Assessing AstraZeneca’s (LSE:AZN) Valuation After Its Recent Share Price Cool‑Off

What is happening with AstraZeneca shares?

AstraZeneca (LSE:AZN) has quietly cooled off after a strong run this year, with the share price slipping around 1% over the past month, even though the past 3 months remain firmly positive.

See our latest analysis for AstraZeneca.

That dip comes after a powerful run, with a roughly 21% 3 month share price return and a double digit year to date gain, while a 33.6% one year total shareholder return signals momentum is still broadly intact.

If AstraZeneca has piqued your interest, this could be a good moment to explore other resilient healthcare names and see what stands out in healthcare stocks.

With earnings still growing and the shares trading at a modest discount to analyst targets and some measures of intrinsic value, the key question now is whether AstraZeneca is undervalued or if the market is already pricing in its next leg of growth.

Most Popular Narrative Narrative: 9.3% Undervalued

Compared to the last close at £136.32, the most widely followed narrative points to a higher fair value, framing AstraZeneca as modestly mispriced.

The analysts have a consensus price target of £136.49 for AstraZeneca based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £180.93 and the most bearish reporting a price target of just £108.24.

Want to see how steady mid single digit revenue growth, rising margins and a punchy future earnings multiple all combine into that higher fair value signal?

Result: Fair Value of $150.26 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent patent pressures on key oncology brands and intensifying global drug pricing reforms could weaken margins quickly and challenge that undervaluation thesis.

Find out about the key risks to this AstraZeneca narrative.

Another Lens on Valuation

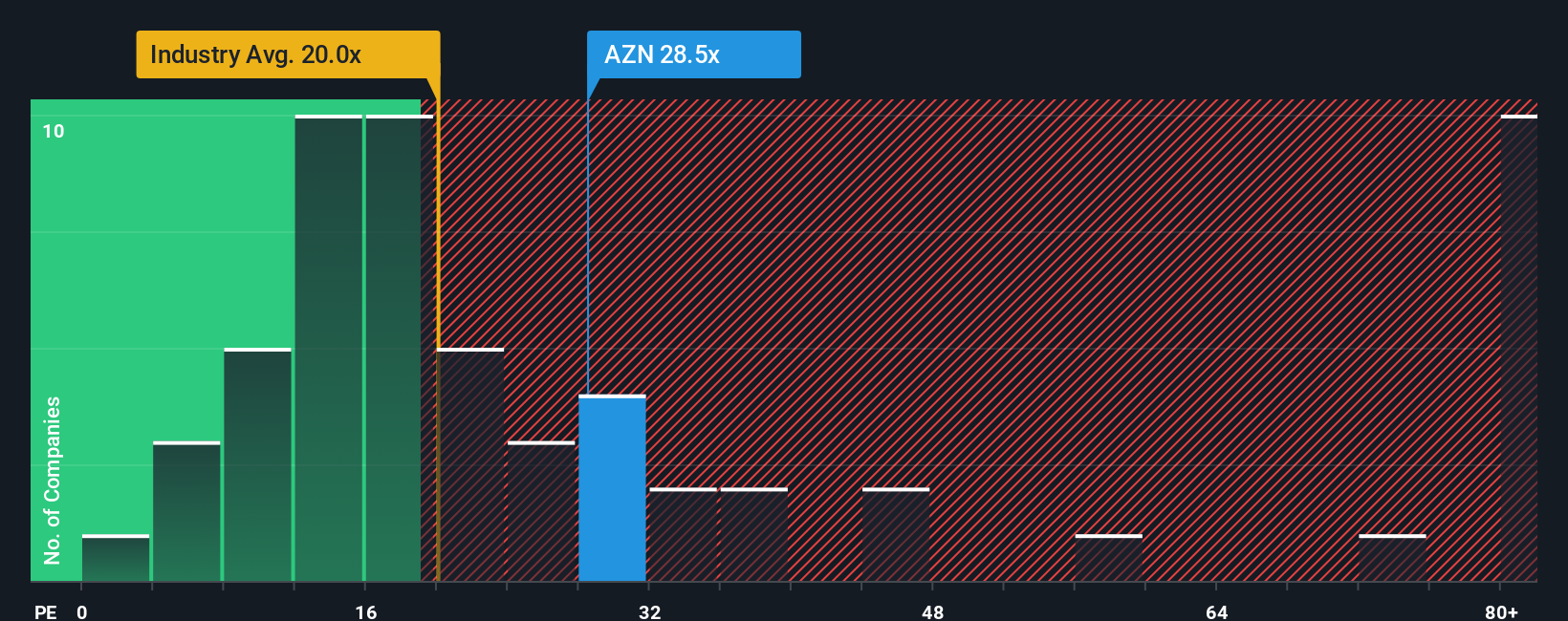

Those optimistic fair value estimates sit uneasily alongside AstraZeneca's rich price to earnings profile. The shares trade on about 30.3 times earnings, well above the European pharma average of 25 times and peer average of 13 times, even if our fair ratio sits close by at 30.9 times. Is the growth story strong enough to justify staying at the expensive end of the spectrum?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own AstraZeneca Narrative

If you see the story differently or simply want to dig into the numbers yourself, you can build a fresh take in just a few minutes: Do it your way.

A great starting point for your AstraZeneca research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investment move?

Before you leave, consider locking in your next smart idea with the Simply Wall St Screener so you are not relying on just one stock story.

- Capture potential market mispricings by targeting quality companies trading below their estimated cash flow value with these 898 undervalued stocks based on cash flows.

- Capitalize on cutting edge innovation by zeroing in on these 24 AI penny stocks shaping the future of automation, software, and intelligent services.

- Strengthen your income stream by focusing on reliable payers through these 10 dividend stocks with yields > 3% that can support long term total returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com