JPMorgan (JPM) Valuation Check After 10% Monthly Gain and 39% One-Year Share Price Rally

Event driven move in JPMorgan Chase stock

JPMorgan Chase (JPM) has been grinding higher, with the stock now up about 10 % over the past month and roughly 39 % over the past year, outpacing many large bank peers.

See our latest analysis for JPMorgan Chase.

The latest climb in JPMorgan Chase shares, with a 30 day share price return of just over 10 % and a 1 year total shareholder return approaching 39 %, points to momentum building as investors increasingly price in durable earnings power and manageable credit risk at a 329.17 dollars share price.

If this kind of steady compounding appeals to you, it could be a good moment to broaden your watchlist and explore fast growing stocks with high insider ownership for other under the radar opportunities.

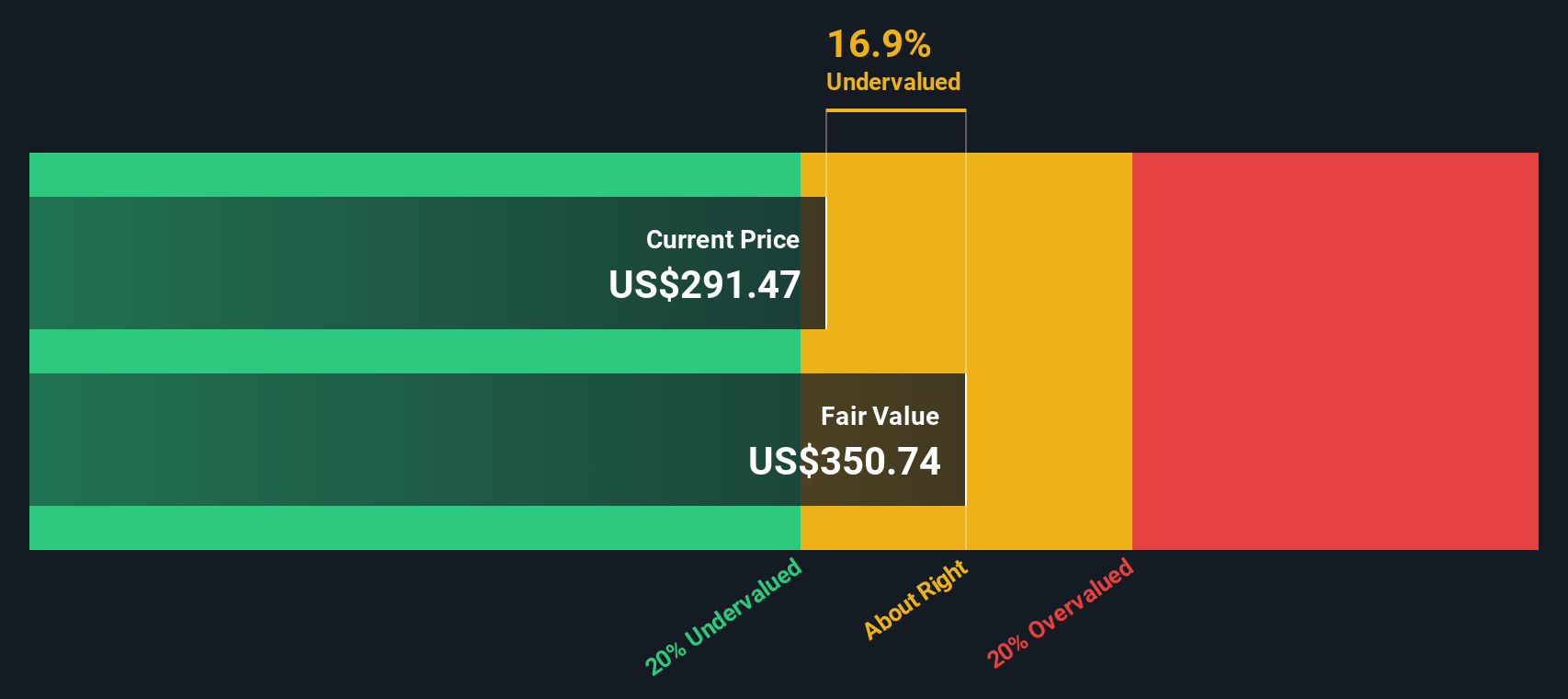

With shares hovering near Wall Street price targets but still trading at a modest intrinsic value discount, the key question now is whether JPMorgan Chase is quietly undervalued or if markets are already baking in years of growth.

Most Popular Narrative Narrative: 30% Overvalued

The most widely followed narrative pegs JPMorgan Chase's fair value slightly below the current 329.17 dollars share price. This frames the rally as a stretch beyond fundamentals rather than a clear bargain.

The firm's diversified model (noted by balanced growth across CIB, Card, Asset or Wealth Management, and international expansion), along with robust deal pipelines, positions it to gain share and demonstrate resilience across macro cycles. This should underpin stable or increasing earnings even as economic conditions shift.

Curious why a bank with resilient earnings, expanding fee lines, and shrinking share count still screens expensive in this narrative? The answer lies in how future margins, modest top line growth, and a premium earnings multiple are stitched together to justify today's price.

Result: Fair Value of $328.09 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, two potential spoilers still loom: intensifying fintech and stablecoin competition, and costlier regulation that could squeeze margins and challenge JPMorgan's premium valuation.

Find out about the key risks to this JPMorgan Chase narrative.

Another Take On Value

While the narrative model flags JPMorgan Chase as roughly 30 percent overvalued, our DCF view is more forgiving. The SWS DCF model suggests shares are about 8.6 percent undervalued versus a 360.3 dollars fair value. Which lens better captures the risk and reward from here?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out JPMorgan Chase for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 904 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own JPMorgan Chase Narrative

If you see the story differently, or simply prefer digging into the numbers yourself, you can build a complete view in minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding JPMorgan Chase.

Looking for more investment ideas?

If you are serious about leveling up your returns, do not stop at JPMorgan when Simply Wall St can direct you to fresh, high conviction ideas in minutes.

- Rotate toward potential bargains by scanning these 904 undervalued stocks based on cash flows that the market may be mispricing based on future cash flows and fundamentals.

- Tap into the next wave of innovation by targeting these 24 AI penny stocks positioned to turn artificial intelligence breakthroughs into durable revenue and profit growth.

- Strengthen your income stream by filtering for these 10 dividend stocks with yields > 3% that can support reliable payouts while still leaving room for capital appreciation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com