Should CEO Exit, Activist Stake, and Global Franchising Plans Require Action From lululemon (LULU) Investors?

- Lululemon Athletica has recently faced a packed agenda: CEO Calvin McDonald’s planned January 2026 departure, Elliott Investment Management’s more than US$1.00 billion activist stake and CEO push, its removal from the Nasdaq-100, and plans to enter six new international markets via franchise partnerships in 2026.

- These developments highlight a company at an inflection point, where leadership change, activist pressure, and an ambitious global expansion strategy could reshape how the brand balances U.S. weakness with international growth.

- We’ll now examine how Elliott’s activist involvement and CEO succession efforts might influence Lululemon’s existing investment narrative around growth and margins.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

lululemon athletica Investment Narrative Recap

To own Lululemon today, you need to believe its brand, product engine, and international opportunity can offset U.S. softness, tariff headwinds, and now governance uncertainty. The key near term catalyst is whether a new CEO and Elliott’s involvement can accelerate a reset in product and reignite U.S. growth. The biggest current risk is that weakening U.S. demand and higher costs from tariffs and de minimis changes pressure margins faster than mitigation efforts can help; Elliott’s stake does not directly change that.

The most relevant update here is Elliott Investment Management’s more than US$1.00 billion activist stake and push for Jane Nielsen as CEO. This inserts an additional voice into an already complex CEO search and comes just as Lululemon is guiding for modest full year revenue growth and margin pressure from tariffs, meaning any leadership outcome will likely be judged quickly against progress in stabilizing U.S. trends and protecting profitability.

Yet behind the brand strength and activist involvement, investors should still be aware of how much tariff and de minimis changes could compress margins and...

Read the full narrative on lululemon athletica (it's free!)

lululemon athletica's narrative projects $12.8 billion revenue and $1.9 billion earnings by 2028.

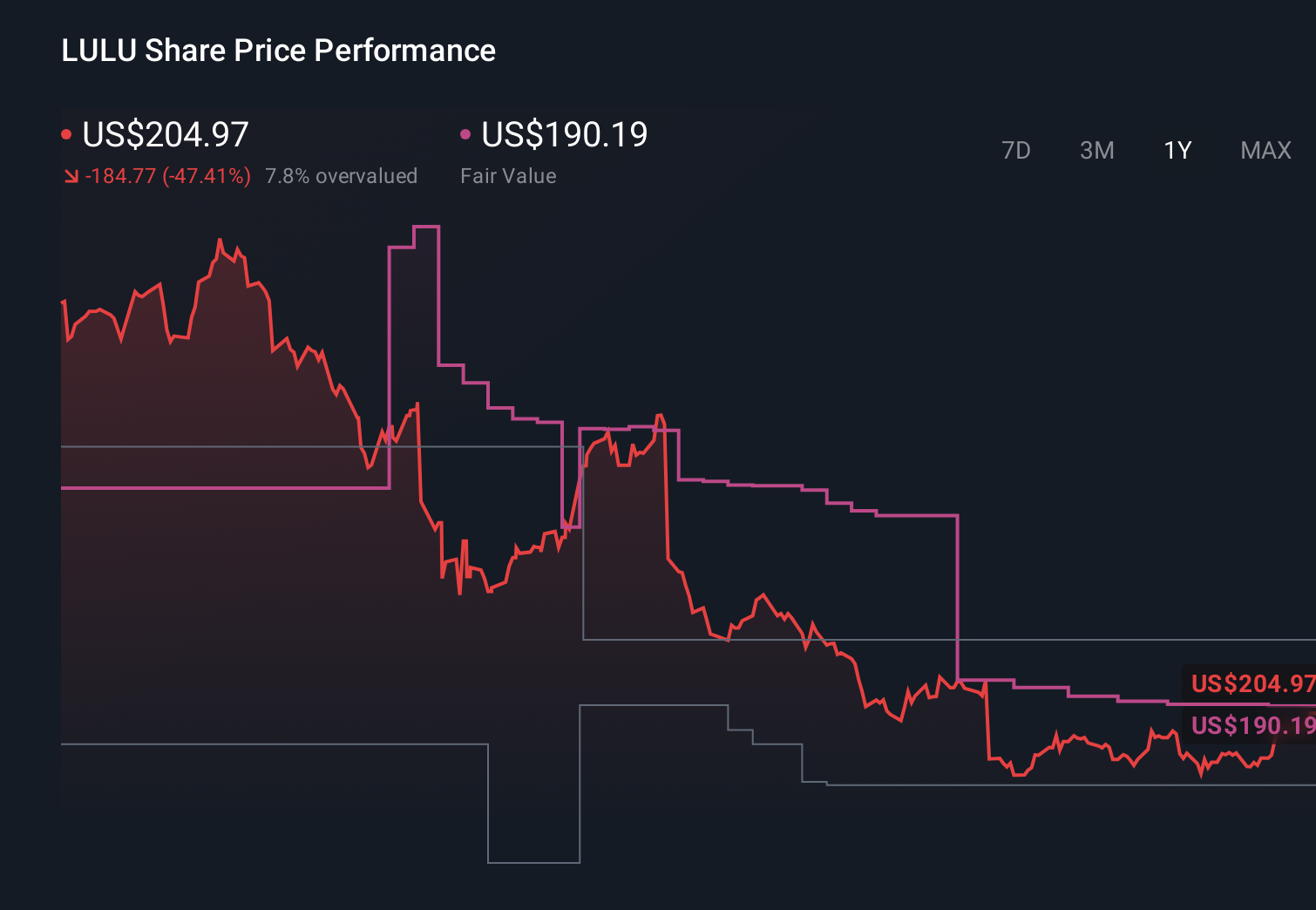

Uncover how lululemon athletica's forecasts yield a $190.19 fair value, a 10% downside to its current price.

Exploring Other Perspectives

Forty four members of the Simply Wall St Community value Lululemon anywhere between US$160 and about US$410 per share, showing how far apart views can be. Against that spread, the pressure on U.S. demand and margins from tariffs and de minimis removal may be one of the fault lines driving such different expectations for the company’s earnings power over time.

Explore 44 other fair value estimates on lululemon athletica - why the stock might be worth 25% less than the current price!

Build Your Own lululemon athletica Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your lululemon athletica research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free lululemon athletica research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate lululemon athletica's overall financial health at a glance.

Seeking Other Investments?

Our top stock finds are flying under the radar-for now. Get in early:

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 35 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com