Insider Buying Highlights Undervalued Asian Small Caps For December 2025

As the Asian markets navigate a landscape marked by significant monetary policy shifts, including the Bank of Japan's recent interest rate hike to its highest level in three decades, small-cap stocks are drawing attention amid broader economic uncertainties. In this dynamic environment, discerning investors often look for companies with strong fundamentals and potential for growth that may be overlooked by the market, especially when insider buying suggests confidence from those closest to the business.

Top 10 Undervalued Small Caps With Insider Buying In Asia

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Security Bank | 4.1x | 0.9x | 28.85% | ★★★★★★ |

| Paragon Care | 17.3x | 0.1x | 22.42% | ★★★★★☆ |

| Vita Life Sciences | 14.9x | 1.6x | 37.31% | ★★★★☆☆ |

| Chinasoft International | 21.2x | 0.7x | -1186.43% | ★★★★☆☆ |

| BWP Trust | 11.0x | 14.4x | 11.11% | ★★★★☆☆ |

| Hung Hing Printing Group | NA | 0.4x | 44.02% | ★★★★☆☆ |

| Dicker Data | 22.4x | 0.8x | -47.07% | ★★★☆☆☆ |

| Nickel Asia | 12.2x | 1.9x | 12.82% | ★★★☆☆☆ |

| Ever Sunshine Services Group | 6.2x | 0.4x | -398.97% | ★★★☆☆☆ |

| Nufarm | NA | 0.3x | -126.96% | ★★★☆☆☆ |

Here's a peek at a few of the choices from the screener.

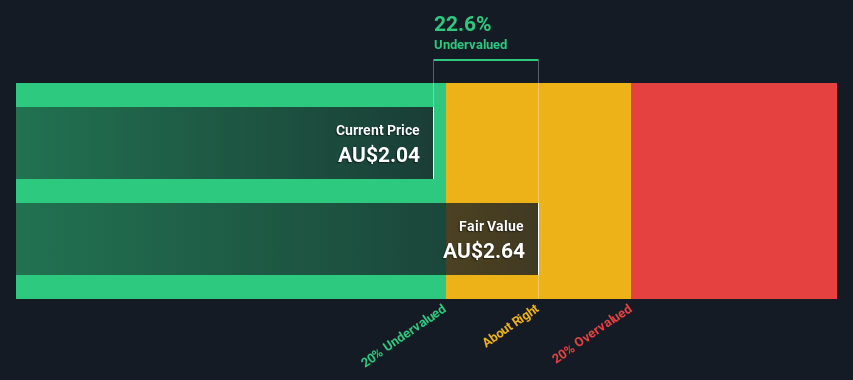

Autosports Group (ASX:ASG)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Autosports Group is an Australian company primarily engaged in motor vehicle retailing, with a focus on luxury and prestige brands, and has a market cap of A$0.63 billion.

Operations: The company generates revenue primarily through motor vehicle retailing, with the latest reported revenue at A$2.86 billion. Cost of goods sold (COGS) accounts for a significant portion of expenses, totaling A$2.35 billion in the most recent period. The gross profit margin has shown a decline over recent periods, standing at 17.98% as of June 2025. Operating expenses are also substantial, with general and administrative expenses being a notable component at A$236.54 million in the same timeframe.

PE: 24.2x

Autosports Group, a player in the automotive retail industry, has seen a dip in profit margins from 2.3% last year to 1.1% this year, reflecting some financial strain. Their reliance on external borrowing for funding adds risk to their balance sheet. However, earnings are projected to grow by 15.82% annually, offering potential upside for investors eyeing growth opportunities within small-cap stocks in Asia. Recent insider confidence is evident with share purchases made between October and November 2025, suggesting positive sentiment among management regarding future prospects.

- Click to explore a detailed breakdown of our findings in Autosports Group's valuation report.

Explore historical data to track Autosports Group's performance over time in our Past section.

Shanghai Haohai Biological Technology (SEHK:6826)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Shanghai Haohai Biological Technology is involved in the production and sale of biologics, specifically focusing on medical hyaluronic acid, with a market cap of CN¥17.45 billion.

Operations: The company generates revenue primarily from the production and sale of biologics, including medical hyaluronic acid. Over recent periods, its gross profit margin has shown a declining trend, with the most recent figure at 68.38%. Operating expenses are significant, driven mainly by sales and marketing efforts. The net income margin reflects a similar downward trajectory, currently standing at 15.34%.

PE: 13.6x

Shanghai Haohai Biological Technology, a smaller player in Asia's market, reported sales of CNY 1.9 billion for the nine months ending September 2025, down from CNY 2.1 billion the previous year. Net income also saw a dip to CNY 305 million from CNY 341 million. Despite these declines, insider confidence is evident as they increased their holdings recently. The company forecasts earnings growth of 21.81% annually amidst reliance on external borrowing for funding, highlighting potential future growth opportunities despite current financial pressures.

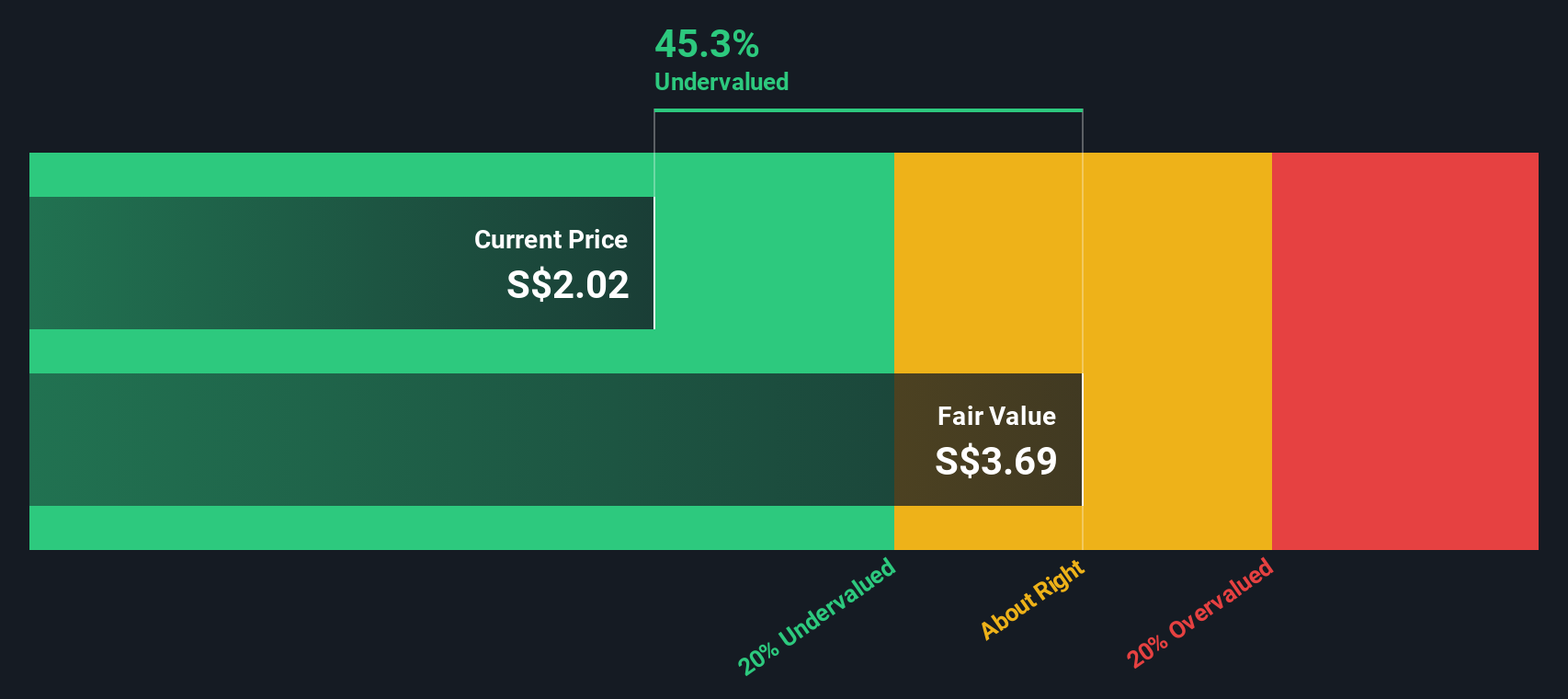

Ho Bee Land (SGX:H13)

Simply Wall St Value Rating: ★★★★★☆

Overview: Ho Bee Land is a real estate company engaged in property investment and development, with a market cap of approximately $2.35 billion SGD.

Operations: Ho Bee Land derives its revenue primarily from property investment and development, with notable figures of SGD 247.63 million and SGD 228.13 million, respectively. The company has experienced fluctuations in its gross profit margin, which was last recorded at 57.41%.

PE: 9.7x

Ho Bee Land, a smaller player in the Asian real estate market, is attracting attention due to insider confidence. Executive Chairman Thian Poh Chua recently acquired 143,500 shares at a transaction value of S$248,972 between October and December 2025. Despite anticipated earnings decline by 5.9% annually over the next three years and reliance on higher-risk external funding, this insider activity suggests potential optimism about future prospects. However, interest payments remain poorly covered by earnings.

Key Takeaways

- Click through to start exploring the rest of the 49 Undervalued Asian Small Caps With Insider Buying now.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com