Evaluating Orla Mining (TSX:OLA) After High-Grade Musselwhite Drill Success and Resource Expansion Potential

Orla Mining (TSX:OLA) just confirmed high grade extensions to its Musselwhite mine trend, with new drilling two kilometres downplunge suggesting more ounces in the ground and a potentially longer mine life.

See our latest analysis for Orla Mining.

The latest Musselwhite drilling success comes after a busy year for Orla, including fresh board-level financial expertise. It lands against a backdrop of powerful momentum, with a year to date share price return of 133.49 percent and a three year total shareholder return of 250.44 percent, signalling that investors see the growth story accelerating rather than fading.

If this kind of exploration driven rerating has caught your attention, it could be a good moment to see what else is out there and explore fast growing stocks with high insider ownership.

Yet with the shares already up strongly and trading below, but not far from, analyst targets, the key question now is whether Orla still trades at a meaningful discount or if the market is already pricing in that growth.

Most Popular Narrative: 16.9% Undervalued

With Orla Mining last closing at CA$19.87 versus a narrative fair value near CA$23.91, the story implies more upside driven by execution and growth.

Robust production growth and revenue diversification from integrating Musselwhite, as well as future contributions from South Railroad and expanded Camino Rojo underground, are likely underappreciated catalysts that will increase long term revenue and reduce operational risk.

Curious how this story gets from today’s modest margins to a far richer future, with earnings and valuation metrics more often seen in market darlings? The narrative leans on aggressive revenue expansion, a sharp step up in profitability, and a very specific future earnings multiple to justify that higher price. Want to see exactly which financial milestones have to fall into place for this target to work?

Result: Fair Value of $23.91 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside depends on smooth execution, and any permitting delays or cost inflation could quickly compress margins and derail those ambitious earnings targets.

Find out about the key risks to this Orla Mining narrative.

Another Lens On Value

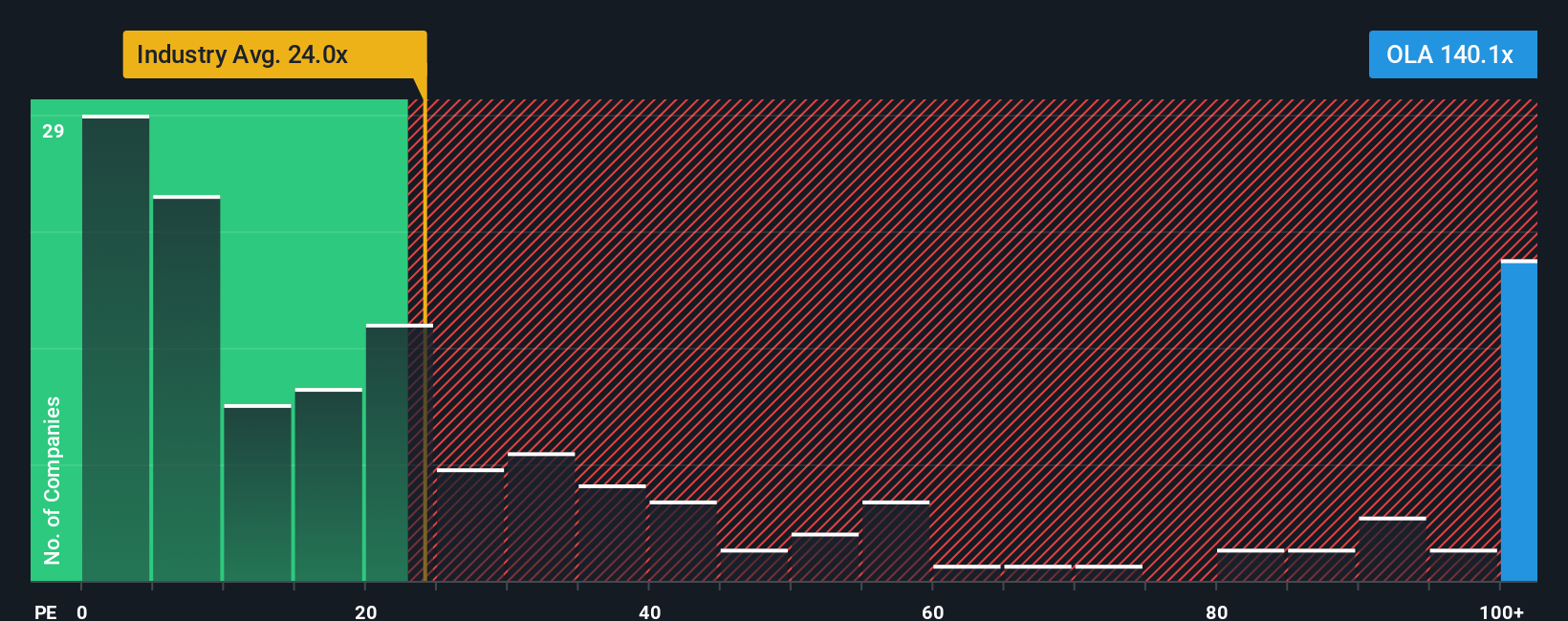

Step away from narratives and the picture shifts. On earnings, Orla trades on about 91.9 times, compared with 21.9 times for the Canadian metals and mining group and a 25 times fair ratio. That kind of premium can vanish fast if growth or gold prices wobble. Is this upside already spent?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Orla Mining Narrative

If you see the numbers differently or want to dive deeper into the data yourself, you can build a complete narrative in minutes: Do it your way.

A great starting point for your Orla Mining research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Do not stop with one compelling story when you can quickly scan fresh opportunities, compare potential returns, and position yourself ahead of the next wave of market winners.

- Capture out of favor bargains by targeting companies that look mispriced on future cash flows through these 904 undervalued stocks based on cash flows before the crowd notices.

- Capitalize on the AI boom by focusing on innovators shaping automation and intelligent systems with these 24 AI penny stocks.

- Lock in income potential by zeroing in on dependable payers via these 10 dividend stocks with yields > 3% that can strengthen your portfolio through every cycle.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com