Reassessing MSCI (MSCI) Valuation as It Weighs Excluding High Digital-Asset Firms from Indexes

MSCI (MSCI) has kicked off a heated debate by reviewing whether companies with more than 50% of their assets in Bitcoin and other digital tokens still belong in its flagship equity indexes.

See our latest analysis for MSCI.

The review lands at an interesting moment for MSCI, with a 30 day share price return of 4.52 percent helping the stock claw back some of its year to date softness. A 5 year total shareholder return above 40 percent shows the longer term story is still intact even as momentum has cooled.

If this kind of structural shift in indexing has you rethinking your opportunity set, it could be a good time to explore fast growing stocks with high insider ownership.

With revenue and earnings still growing at a healthy clip and the share price sitting about 13 percent below analyst targets, yet trading at a premium to intrinsic value, is MSCI a bargain in waiting or is future growth already priced in?

Most Popular Narrative Narrative: 11.5% Undervalued

Compared with the last close of $581.75, the most widely followed narrative points to a higher fair value, framing MSCI as modestly mispriced but not speculative.

The analysts have a consensus price target of $619.071 for MSCI based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $700.0, and the most bearish reporting a price target of just $520.0.

Want to see what is powering that valuation gap? The storyline leans on steady revenue compounding, rising margins, and a premium earnings multiple that rivals market leaders.

Result: Fair Value of $657.56 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slower sustainability demand and potential fee compression in passive products could challenge MSCI's premium multiple if growth falls short of expectations.

Find out about the key risks to this MSCI narrative.

Another Lens on Value

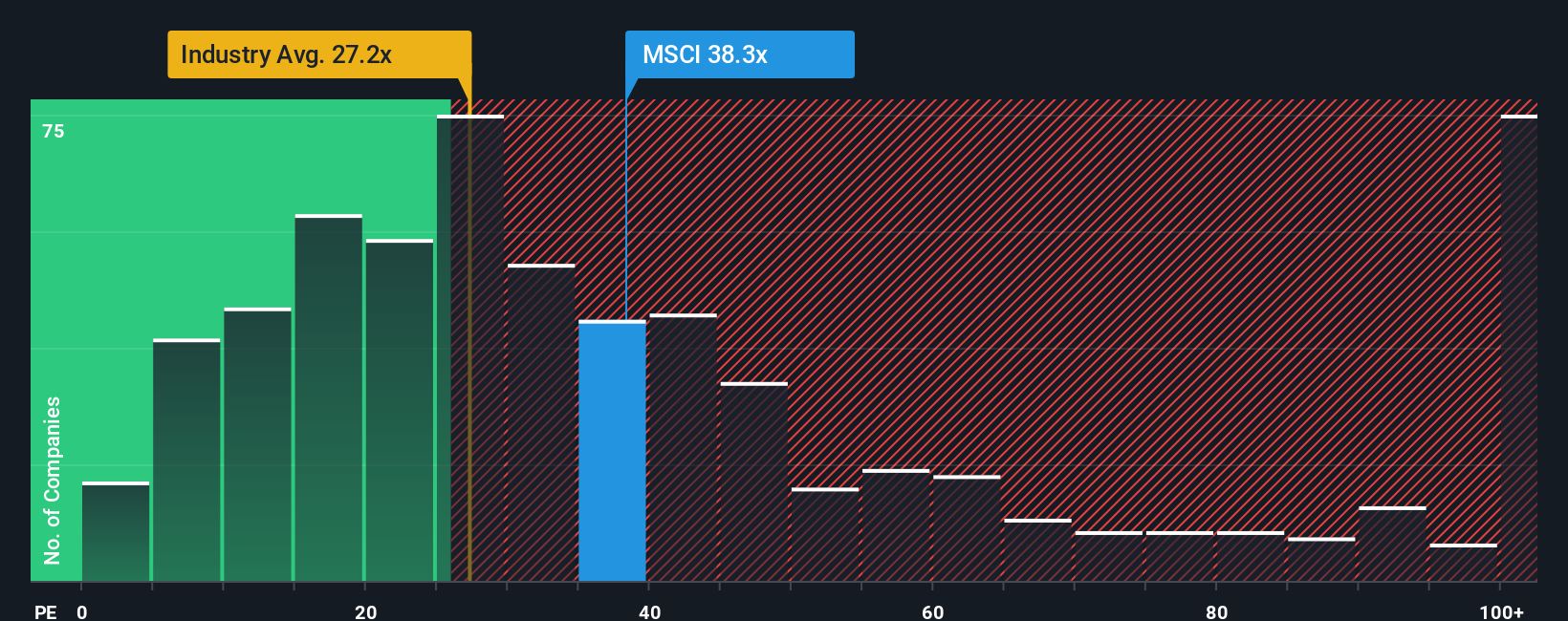

Step back from fair value estimates and the picture looks tougher. At 35.7 times earnings, MSCI trades above both Capital Markets peers at 25.7 times and a fair ratio of 16.7 times. This points to real de rating risk if growth or sentiment slips.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own MSCI Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalized view in minutes: Do it your way.

A great starting point for your MSCI research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Do not stop at one opportunity. Your next market winner could be hiding in plain sight, and the Simply Wall St Screener helps you uncover it fast.

- Capture potential multibaggers early by targeting these 3630 penny stocks with strong financials that already back up their promise with solid financials.

- Position yourself at the cutting edge of innovation by focusing on these 24 AI penny stocks in the artificial intelligence space.

- Explore stronger income potential by filtering for these 10 dividend stocks with yields > 3% that can add income to your portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com