Targa Resources (TRGP): Revisiting Valuation After a Steady Multi-Year Share Price Climb

Targa Resources (TRGP) has been quietly grinding higher, and with the stock up about 8% over the past month and 7% in the past 3 months, investors are revisiting its long term story.

See our latest analysis for Targa Resources.

Zooming out, that 8 percent 1 month share price return fits into a steadier climb toward the current 183.73 dollars level. A powerful 3 year total shareholder return above 170 percent shows longer term momentum is still very much intact.

If Targa's steady gains have you thinking about what else might be quietly compounding in the background, now is a smart time to discover fast growing stocks with high insider ownership.

With earnings still growing and shares trading about 14 percent below analyst targets, the question now is simple: is Targa still undervalued or is the market already pricing in years of future growth?

Most Popular Narrative: 12% Undervalued

Compared to Targa Resources last close of 183.73 dollars, the most popular narrative points to a meaningfully higher fair value anchored in future cash flows.

The analysts have a consensus price target of $207.421 for Targa Resources based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the more bullish reporting a price target of $240.0, and the most bearish reporting a price target of just $186.0.

Want to see what justifies paying a premium multiple for a midstream name, while still calling it undervalued? The narrative leans on accelerating revenues, expanding margins and shrinking share count to defend a valuation usually reserved for faster growing sectors. Curious how those moving parts stack up over the next few years to close the gap to that fair value?

Result: Fair Value of $208.90 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensifying Permian competition and potential midstream overbuild could compress fees and margins, limiting upside if volumes or export economics disappoint.

Find out about the key risks to this Targa Resources narrative.

Another Angle on Valuation

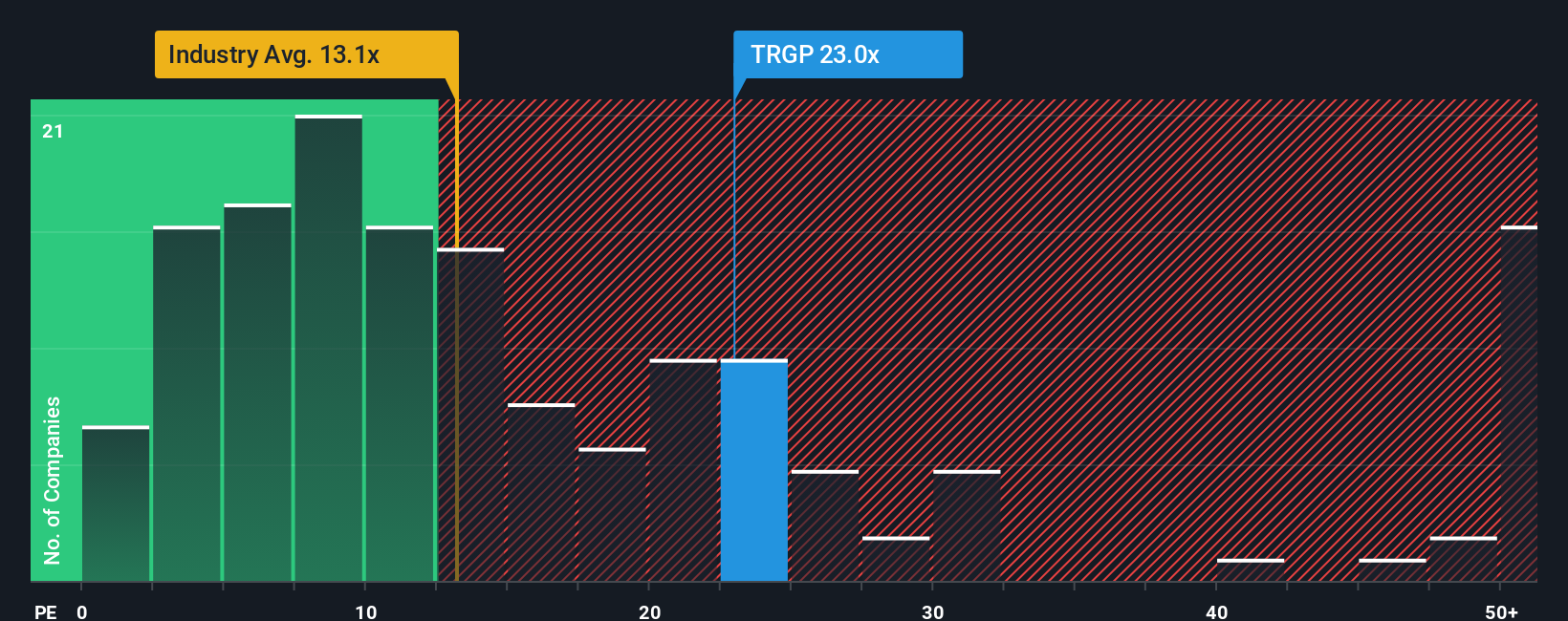

On simpler earnings multiples, Targa looks far less forgiving. Its 24.4 times price to earnings sits well above the US Oil and Gas average of 12.9 times, a 14.3 times peer average, and even our 20.3 times fair ratio. This raises the risk that sentiment, not fundamentals, is doing more of the heavy lifting.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Targa Resources Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalized view in just minutes: Do it your way.

A great starting point for your Targa Resources research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in an edge by using the Simply Wall Street Screener to uncover fresh opportunities that could strengthen and diversify your portfolio.

- Target steady cash returns by scanning these 10 dividend stocks with yields > 3% that may offer reliable income alongside potential capital growth.

- Ride powerful tech tailwinds by filtering for these 24 AI penny stocks positioned to benefit from the rapid adoption of artificial intelligence.

- Capitalize on market mispricing by reviewing these 904 undervalued stocks based on cash flows that could be trading below their intrinsic worth based on future cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com