Exploring December 2025's Undervalued European Small Caps With Insider Action

As the pan-European STOXX Europe 600 Index rises by 1.60%, buoyed by signs of steady economic growth and looser monetary policy, small-cap stocks in Europe are garnering attention amid these favorable conditions. In this environment, identifying promising small-cap stocks involves looking for companies with solid fundamentals that can capitalize on economic stability and potential insider actions that may indicate confidence in their future prospects.

Top 10 Undervalued Small Caps With Insider Buying In Europe

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Norcros | 13.4x | 0.7x | 42.33% | ★★★★★☆ |

| A.G. BARR | 14.3x | 1.6x | 48.80% | ★★★★★☆ |

| Speedy Hire | NA | 0.3x | 42.69% | ★★★★★☆ |

| Eastnine | 12.2x | 7.7x | 48.62% | ★★★★★☆ |

| Eurocell | 16.3x | 0.3x | 39.98% | ★★★★☆☆ |

| Senior | 25.2x | 0.8x | 24.95% | ★★★★☆☆ |

| Tristel | 29.3x | 4.2x | 20.45% | ★★★☆☆☆ |

| Gooch & Housego | 46.8x | 1.1x | 22.13% | ★★★☆☆☆ |

| Kendrion | 29.2x | 0.7x | 41.84% | ★★★☆☆☆ |

| CVS Group | 47.6x | 1.3x | 23.76% | ★★★☆☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

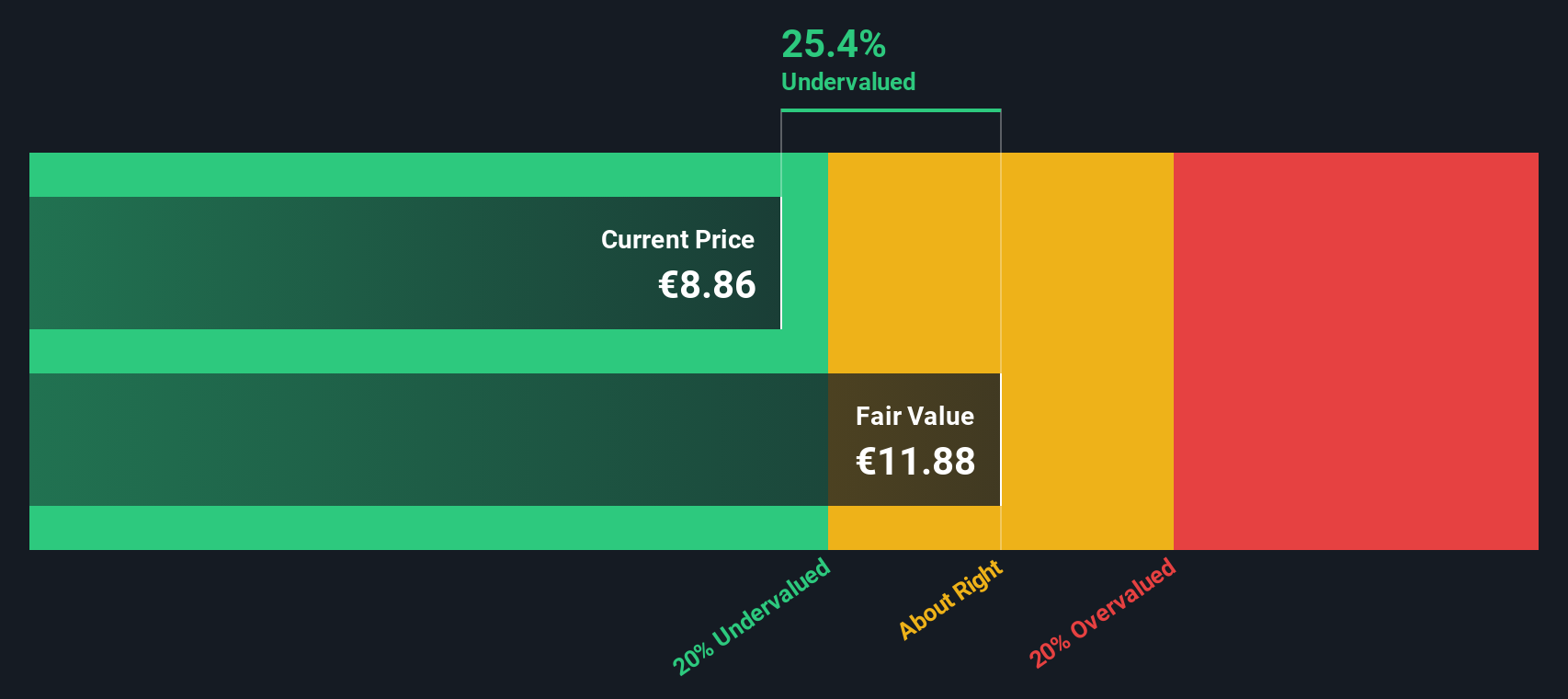

Fugro (ENXTAM:FUR)

Simply Wall St Value Rating: ★★★★★☆

Overview: Fugro is a global company specializing in geotechnical, survey, subsea, and geosciences services with operations across the Americas, Asia Pacific, Europe-Africa, and the Middle East & India regions.

Operations: The company generates revenue primarily from its operations in Europe-Africa, followed by the Americas and Asia Pacific. The gross profit margin experienced a notable increase from 25.00% in early 2020 to 37.21% by late 2024, reflecting improved cost management and operational efficiency. Despite fluctuations in net income margins over the years, recent figures show positive growth with a net income margin reaching up to 13.08% by mid-2024, indicating enhanced profitability amidst varying operating expenses and non-operating costs.

PE: 7.1x

Fugro, a small company in Europe, presents an intriguing opportunity with its current financial landscape. Despite a dip in profit margins from 13.1% to 6.3%, earnings are expected to grow by 8.47% annually, hinting at potential recovery and growth. Insider confidence is evident as they increased their share purchases over the past year, signaling belief in future prospects. However, reliance on external borrowing poses risks amidst its recent removal from the Euronext 150 Index as of October 2025.

- Click here and access our complete valuation analysis report to understand the dynamics of Fugro.

Evaluate Fugro's historical performance by accessing our past performance report.

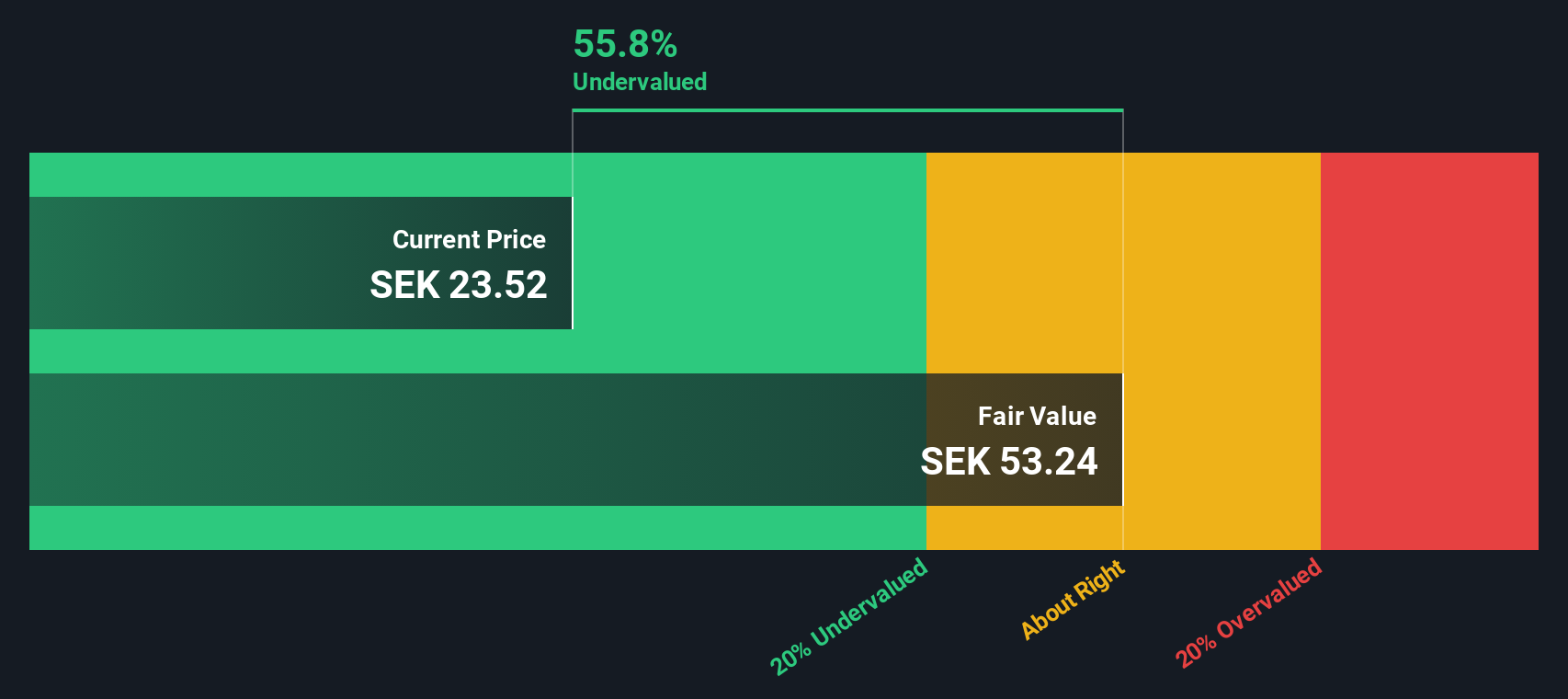

BHG Group (OM:BHG)

Simply Wall St Value Rating: ★★★★☆☆

Overview: BHG Group operates in the e-commerce sector, focusing on home improvement and living products, with a market capitalization of SEK 2.95 billion.

Operations: The company generates revenue primarily from its segments: Home Improvement, Value Home, and Premium Living. The gross profit margin has shown variability, with a notable increase to 18.80% in Q3 2023. Operating expenses have fluctuated over time, impacting net income margins significantly.

PE: -16.6x

BHG Group, a European small company, reported a notable turnaround with net income of SEK 11.2 million for Q3 2025, reversing last year's loss of SEK 66.8 million. Sales climbed to SEK 2,597.4 million from SEK 2,354.1 million in the same period last year. Despite relying on external borrowing for funding, insiders demonstrated confidence by purchasing shares recently. Earnings are projected to grow significantly at an annual rate of over 80%, suggesting potential future growth amidst current financial improvements.

- Delve into the full analysis valuation report here for a deeper understanding of BHG Group.

Gain insights into BHG Group's past trends and performance with our Past report.

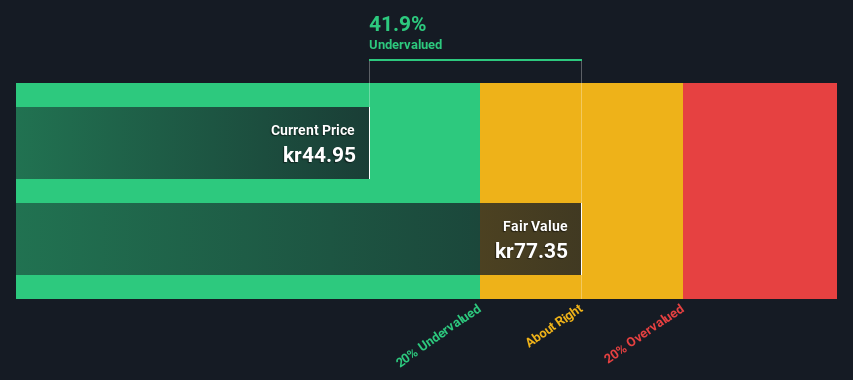

Eastnine (OM:EAST)

Simply Wall St Value Rating: ★★★★★☆

Overview: Eastnine is a real estate company focused on property investments in the Baltic capitals, with a market cap of €0.18 billion.

Operations: The company's revenue primarily comes from its properties in Vilnius, Lithuania and Riga, Latvia. It has demonstrated a consistent gross profit margin of approximately 93% to 94% over recent periods. Operating expenses include general and administrative costs, which have been around €4 million recently.

PE: 12.2x

Eastnine's recent financial performance shows promising growth, with third-quarter sales jumping to €15.53 million from last year's €10.7 million, and net income climbing to €9.65 million from €0.801 million. Despite this growth, earnings are forecasted to decline by 4.2% annually over the next three years due to reliance on external borrowing for funding, which carries higher risk than customer deposits. Insider confidence is evident as insiders have been purchasing shares recently, reflecting potential optimism about future prospects even amidst executive changes like the upcoming CFO transition in June 2026.

- Take a closer look at Eastnine's potential here in our valuation report.

Gain insights into Eastnine's historical performance by reviewing our past performance report.

Make It Happen

- Click through to start exploring the rest of the 71 Undervalued European Small Caps With Insider Buying now.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com