A look at Americas Gold and Silver (TSX:USA) valuation after its inclusion in a key global mining index

Index inclusion puts Americas Gold and Silver in sharper focus

Americas Gold and Silver (TSX:USA) has just been added to the S and P TSX Global Mining Index, a move that can quietly broaden its shareholder base and influence trading patterns over time.

See our latest analysis for Americas Gold and Silver.

The index inclusion lands on top of an already strong run, with a 30 day share price return of 44.3 percent and a 1 year total shareholder return of 480.36 percent, suggesting momentum is still building despite the volatile longer term track record.

If this kind of move has you wondering what else might be setting up for a strong run, it could be worth exploring fast growing stocks with high insider ownership.

Yet despite a sharp rerating and improving fundamentals, the shares still trade at a discount to analyst targets and some estimates of intrinsic value. This raises the question: is this a fresh buying opportunity, or is the market already pricing in future growth?

Most Popular Narrative Narrative: 10.1% Undervalued

With Americas Gold and Silver last closing at CA$7.98 against a narrative fair value of CA$8.88, the story leans toward further upside driven by operations.

The transition to the higher-grade silver-copper EC120 at Cosalá, with commercial production expected by year end 2025, promises significant increases in silver output and free cash flow, directly boosting consolidated revenue and improving cash generation.

Curious how a ramp up in output, rising margins and a richer earnings multiple all fit together to back this valuation? The narrative stitches these moving parts into a single, aggressive growth path that could reframe what investors are willing to pay for this stock.

Result: Fair Value of $8.88 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, concentrated reliance on Galena and Cosalá, along with high all in sustaining costs, means any production setback or cost overrun could quickly derail this upside.

Find out about the key risks to this Americas Gold and Silver narrative.

Another Lens on Value

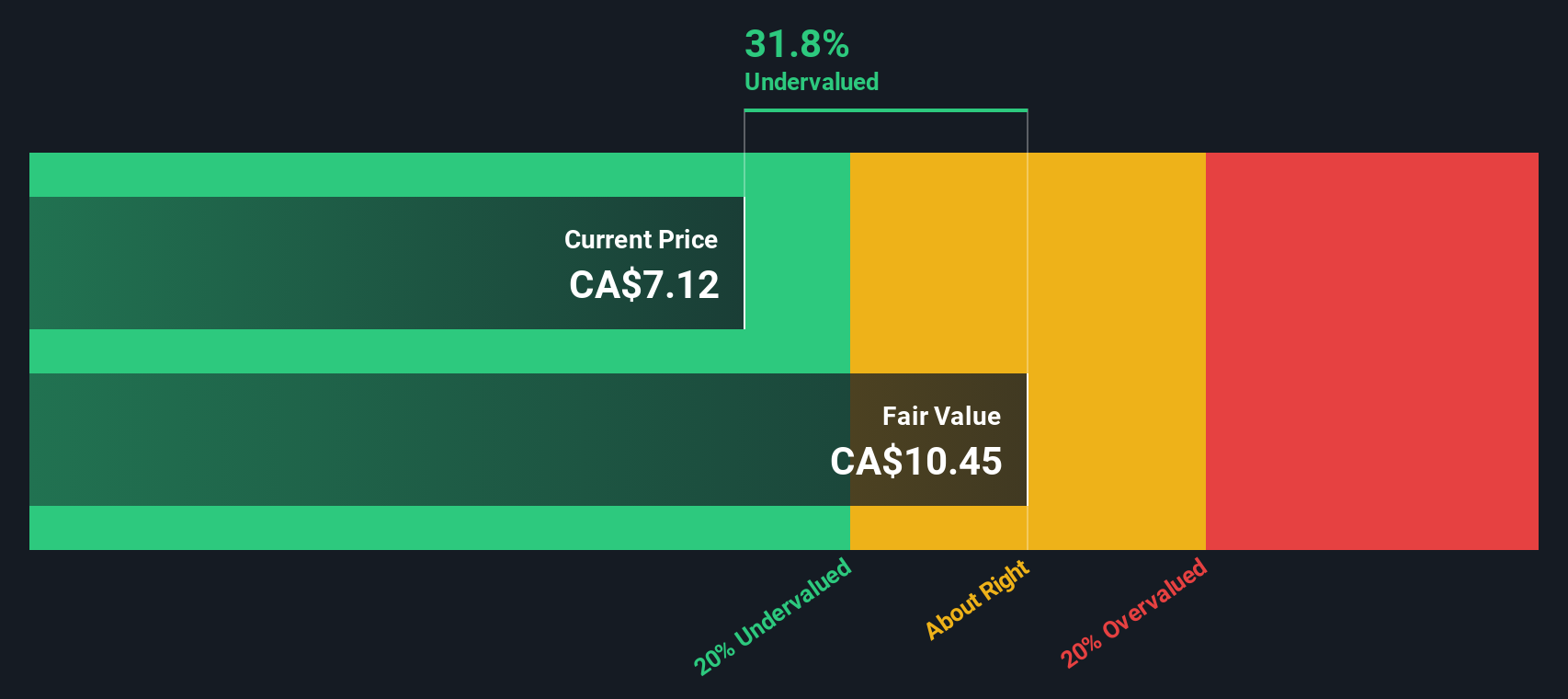

Our DCF model paints a different picture, pointing to an intrinsic value of about CA$10.46, meaning the shares screen as more deeply undervalued than the narrative fair value suggests. If cash flows really ramp as forecast, could the market be underestimating how far this rerating can run?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Americas Gold and Silver Narrative

If you see the story differently, or simply want to test your own assumptions against the data, you can build a fresh view in minutes, Do it your way.

A great starting point for your Americas Gold and Silver research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investing move?

Before you move on, lock in your advantage by using the Simply Wall St Screener to surface fresh, data driven opportunities that others are still overlooking.

- Target reliable income streams by scanning these 10 dividend stocks with yields > 3% that can strengthen your portfolio with consistent cash returns.

- Ride structural growth trends by zeroing in on these 24 AI penny stocks that stand to benefit from accelerating adoption of intelligent automation.

- Hunt for mispriced potential by focusing on these 904 undervalued stocks based on cash flows, built to spotlight stocks where market expectations still lag underlying cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com