Deutsche Bank (XTRA:DBK) Valuation Check After New Bond Issuances and Metaplanet ADR Mandate

Deutsche Bank (XTRA:DBK) has quietly stacked up a series of new senior unsecured bond issues and a fresh ADR mandate with Metaplanet, developments that subtly reshape the risk return profile behind today’s share price.

See our latest analysis for Deutsche Bank.

These steady funding moves and the new Metaplanet ADR mandate land against a powerful backdrop, with Deutsche Bank’s share price up strongly and a triple digit one year total shareholder return suggesting momentum is still very much building.

If you are reassessing your financials exposure after Deutsche Bank’s run, it is a good moment to widen the lens and explore fast growing stocks with high insider ownership.

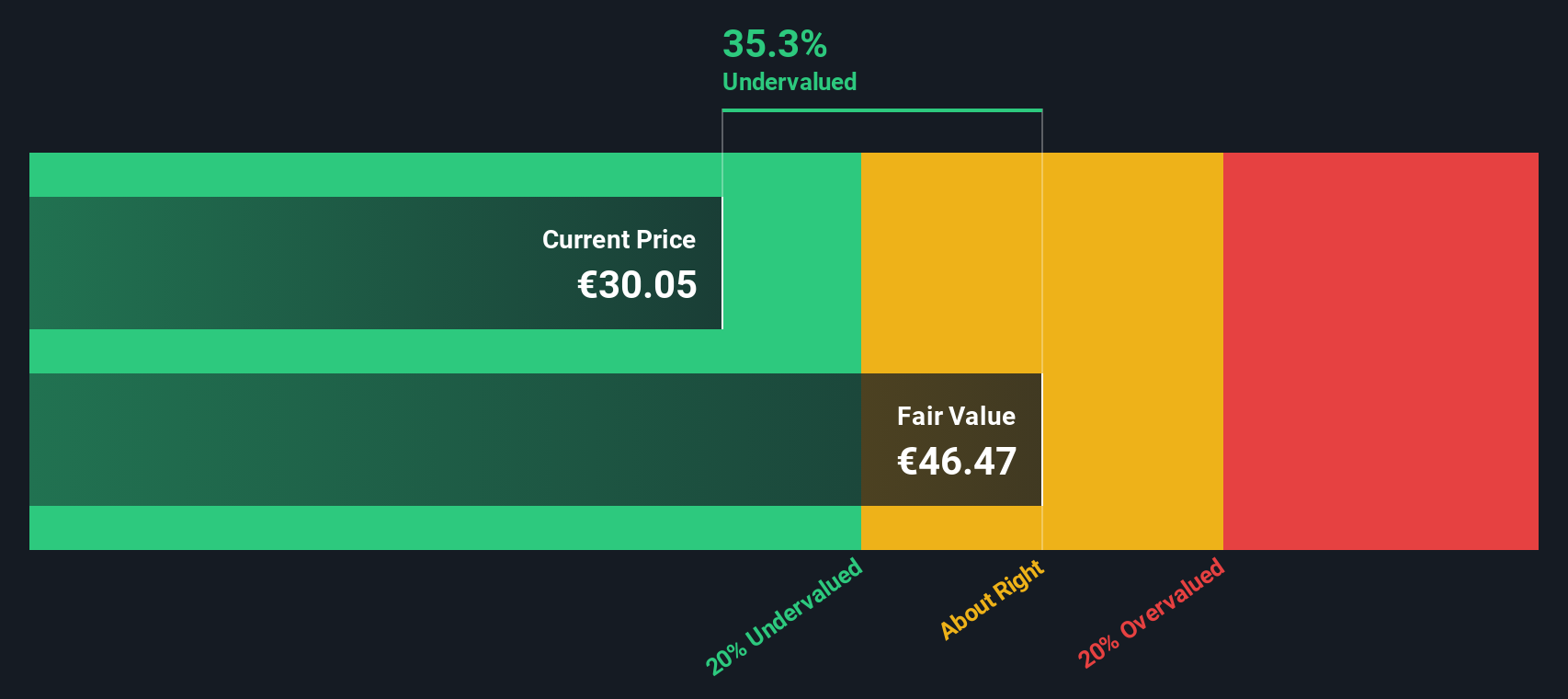

Despite a one year total return above 100 percent and the current price edging past consensus targets, Deutsche Bank still screens at a modest intrinsic discount. This raises a key question: is there more upside to capture, or has the market fully priced in future growth?

Most Popular Narrative: 6.5% Overvalued

With Deutsche Bank last closing at €33.30 against a narrative fair value of €31.27, the story leans toward a mildly stretched valuation built on steady, not explosive, growth.

The analysts have a consensus price target of €27.954 for Deutsche Bank based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €35.0, and the most bearish reporting a price target of just €10.93.

Want to see how modest revenue growth, firmer margins, and a deliberately lower future earnings multiple still justify today’s price? The full narrative reveals the exact earnings path, valuation reset, and capital return assumptions that underpin this fair value call, and why they still point to limited upside from here.

Result: Fair Value of €31.27 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistently higher credit losses or an adverse outcome on lingering litigation could quickly erode earnings momentum and challenge the current valuation narrative.

Find out about the key risks to this Deutsche Bank narrative.

Another Lens on Value

Step away from the narrative fair value and Deutsche Bank actually trades about 7.2 percent below our estimate of fair value using the SWS DCF model, implying the shares are modestly undervalued rather than 6.5 percent overvalued. Which lens better matches your own assumptions?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Deutsche Bank Narrative

If you see the story differently or want to stress test your own assumptions using our data and tools, you can build a custom view in just a few minutes, Do it your way.

A great starting point for your Deutsche Bank research is our analysis highlighting 4 key rewards and 4 important warning signs that could impact your investment decision.

Ready for your next investing move?

Do not stop at one compelling story. Use the Simply Wall St Screener to uncover fresh opportunities that could sharpen your portfolio and keep you ahead.

- Capture income potential by reviewing these 10 dividend stocks with yields > 3% that can strengthen your portfolio’s cash flow while markets stay unpredictable.

- Ride structural growth trends with these 29 healthcare AI stocks, where data driven medicine and automation reshape how healthcare leaders earn and scale.

- Position yourself early in financial innovation by assessing these 80 cryptocurrency and blockchain stocks transforming payments, security, and digital asset infrastructure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com