SEI Investments (SEIC): Assessing Valuation as Founder Alfred West Prepares to Hand Over the Chairmanship

SEI Investments (SEIC) just hit a major milestone, as founder Alfred P. West, Jr. prepares to step down as Executive Chairman and director on January 1, 2026, handing the chair role to Carl A. Guarino.

See our latest analysis for SEI Investments.

The leadership handover comes as SEI Investments trades at $85.37, with a 30 day share price return of 7.60 percent pointing to building momentum, while a three year total shareholder return near 53 percent underlines its longer term wealth creation.

If this transition has you rethinking your portfolio, it could be a smart moment to explore fast growing stocks with high insider ownership for other compelling growth stories with aligned insiders.

With growth still solid and the share price sitting about 14 percent below analyst targets, the key question now is whether SEI is trading at a quiet discount or if the market is already pricing in its next leg of growth.

Most Popular Narrative: 10.9% Undervalued

With SEI Investments closing at $85.37 against a narrative fair value near $95.83, the valuation framework leans toward a moderate upside scenario grounded in steady execution.

SEI's continued and proactive investment in modern technology platforms targeting scalability, automation, and cost efficiency positions the company to capitalize on increasing demand for digital transformation and outsourcing within financial services, with the potential to support sustained top line revenue growth and long term operating margin improvement.

Want to see how measured revenue growth, evolving margins, and a richer earnings multiple all weave together into that higher fair value estimate? The narrative breaks down which cash flows matter most, how profitability is expected to bend over time, and why today’s valuation assumes a stronger, leaner SEI a few years from now.

Result: Fair Value of $95.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, significant ongoing tech and talent investments, along with tougher competition for larger RIAs, could squeeze margins and derail that margin expansion narrative.

Find out about the key risks to this SEI Investments narrative.

Another Angle on Value

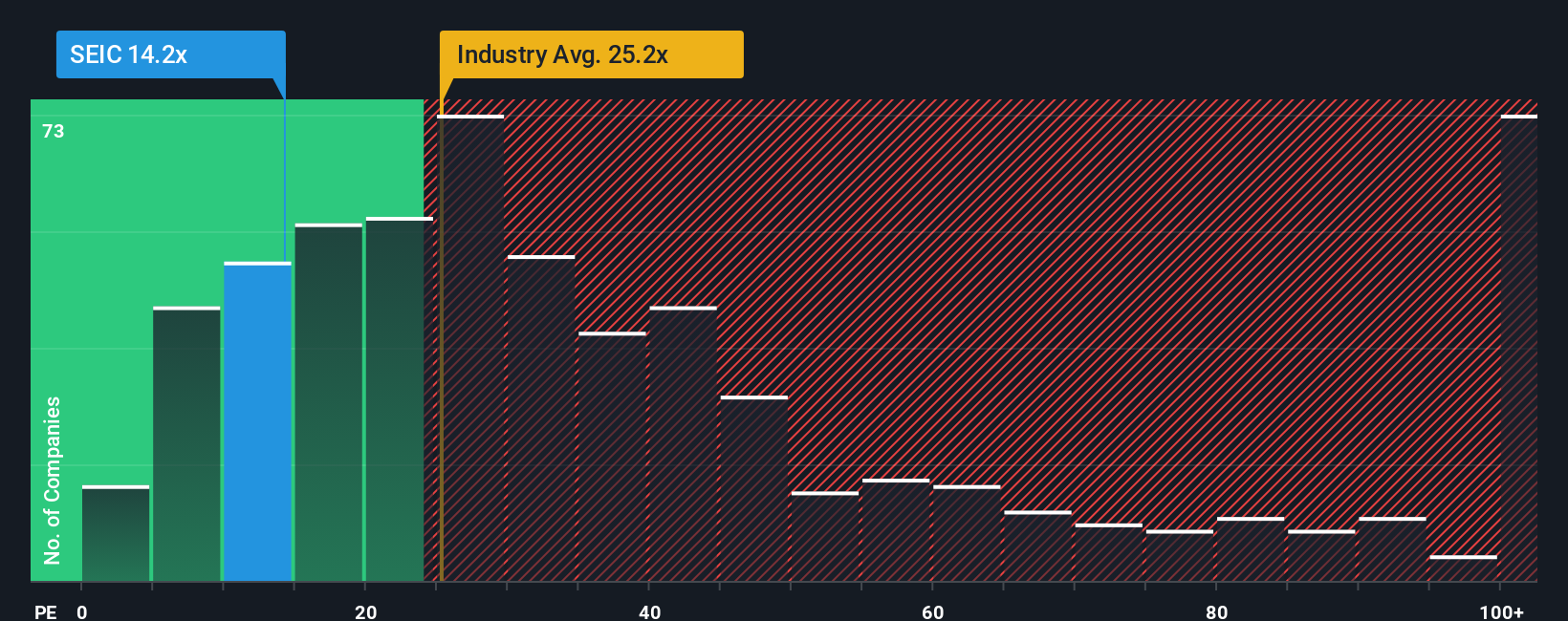

While the narrative fair value suggests SEI Investments is about 11 percent undervalued, the earnings multiple sends a different signal. At 15.1 times earnings, the stock trades below the US Capital Markets average of 25.6 times and peers at 18.5 times, yet above its 13.5 times fair ratio, hinting at some valuation stretch. Is the discount real, or has the easy upside already been used up?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own SEI Investments Narrative

If you see the story differently or would rather dig into the numbers yourself, you can build a personalized view in just minutes: Do it your way.

A great starting point for your SEI Investments research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next opportunities by using the Simply Wall Street Screener to surface focused, data driven stock ideas that others might overlook.

- Capture potential multi baggers early by targeting under the radar names using these 3630 penny stocks with strong financials with robust underlying fundamentals.

- Tap into the next wave of intelligent automation by zeroing in on these 29 healthcare AI stocks that are reshaping diagnostics, treatment, and patient outcomes.

- Strengthen your income stream by filtering for reliable payers through these 10 dividend stocks with yields > 3% that aim to reward shareholders with yields above 3 percent.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com