Maersk (CPSE:MAERSK B): Is the Recent Share Price Strength Justified by Its Valuation?

Short term moves and recent performance

A.P. Møller - Mærsk (CPSE:MAERSK B) has quietly climbed over the past month, even without a clear headline catalyst, leaving investors wondering whether the recent strength is sustainable or merely sentiment driven.

See our latest analysis for A.P. Møller - Mærsk.

That recent upswing fits into a broader recovery story, with the share price up solidly over the past quarter and year to date. A strong one year total shareholder return suggests momentum is quietly rebuilding around the stock.

If Maersk’s move has you rethinking the logistics and transport space, this could be a good time to widen your search and explore fast growing stocks with high insider ownership.

But with profits coming off their peak and the share price already well ahead of analysts’ targets, is Maersk still trading below its true worth, or is the market already pricing in any future recovery?

Most Popular Narrative: 21% Overvalued

With A.P. Møller - Mærsk last closing at DKK14,485 versus a narrative fair value near DKK11,992, the current share price sits well above that framework and leans heavily on aggressive long term assumptions.

The ongoing decline in average freight rates due to industry overcapacity, combined with intensifying digitalization and the rise of asset light competing platforms, poses a structural challenge to Maersk's pricing power and long term revenue growth; if investors are discounting these headwinds, forecasts for sustained high profitability or outsized long term earnings may be too optimistic.

Want to see why a mature shipper is being valued like a fast growing disruptor, with shrinking revenues and radically different margins baked in? The narrative leans on a dramatic reset in profitability, a bold future earnings multiple, and a delicate balance between falling top line and defended bottom line. Curious which specific assumptions have to hold together for this stretched valuation story to work? Dive into the full narrative to unpack the numbers behind that call.

Result: Fair Value of $11,991.74 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained efficiency gains from the Gemini network and resilient terminal performance could bolster margins and weaken the case for an overextended valuation reset.

Find out about the key risks to this A.P. Møller - Mærsk narrative.

Another View on Valuation

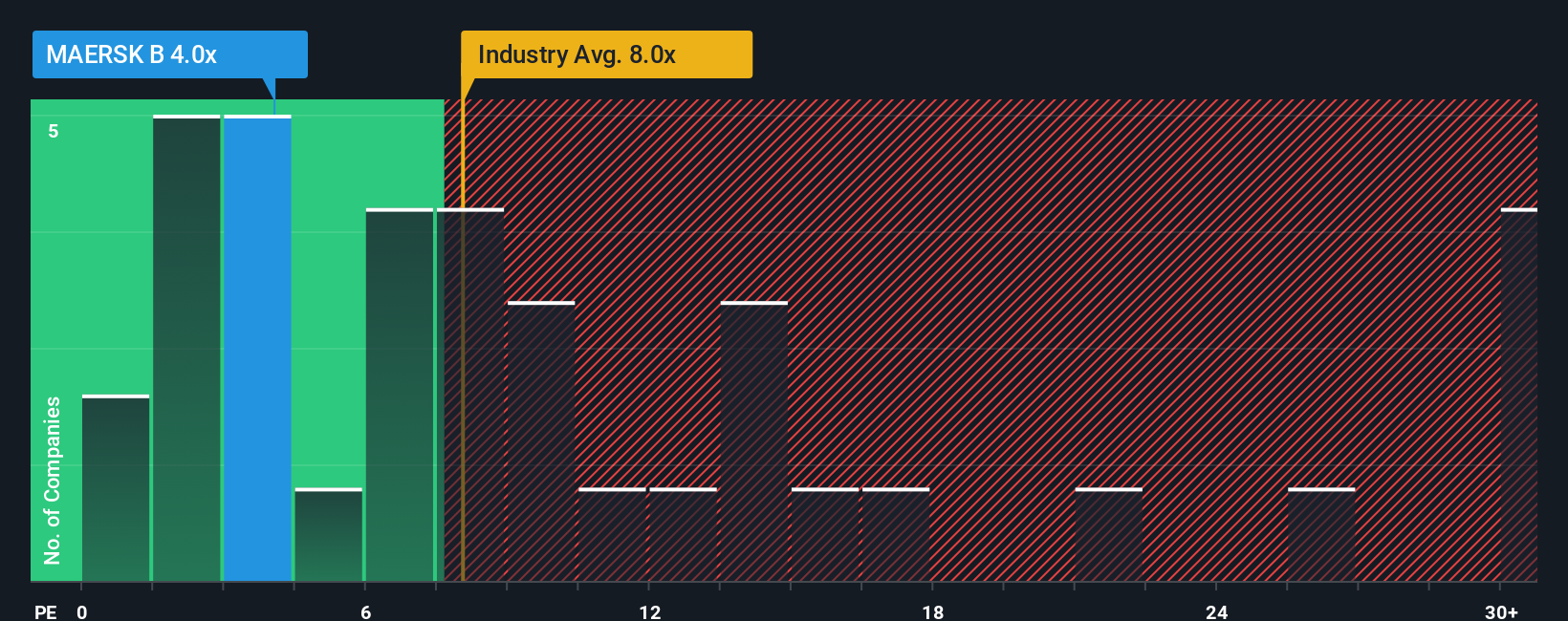

Looking at Maersk through a simple price to earnings lens paints a quieter picture. The stock trades at 6.9 times earnings, cheaper than both Danish peers at 18 times and the European shipping average of 9.3 times, yet a touch above its 6.1 times fair ratio. This implies only modest overpricing.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own A.P. Møller - Mærsk Narrative

If this perspective does not quite match your view or you prefer to dig into the numbers yourself, you can build a custom narrative in just a few minutes, Do it your way.

A great starting point for your A.P. Møller - Mærsk research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more investing ideas?

Do not stop at a single shipping giant when the market is full of opportunities. Use the Simply Wall St Screener now to sharpen your edge.

- Capture powerful cash flow bargains before they rerate by running through these 902 undervalued stocks based on cash flows and focusing on businesses the market has not fully appreciated yet.

- Tap into structural tailwinds in medical innovation with these 29 healthcare AI stocks, where data driven breakthroughs could support durable, long term growth stories.

- Position yourself early in the evolution of digital assets by checking these 79 cryptocurrency and blockchain stocks for companies building real businesses around blockchain and cryptocurrency infrastructure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com