EyePoint (EYPT) Valuation Check as Upgraded Earnings Estimates Fuel Strong Share Price Momentum

EyePoint (EYPT) has been drawing attention after fresh upward revisions to its earnings estimates and strong momentum scores, a combination that often signals shifting expectations for a company’s financial trajectory.

See our latest analysis for EyePoint.

The latest leg higher, including a 1 day share price return of 8.15 percent and 30 day share price return of 37.79 percent, adds to a powerful year to date share price return of 134.74 percent and a 3 year total shareholder return of 552.25 percent. This underlines that momentum is building as investors reprice EyePoint’s growth potential and risk profile.

If EyePoint’s run up has you rethinking your watchlist, this could be a moment to explore other innovative names across healthcare stocks for fresh ideas.

Yet with shares still trading at a steep discount to Wall Street’s price target, even after such explosive gains, investors face a key question: is EyePoint still mispriced, or has the market already baked in its future growth?

Most Popular Narrative Narrative: 48% Undervalued

With EyePoint closing at $18.85 against a narrative fair value near $36, the story hinges on aggressive growth assumptions and faith in its lead asset.

Analysts are assuming EyePoint Pharmaceuticals's revenue will grow by 41.4% annually over the next 3 years. In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 86.1x on those 2028 earnings, up from -4.7x today.

Want to know what kind of revenue ramp and margin shift it takes to support that kind of future earnings multiple? The narrative spells it out. Curious?

Result: Fair Value of $36.08 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, setbacks in DURAVYU’s Phase 3 trials, or slower than expected adoption in crowded retinal markets, could quickly unravel this bullish growth narrative.

Find out about the key risks to this EyePoint narrative.

Another View: Rich Sales Multiple Raises Questions

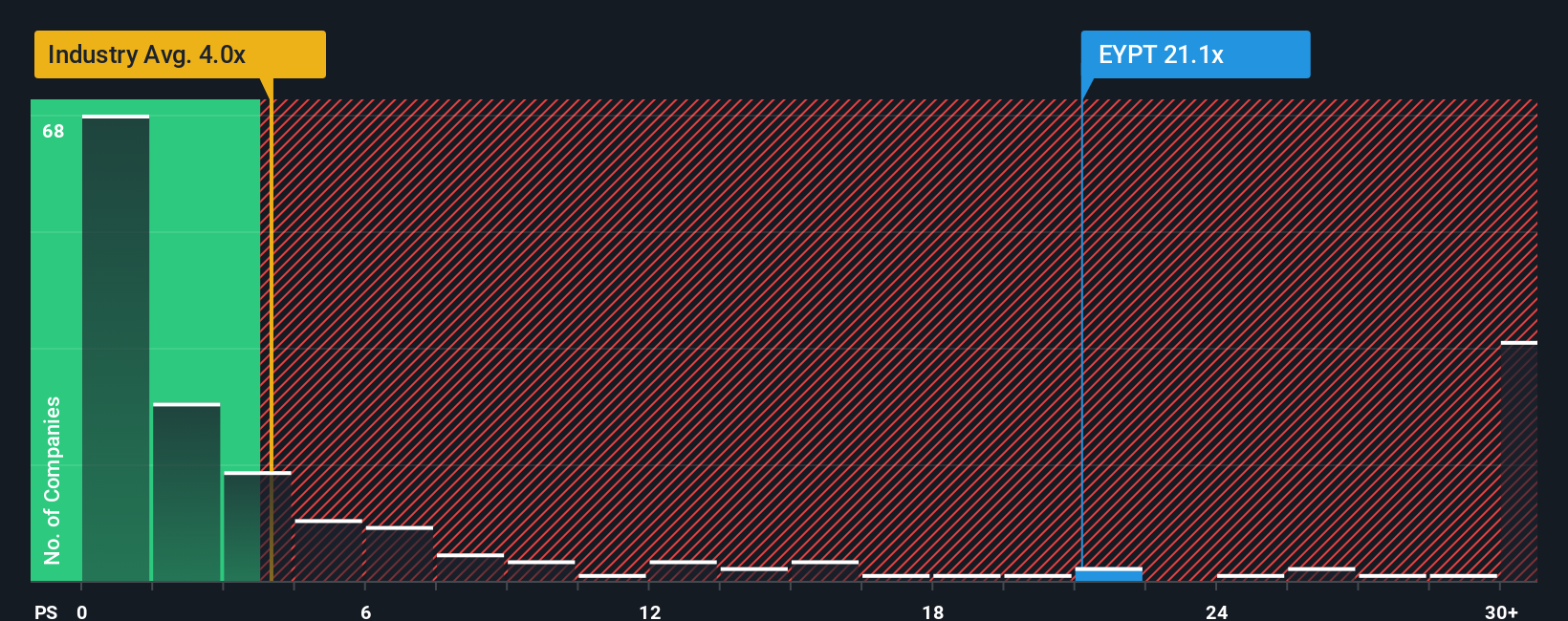

While the fair value narrative suggests EyePoint is almost 48 percent undervalued, its price to sales ratio of 36.9 times looks stretched versus the US pharma industry at 4.3 times and peers at 2 times, and far above a fair ratio of 0.1 times. This raises real valuation risk if growth stumbles.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own EyePoint Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom narrative in just minutes: Do it your way.

A great starting point for your EyePoint research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Ready for more investment ideas?

If EyePoint has sharpened your interest in high potential opportunities, do not stop here. Use the Simply Wall Street Screener to uncover your next smart move.

- Capture potential mispricings by scanning these 907 undervalued stocks based on cash flows that strong cash flows suggest the market has overlooked.

- Explore innovation-focused ideas by targeting these 24 AI penny stocks positioned at the intersection of rapid growth and transformative technology.

- Identify income-focused opportunities by filtering for these 10 dividend stocks with yields > 3% that could strengthen your portfolio’s long term return profile.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com