Hesai Group (NasdaqGS:HSAI): Reassessing Valuation After Landmark Keeta Drone Lidar Partnership

Hesai Group (NasdaqGS:HSAI) just moved deeper into drone logistics after signing a strategic deal to supply its FTX solid-state lidar for Meituan’s Keeta Drone M-Drone 4L delivery platform.

See our latest analysis for Hesai Group.

The Keeta Drone deal lands at a time when sentiment around Hesai is turning more optimistic, with a roughly 22.7% 1 month share price return and a strong 73.9% 1 year total shareholder return, even after a recent pullback from the $22.36 level.

If this lidar partnership has you rethinking growth potential in automation and autonomy, it could be worth exploring high growth tech and AI stocks as another source of fast moving, innovation driven ideas.

With earnings accelerating and the share price already up sharply over the past year, is Hesai still trading at a meaningful discount to its growth potential, or are investors already paying up for tomorrow’s lidar wins?

Most Popular Narrative: 25% Undervalued

With Hesai closing at $22.36 against a most popular narrative fair value near $29.83, the story hinges on aggressive growth compounding into 2030 and beyond.

The growth of the ADAS market and LiDAR adoption in EVs is expected to rise from 8% in 2023 to 20% in 2025 and 56% by 2030, potentially increasing future revenue and market share.

Want to see what powers this gap between price and perceived value? The narrative leans on rapid scale up, richer margins and a punchy future earnings multiple. Curious how those pieces fit together and what kind of profit profile is being projected to justify that destination price? Read on to uncover the full playbook behind this valuation path.

Result: Fair Value of $29.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, analysts still flag execution risks from heavy client concentration and aggressive overseas expansion, which could quickly challenge today’s optimistic lidar growth assumptions.

Find out about the key risks to this Hesai Group narrative.

Another View: Rich Multiples Signal Less Cushion

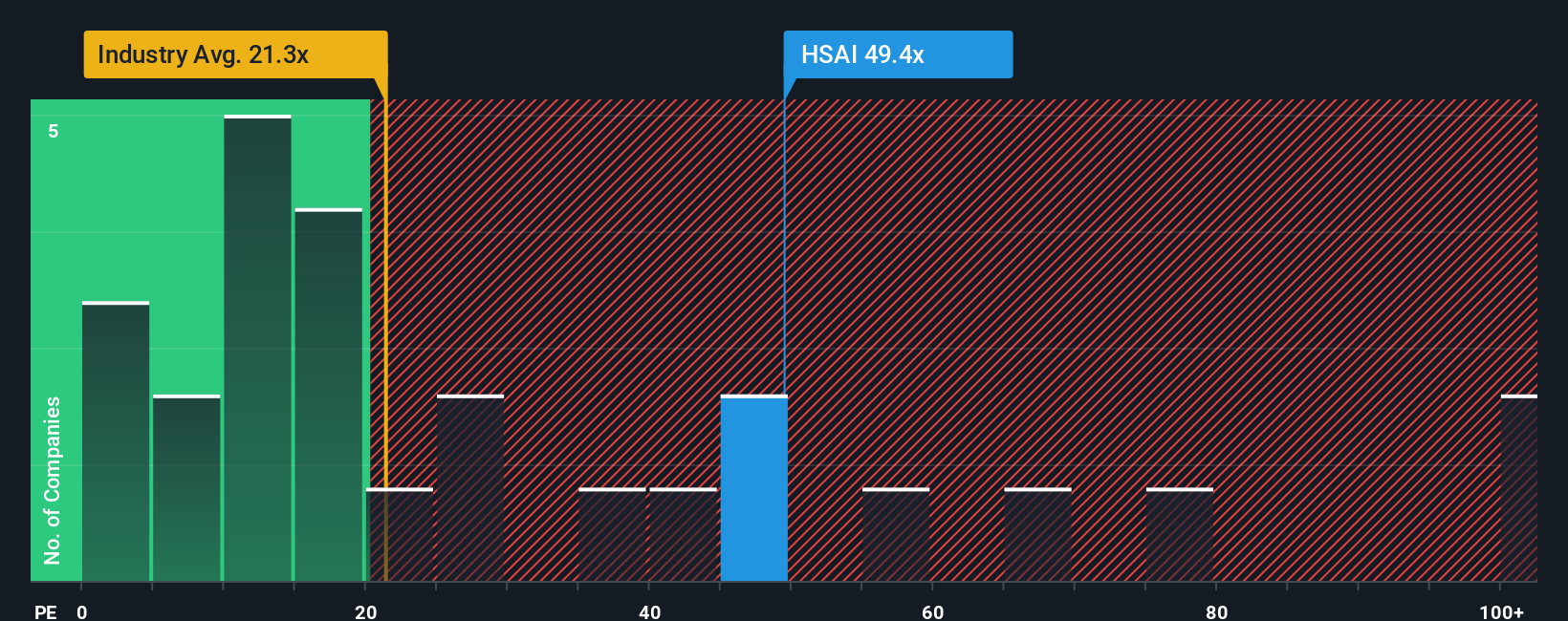

While narrative and fair value estimates point to upside, Hesai trades on a 57x price to earnings ratio versus about 18.9x for the US Auto Components industry, a 40.8x fair ratio, and roughly 12.1x for peers. This leaves little room for hiccups if growth stumbles.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Hesai Group Narrative

If you see the numbers differently or want to stress test your own assumptions, you can build a custom Hesai storyline in minutes: Do it your way.

A great starting point for your Hesai Group research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more forward looking opportunities?

Do not stop with a single lidar story when the market is full of ambitious businesses. Use the Simply Wall St Screener to uncover your next move.

- Capture potential mispricings early by scanning these 904 undervalued stocks based on cash flows that could offer stronger upside than widely followed names.

- Ride structural growth in automation and smart infrastructure by targeting these 24 AI penny stocks positioned to benefit from accelerating AI adoption.

- Boost your income stream by focusing on these 10 dividend stocks with yields > 3% that combine reliable payouts with solid fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com