ASX Penny Stocks Spotlight: Cuscal And Two Noteworthy Contenders

As the Australian market approaches the holiday season with a slight dip, largely due to profit-taking and global influences, investors are keeping a close eye on opportunities within smaller sectors. Penny stocks, though an older term, remain significant for those interested in growth potential through investments in newer or smaller companies. By focusing on penny stocks with solid financials and promising prospects, investors can uncover potential opportunities that balance risk and reward effectively.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.405 | A$116.07M | ✅ 4 ⚠️ 4 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.39 | A$65.57M | ✅ 2 ⚠️ 2 View Analysis > |

| Dusk Group (ASX:DSK) | A$0.78 | A$48.57M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$3.00 | A$461.07M | ✅ 4 ⚠️ 2 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$3.14 | A$231.93M | ✅ 4 ⚠️ 1 View Analysis > |

| Veris (ASX:VRS) | A$0.074 | A$39.99M | ✅ 3 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$3.14 | A$3.59B | ✅ 4 ⚠️ 2 View Analysis > |

| Service Stream (ASX:SSM) | A$2.26 | A$1.38B | ✅ 3 ⚠️ 2 View Analysis > |

| EDU Holdings (ASX:EDU) | A$0.825 | A$118.74M | ✅ 4 ⚠️ 2 View Analysis > |

| MaxiPARTS (ASX:MXI) | A$2.26 | A$125.53M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 429 stocks from our ASX Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Cuscal (ASX:CCL)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Cuscal Limited, with a market cap of A$835.21 million, offers payment and regulated data products and services to financial and consumer-centric institutions in Australia.

Operations: Cuscal generates revenue of A$492.5 million from its operations in Australia.

Market Cap: A$835.21M

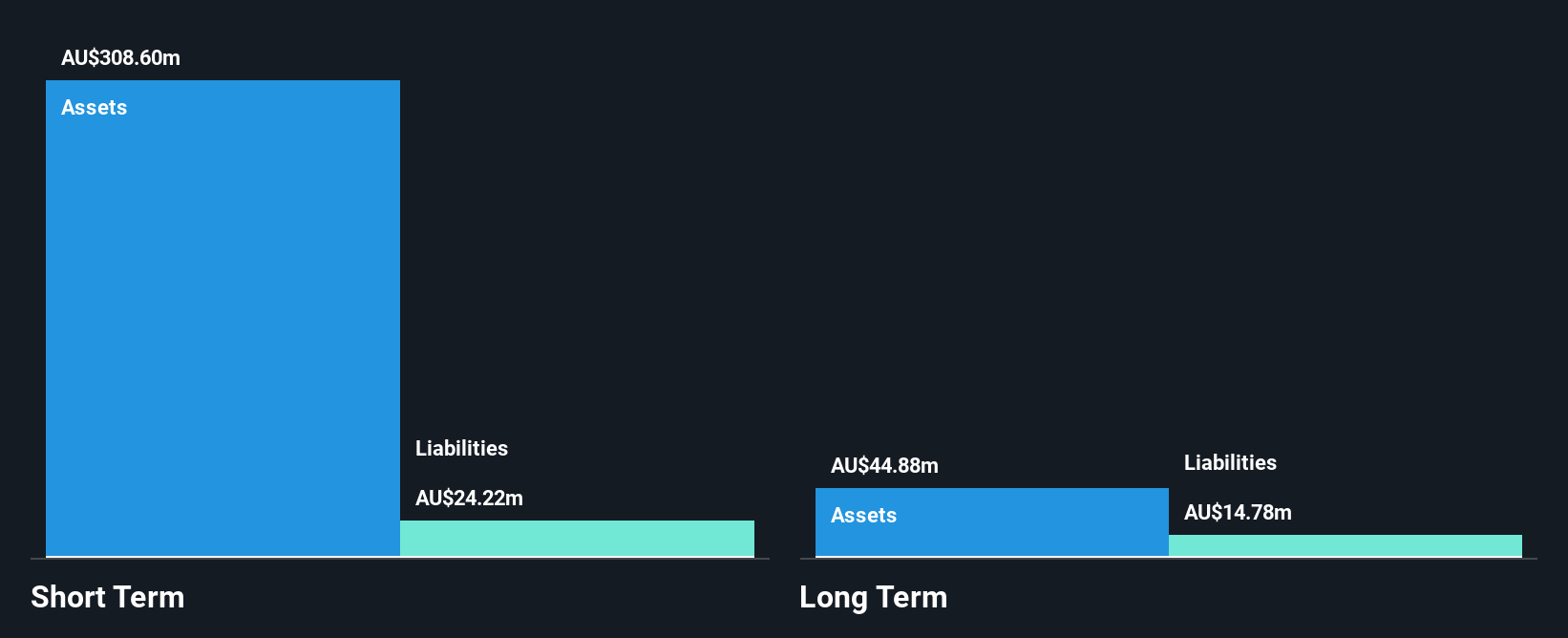

Cuscal Limited, with a market cap of A$835.21 million and revenue of A$492.5 million, is navigating the financial landscape with strong asset coverage over both short-term (A$2.7 billion) and long-term liabilities (A$542.7 million). Recent board changes include the appointment of Peter Wright as an Independent Non-Executive Director, bringing significant expertise in payments and technology sectors. Despite a decrease in net profit margins from 6.6% to 5.8% year-over-year, Cuscal maintains high-quality earnings and reduced its debt-to-equity ratio significantly over five years while forecasting earnings growth at 20.08% annually amidst stable weekly volatility.

- Navigate through the intricacies of Cuscal with our comprehensive balance sheet health report here.

- Understand Cuscal's earnings outlook by examining our growth report.

DroneShield (ASX:DRO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: DroneShield Limited develops, commercializes, and sells hardware and software technology for drone detection and security in Australia and the United States, with a market cap of A$3 billion.

Operations: The company's revenue is primarily derived from its Aerospace & Defense segment, totaling A$107.17 million.

Market Cap: A$3B

DroneShield Limited, with a market cap of A$3 billion and revenue from its Aerospace & Defense segment totaling A$107.17 million, has experienced significant volatility in its share price over the past three months. Despite being debt-free, the company faces challenges with negative earnings growth of -24.9% over the past year and declining profit margins from 11.3% to 5.2%. Recent executive changes include the resignation of U.S. CEO Matt McCrann and appointments within its technology leadership team, which may impact strategic direction as it aims to capitalize on global defense demand amidst insider selling activities in recent months.

- Jump into the full analysis health report here for a deeper understanding of DroneShield.

- Gain insights into DroneShield's outlook and expected performance with our report on the company's earnings estimates.

TPG Telecom (ASX:TPG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: TPG Telecom Limited offers telecommunications services to a diverse range of customers in Australia, including consumer, business, enterprise, government, and wholesale sectors, with a market cap of A$7.46 billion.

Operations: The company's revenue is derived from two primary segments: Consumer, which generated A$4.53 billion, and Enterprise, Government and Wholesale, contributing A$1.11 billion.

Market Cap: A$7.46B

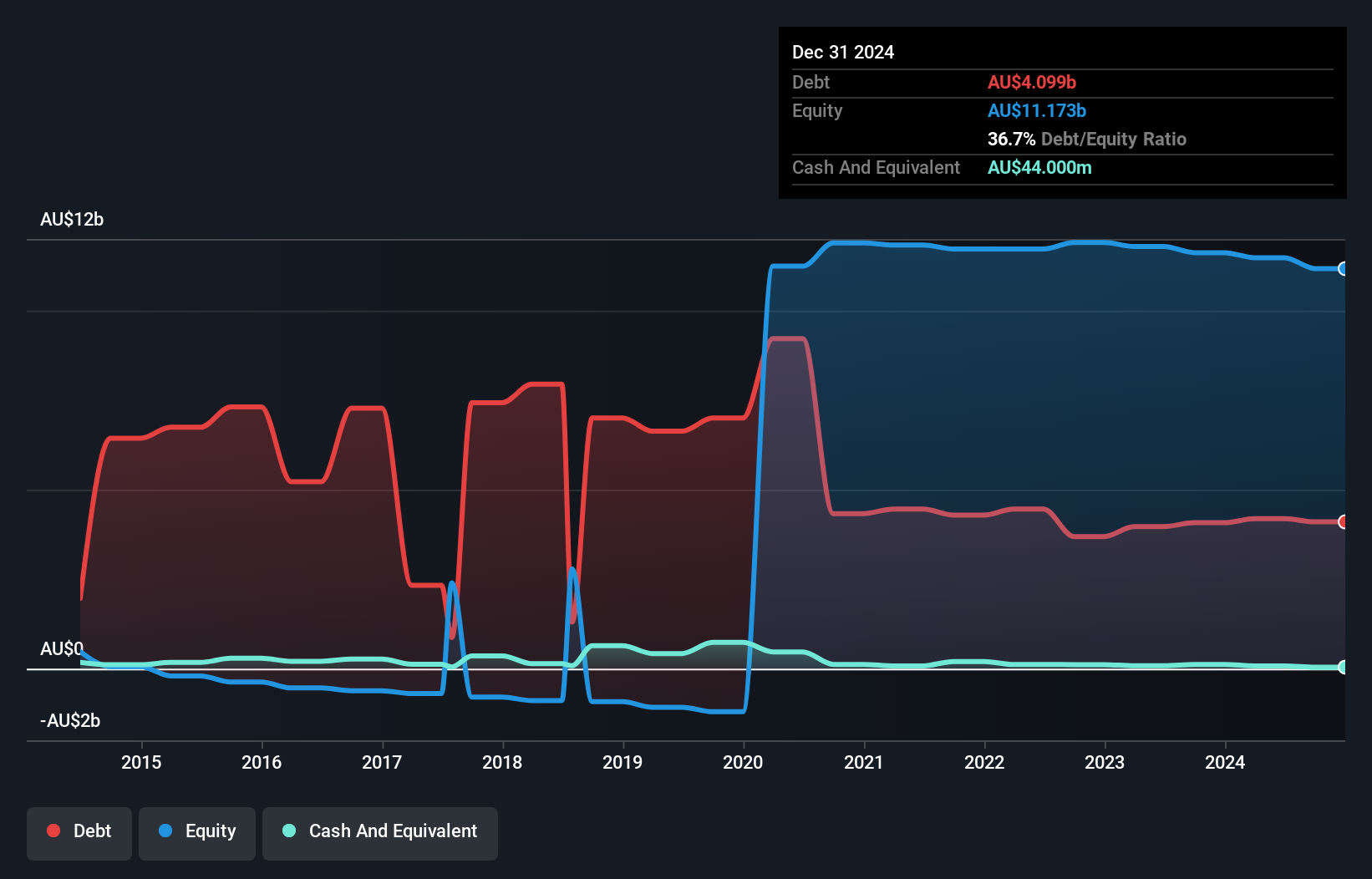

TPG Telecom Limited, with a market cap of A$7.46 billion, has recently completed several follow-on equity offerings totaling over A$1 billion to strengthen its financial position. Despite being unprofitable and experiencing increased losses over the past five years, TPG's debt-to-equity ratio has improved from 82% to 37.4%, indicating better financial management. The company is trading at a significant discount compared to its estimated fair value and peers in the industry. While it offers a dividend yield of 4.68%, this is not well covered by earnings, suggesting potential risks for income-focused investors despite having sufficient cash runway for more than three years due to positive free cash flow growth.

- Take a closer look at TPG Telecom's potential here in our financial health report.

- Explore TPG Telecom's analyst forecasts in our growth report.

Taking Advantage

- Reveal the 429 hidden gems among our ASX Penny Stocks screener with a single click here.

- Interested In Other Possibilities? This technology could replace computers: discover the 28 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com