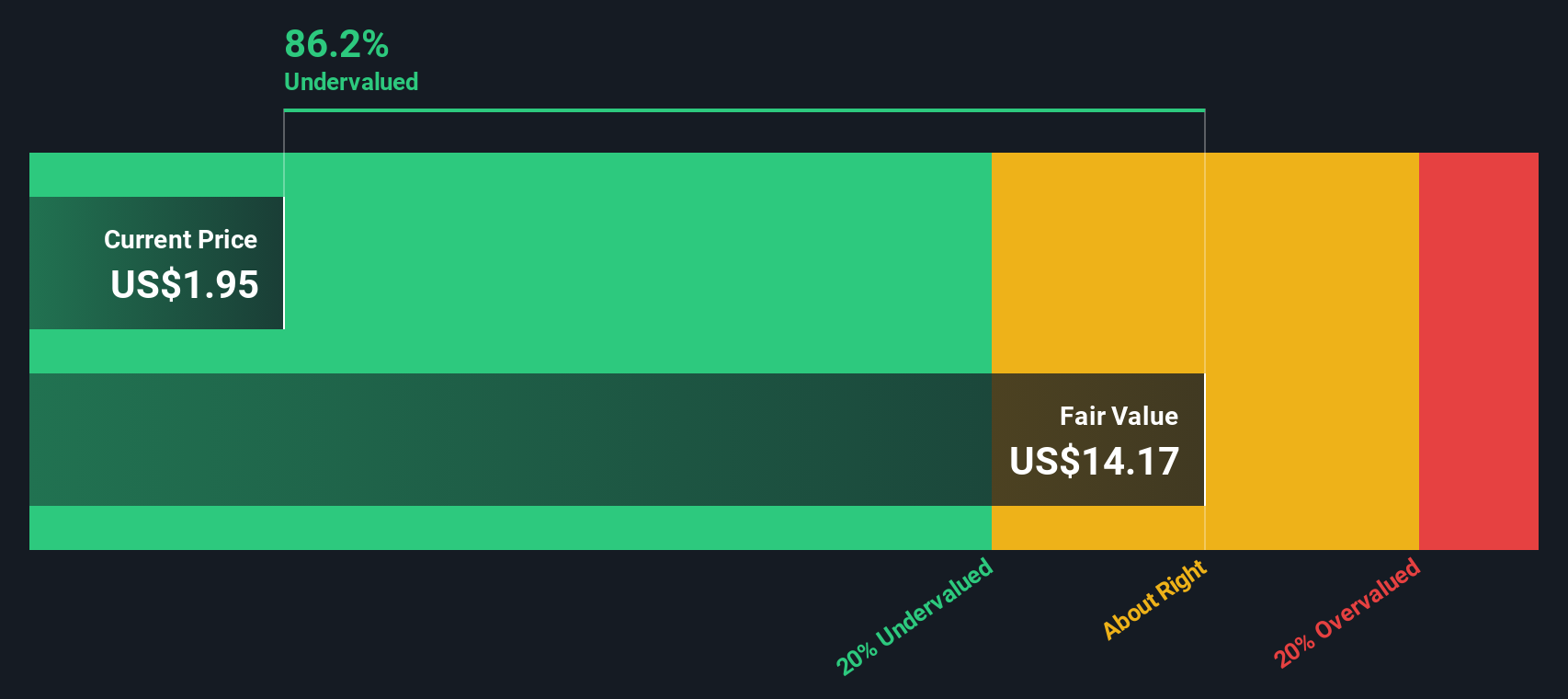

While our DCF model flags Gevo as trading 84.6 percent below its fair value, its 4.3 times price to sales ratio looks steep next to peers at 0.6 times and an estimated fair ratio of 0.9 times. Is the market overpaying for hope or underpricing long term cash flows?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Gevo Narrative

If you see the story differently or want to stress test the numbers with your own assumptions, you can build a fresh view in minutes: Do it your way.

A great starting point for your Gevo research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next potential opportunity with a few targeted screens that can surface compelling setups you might otherwise miss.

- Capture early momentum in underfollowed names by scanning these 3629 penny stocks with strong financials for businesses where improving fundamentals could trigger the next sharp re-rating.

- Capitalize on structural shifts in automation and data by using these 24 AI penny stocks to spot companies positioned at the heart of AI driven growth.

- Lock onto quality at a discount by filtering through these 898 undervalued stocks based on cash flows and flagging stocks where current prices appear misaligned with future cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com