Emerging Penny Stocks To Watch In December 2025

As the U.S. stock market continues to reach new heights with the S&P 500 setting an all-time high, investors are keenly observing emerging opportunities across various sectors. Penny stocks, often associated with smaller or newer companies, may still hold potential for those looking beyond established giants. Despite their vintage name, these stocks can offer surprising value and financial strength in today's dynamic market landscape.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $2.72 | $552.91M | ✅ 3 ⚠️ 0 View Analysis > |

| Waterdrop (WDH) | $1.89 | $687.16M | ✅ 4 ⚠️ 0 View Analysis > |

| WM Technology (MAPS) | $0.8699 | $148.77M | ✅ 4 ⚠️ 2 View Analysis > |

| LexinFintech Holdings (LX) | $3.43 | $577.14M | ✅ 4 ⚠️ 2 View Analysis > |

| Tuya (TUYA) | $2.21 | $1.36B | ✅ 4 ⚠️ 1 View Analysis > |

| CI&T (CINT) | $4.51 | $601.05M | ✅ 5 ⚠️ 0 View Analysis > |

| Golden Growers Cooperative (GGRO.U) | $5.00 | $77.45M | ✅ 2 ⚠️ 5 View Analysis > |

| VAALCO Energy (EGY) | $3.47 | $362.82M | ✅ 2 ⚠️ 3 View Analysis > |

| BAB (BABB) | $0.905 | $6.57M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.77 | $85.41M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 343 stocks from our US Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Real Brokerage (REAX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: The Real Brokerage Inc. operates as a real estate technology company in the United States and Canada, with a market cap of $828.88 million.

Operations: The company generates revenue primarily through its North American Brokerage segment, which accounted for $1.80 billion.

Market Cap: $828.88M

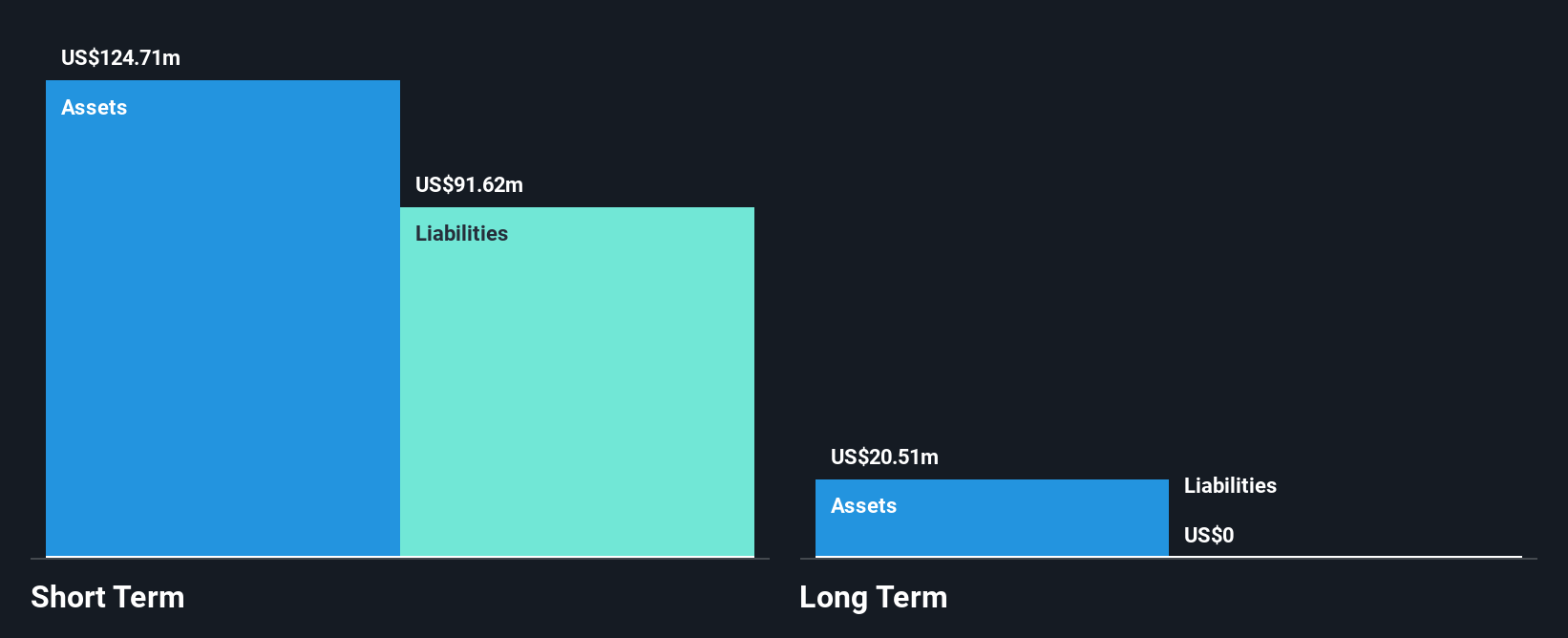

Real Brokerage recently enhanced its AI platform, Leo CoPilot, with voice-first capabilities and expanded support intelligence. The company also introduced HeyLeo, an AI-powered real estate concierge. Despite being unprofitable, Real has a positive cash flow and no debt, providing a cash runway for over three years. Its market cap is US$828.88 million with revenue of US$1.80 billion from its North American Brokerage segment. Recent insider selling might concern investors though the stock trades significantly below estimated fair value. Sandy MacKay's team joining Real could bolster its market presence in Canada.

- Get an in-depth perspective on Real Brokerage's performance by reading our balance sheet health report here.

- Explore Real Brokerage's analyst forecasts in our growth report.

Marqeta (MQ)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Marqeta, Inc. operates a cloud-based open API platform focused on card issuing and transaction processing services, with a market cap of approximately $2.19 billion.

Operations: The company's revenue is primarily derived from Data Processing, amounting to $588.56 million.

Market Cap: $2.19B

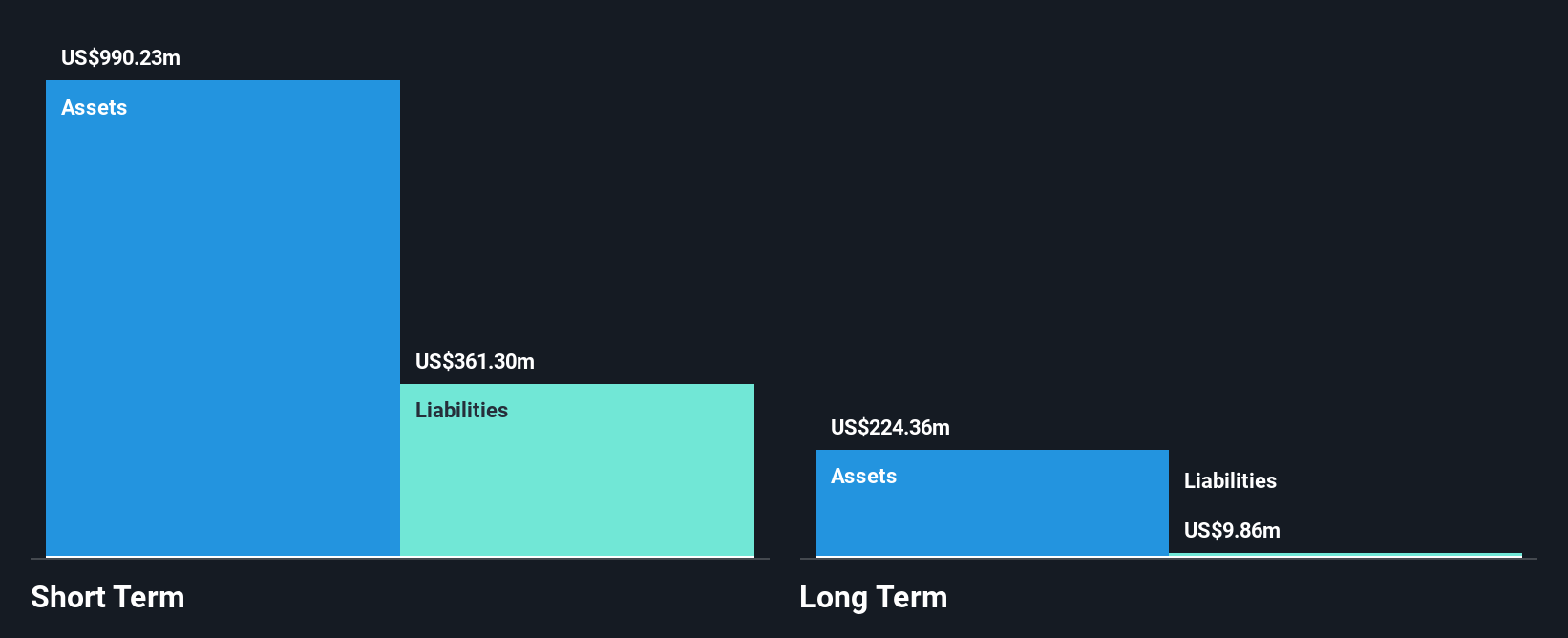

Marqeta, Inc. operates with a market cap of US$2.19 billion and generates revenue primarily from data processing, totaling US$588.56 million. The company is debt-free and maintains short-term assets of US$1.2 billion that comfortably cover its liabilities, providing financial stability despite being unprofitable with a negative return on equity of -4.72%. Marqeta's strategic share repurchase program aims to buy back up to US$100 million worth of stock, reflecting confidence in its capital allocation strategy amid significant insider selling concerns. Recent collaborations, like the expansion with Klarna across Europe, highlight Marqeta’s growth potential in scaling innovative payment solutions globally.

- Unlock comprehensive insights into our analysis of Marqeta stock in this financial health report.

- Gain insights into Marqeta's outlook and expected performance with our report on the company's earnings estimates.

Hyliion Holdings (HYLN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Hyliion Holdings Corp. designs and develops power generators for stationary and mobile applications, with a market cap of approximately $339.63 million.

Operations: Hyliion Holdings Corp. has not reported any revenue segments.

Market Cap: $339.63M

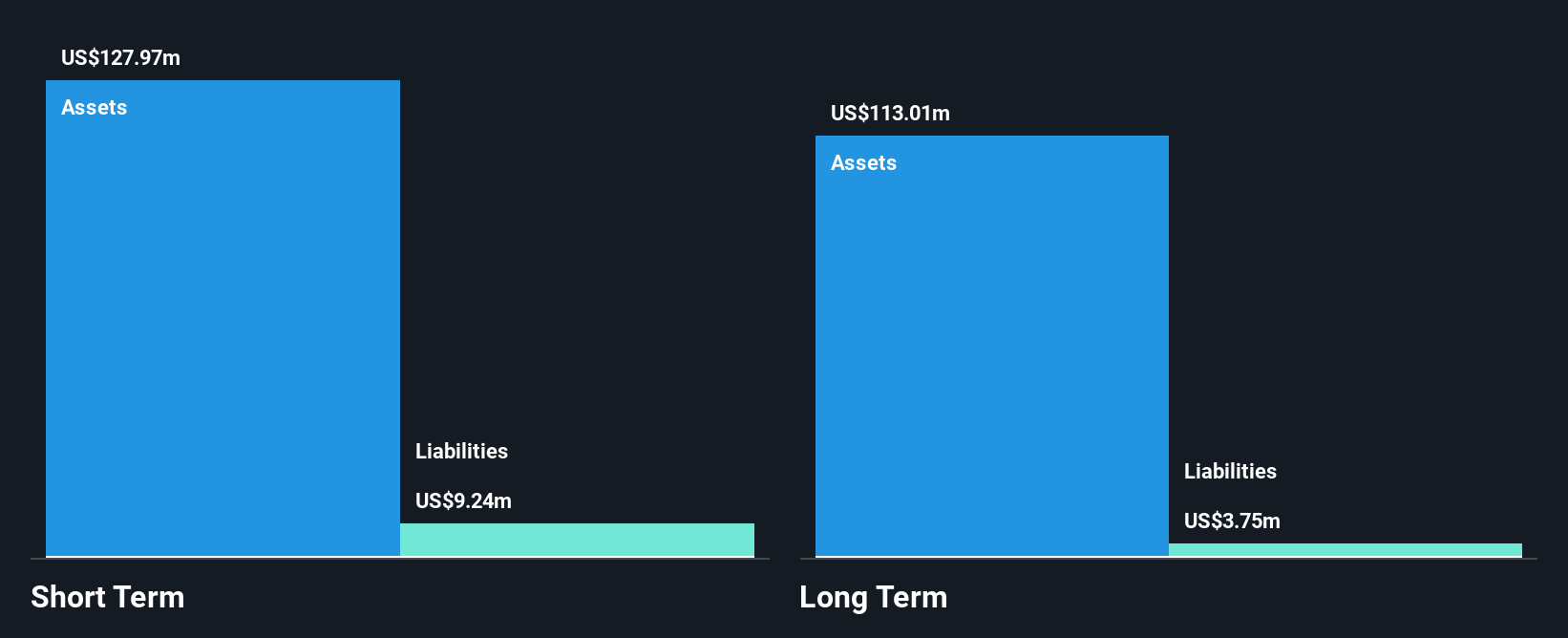

Hyliion Holdings Corp., with a market cap of US$339.63 million, is navigating the challenges typical of penny stocks, including being pre-revenue with reported earnings showing a net loss of US$13.34 million for Q3 2025. Despite this, the company is debt-free and boasts short-term assets of US$110 million against minimal liabilities, providing some financial stability. The recent success in emissions testing for its KARNO Power Module positions Hyliion at the forefront of clean energy technology, potentially paving the way for future commercial deployments across various industries while maintaining adaptability through its fuel-agnostic design.

- Navigate through the intricacies of Hyliion Holdings with our comprehensive balance sheet health report here.

- Learn about Hyliion Holdings' future growth trajectory here.

Where To Now?

- Explore the 343 names from our US Penny Stocks screener here.

- Interested In Other Possibilities? The end of cancer? These 29 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com