IPO News | White Pigeon Online Through Hong Kong Stock Exchange Hearing to Empower Insurance Companies and Scenario Cooperation Services with Technology

The Zhitong Finance App learned that according to the Hong Kong Stock Exchange's disclosure on December 23, White Pigeon Online (Xiamen) Digital Technology Co., Ltd. (abbreviation: White Pigeon Online) passed the Hong Kong Stock Exchange main board listing hearing, and CMBC Capital and BOC International were co-sponsors.

According to the prospectus, White Pigeon Online is an insurance technology company mainly engaged in providing technology-enabled insurance intermediary services for scenario partners and insurance companies. The company mainly uses scenario insurance as a tool to obtain revenue by providing insurance transaction services, accurate marketing and digital solutions, and third party management services (“TPA services ”).

Under the Insurance Transaction Services segment, the company's core business is the distribution of scenario insurance products to the final insured. These products are covered by insurance companies, and White Pigeon Online earns commission income from them.

Scenario insurance generally refers to suitable, short-term, or low-premium insurance products tailored to specific needs in specific situations to provide the insured with on-demand coverage. The company collaborates with insurance companies and scenario partners in the design and customization of insurance products. Scenario partners include diverse institutions and entities such as financial institutions, enterprises, and governments.

According to Insight Consulting, there are more than 100 participants in the Chinese scenario insurance market. In terms of total premiums in 2024, the company ranked 11th among Chinese internet insurance intermediaries, fifth among Chinese online insurance intermediaries, and first among third-party online insurance intermediaries in China, with a market share of 3.4%.

The company's products span nine ecosystems, such as travel, health, and public services, to ensure that effective methods are used to address the different risks in various scenarios in multiple ecosystems, rather than narrowly focusing on a single type of risk in a specific scenario.

For the year ended December 31, 2022, 2023, and 2024, 1,544 billion insurance policies were sold to 128 million final insured persons, 1,968 million policies were sold to 158 million final insured persons, and 994 million insurance policies were sold to 125 million final insured persons, respectively.

At the same time, the company thoroughly understood the digitalization needs of various ecosystems and successfully launched digital solutions to facilitate the operation of digital insurance transaction services. The company's solution is centered on the self-developed White Pigeon e-Insurance system. The system is a cloud-based, dynamically configurable and expandable application system that can help improve the operational efficiency of insurance companies and scenario partners.

In addition, the company also provides TPA services to insurance companies and is authorized to assist them with claims and consulting services. According to the needs of some insurance companies, the company provides TPA services in bundles with insurance transaction services, and insurance companies can choose whether to use such services.

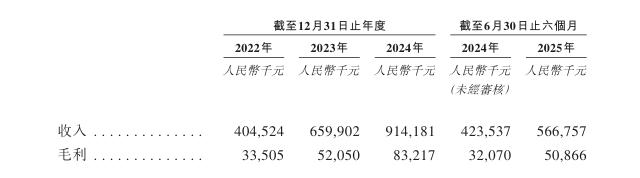

On the financial side, in 2022, 2023, 2024, and 2025, for the six months ended June 30, White Pigeon achieved revenue of about 405 million yuan, 660 million yuan, 914 million yuan, and 567 million yuan respectively. In the same period, gross profit was approximately 33.55 million yuan, 52.05 million yuan, 83.27 million yuan, and 508.66 million yuan, respectively.