Counterpoint Research: Global Foundry 2.0 Market Revenue Increased 17% YoY to US$84.8 billion in Q3 2025

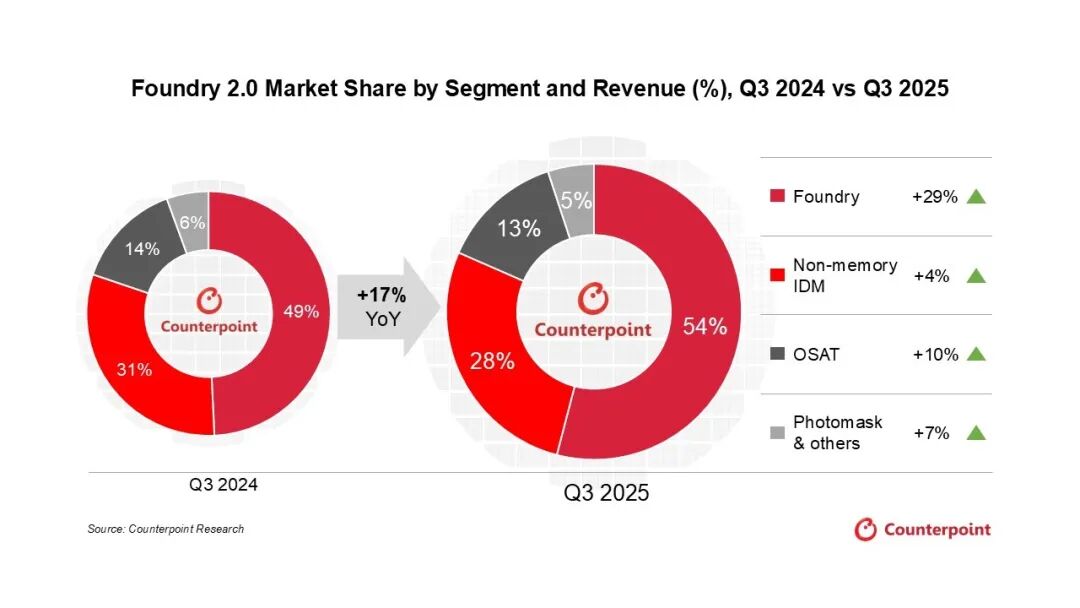

The Zhitong Finance App learned that Counterpoint Research published an article stating that the semiconductor industry has officially entered the “Foundry 2.0” era. This stage is characterized by deep integration of manufacturing, packaging, and testing, and has achieved higher quality growth driven by the global AI boom. According to the “Foundry Revenue, Yield, and Capacity Utilization Tracking Report by Node” recently released by Counterpoint Research, the global foundry 2.0 market revenue increased 17% year-on-year in Q3 2025, reaching US$84.8 billion. This double-digit increase is mainly due to continued demand for AI GPUs in front-end wafer manufacturing and back-end advanced packaging.

The traditional definition of “foundry 1.0” focuses only on chip manufacturing and cannot fully reflect current industry trends. Counterpoint proposed the “Foundry 2.0” concept, incorporating pure wafer foundries, non-storage IDMs, OSAT vendors, and photomask suppliers into a unified analytical framework. Neil Shah, vice president of research at Counterpoint Research, said, “Businesses are transforming from a link in the manufacturing chain to a technology integration platform. This transformation ensures closer vertical collaboration, a faster pace of innovation, and deeper value creation, which are the keys to system-level optimization in the AI era.”

Source: Counterpoint Research

Highlights from Q3 2025 by segment:

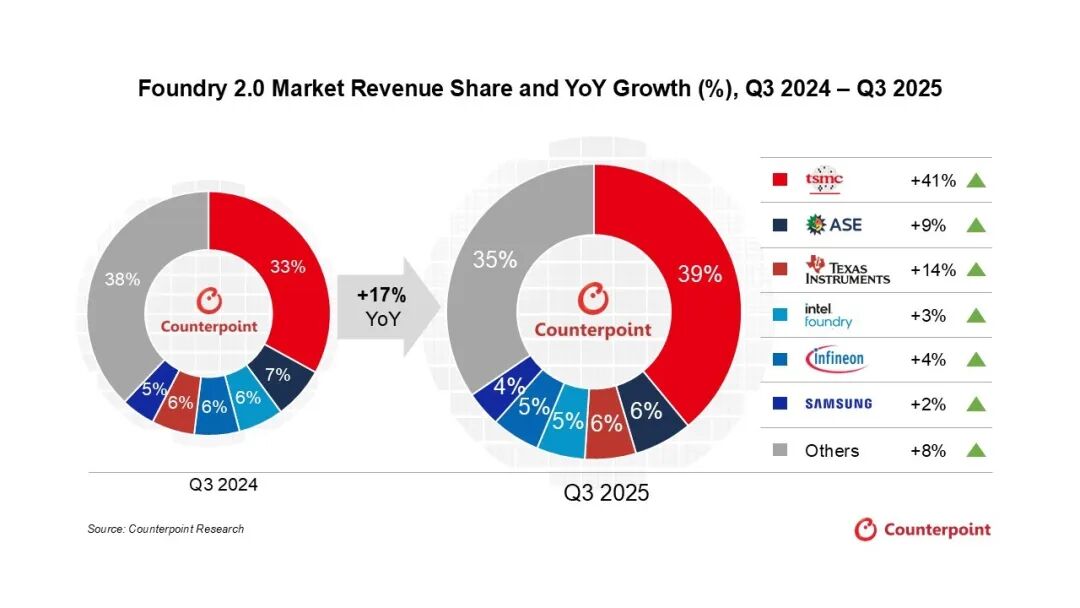

TSMC's outstanding performance: Among pure wafer foundries, TSMC continued to lead the overall market, and revenue increased 41% year over year. The increase is mainly due to the rise in mass production of Apple's flagship smartphone 3nm chips, as well as the full-load demand for 4/5nm processes from AI accelerator customers such as NVIDIA, AMD, and Broadcom. Meanwhile, 4/5nm production capacity continues to be tight, which has become a key factor limiting further growth in TSMC's Q4 revenue. However, TSMC's strong and reliable advanced packaging capabilities will continue to drive revenue growth in 2026.

Non-TSMC wafer foundry growth is slowing: non-TSMC wafer foundries as a whole achieved 6% year-on-year growth in Q3 2025, down from 11% in Q2 2025.

Non-storage IDM companies ushered in a recovery: non-storage IDM vendors resumed overall growth, up 4% year-on-year, indicating that the inventory removal cycle is nearing its end. Texas Instruments led the way with 14% year-on-year growth, while ST also showed signs of abating the downward trend.

The OSAT industry continues to prosper: The OSAT industry's revenue increased 10% year over year in Q3 2025 (5% in the same period in 2024). Sun Moon Light and Silicon Products became the main growth contributors during the quarter, and their FoCoS (Fan-Out Substrate Chip Package) solution benefited from TSMC's spillover orders to meet the needs of AI GPUs and AI ASICs. Counterpoint expects advanced packaging production capacity to increase by 100% year-on-year in 2026, so AI GPUs and AI ASICs will become the main growth engines for OSAT manufacturers from 2025 to 2026.

Source: Counterpoint Research

Regarding the outlook for the rest of the year, senior analyst Jake Lai said, “As the main revenue drivers gradually hit the upper limit of production capacity (4/5nm production capacity is running at full capacity), and CoWoS production capacity continues to be limited, there is limited possibility that TSMC, which will lead the core of overall foundry market growth in 2025, achieve significant month-on-month growth in Q4. As a result, we expect revenue growth in the Foundry 2.0 market to be around 15% for the full year of 2025. Among them, the pure wafer foundry market is expected to grow 26% year over year, and will become a key driving force for overall market expansion, supported by continued shipments of AI GPUs and AI ASICs over the next few quarters.”

Regarding advanced packaging trends, senior analyst William Li stated, “NVIDIA and Broadcom dominate the AI GPU and AI ASIC markets, and fluctuations in demand have a significant impact on overall CoOS demand. In 2026, TSMC is expected to focus primarily on NVIDIA's AI GPU platforms, including Blackwell and Rubin. This will present a strategic opportunity for OSAT vendors. Broadcom and other manufacturers must seek partners outside of the TSMC system to ensure the supply of CoWoS-S production capacity. This spillover demand will be an important driving force for the continued expansion of Sun Moon Light and Silicon products after 2025, particularly in the 2026 AMD Venice and NVIDIA Vera platform-related projects.”