IPO News | Miao Exhibition (300795.SZ) Announces Hong Kong Stock Exchange Focuses on Providing Exhibition Hosting Services

The Zhitong Finance App learned that according to the Hong Kong Stock Exchange's disclosure on December 24, Zhejiang Miaolante Business Exhibition Co., Ltd. (Miao Exhibition for short) submitted a listing application to the main board of the Hong Kong Stock Exchange, and China Merchants Securities International is its sole sponsor.

Company profile

According to the prospectus, Miao Exhibition (300795.SZ) is a mature exhibition service provider. The company's services can be mainly divided into three categories according to their nature, namely exhibition hosting services, exhibition agency services and others.

As an exhibition organizer, the company mainly provides comprehensive services including exhibition management, booth sales and other exhibition-related services, and the exhibition venue covers many countries and regions on five continents, such as the United Arab Emirates, Indonesia, Japan, Mexico, Brazil, Vietnam, mainland China, Poland and Egypt.

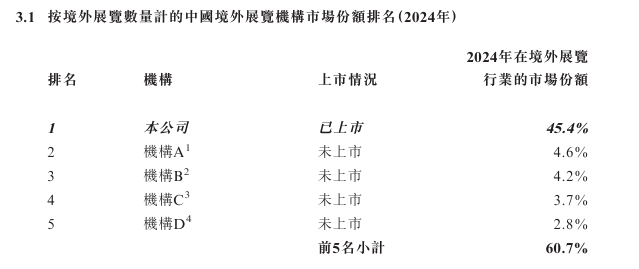

According to Frost & Sullivan, the company ranked first among all overseas exhibition organizations in China based on the number and area of overseas exhibitions held in 2024.

During the track record period, the company mainly provided exhibition hosting services, as the organizer led the entire exhibition process, including exhibition preparation, exhibition implementation, on-site operation and post-exhibition services.

As far as exhibition agency services are concerned, the company buys booths from exhibition organizers and resells them to exhibitors, and usually provides related services (such as arranging travel and accommodation for them). The company's other revenue mainly includes revenue generated from general online marketing services, such as website development and search engine optimization. Such services are not specifically provided for exhibitions.

The company has successfully held 77 exhibitions, attracting tens of thousands of exhibitors to participate in the exhibition. The company focuses on providing exhibition solutions for many industries, and has incubated more than 10 industry-specific exhibition brands, covering the fields of household goods, consumer electronics, textiles and industrial machinery.

Financial data

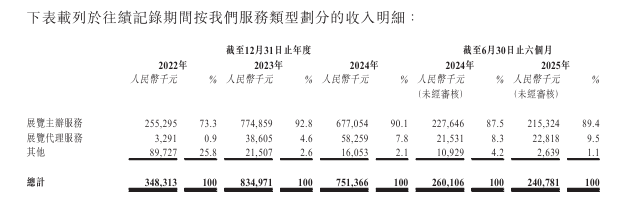

revenue

In 2022, 2023, 2024 and 2025 for the six months ended June 30, the company's revenue was approximately RMB 348 million, RMB 835 million, RMB 751 million, and RMB 241 million, respectively.

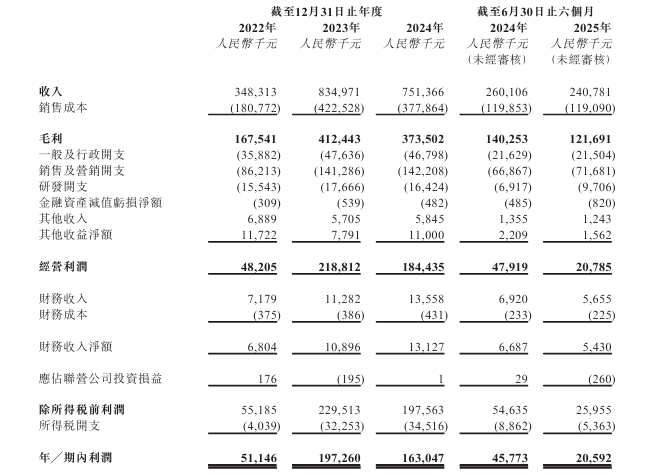

profit

In 2022, 2023, 2024 and 2025 for the six months ended June 30, the company's profit for the year/period was approximately RMB 51.46 million, RMB 197 million, RMB 163 million, and RMB 205.92 million, respectively.

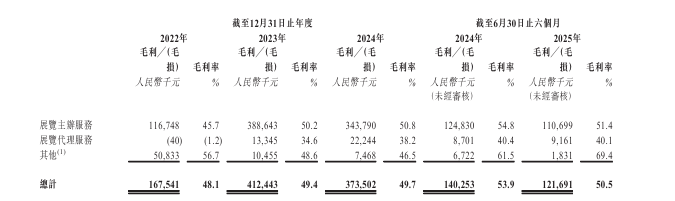

gross profit margin

For 2022, 2023, 2024 and 2025 for the six months ended June 30, the company's gross margins were 48.1%, 49.4%, 49.7% and 50.5%, respectively.

Industry Overview

Exhibition industry overview

The exhibition industry is a highly organized link in the modern service economy, fundamentally creating temporary and centralized markets and information hubs. The industry promotes efficient information exchange and commercial interaction, achieves rapid matching between supply and demand, supports the dissemination of industry development, and accelerates the emergence of business opportunities. As a result, it improves the efficiency of market operations and strengthens overall resource allocation.

The global exhibition industry

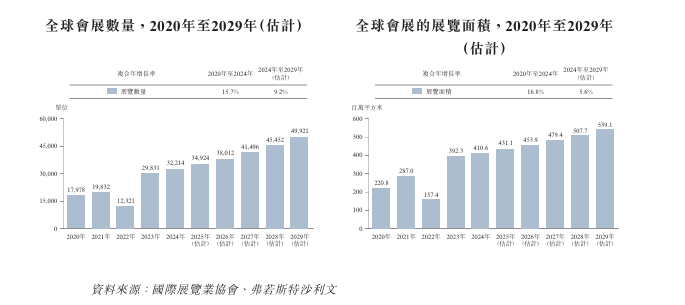

From 2020 to 2024, the number of global exhibitions and related exhibition areas simultaneously rebounded from the pressure base to normal levels. From 2020 to 2022, exhibition activities continued to be limited. In 2022, the number of exhibitions dropped to 12,321, and the exhibition area dropped to 157 million square meters. Both indicators rebounded sharply in 2024 as international travel and offline activities resumed.

Looking ahead to 2024 to 2029, the global exhibition industry is expected to enter a stage of steady and structural expansion in two indicators. The number of exhibitions is expected to increase from 32,214 in 2024 to 49,921 in 2029, with a compound annual growth rate of about 9.2%, while the total exhibition area is expected to increase from 412 million square meters to 539 million square meters, with a compound annual growth rate of about 5.6%.

China's exhibition industry

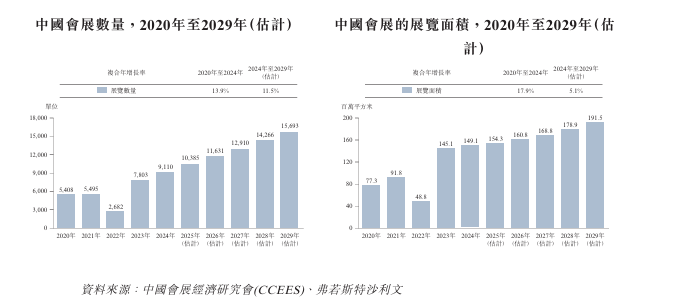

From 2020 to 2024, China's exhibition industry recorded a significant recovery in terms of the number and area of exhibitions. The number of exhibitions increased from 5,408 in 2020 to 9,110 in 2024. Looking ahead to 2024 to 2029, the number of exhibitions is expected to reach 10,385 in 2025 and further increase to 15,693 in 2029, with a CAGR of 11.5% during the forecast period.

Overseas exhibition industry as a whole

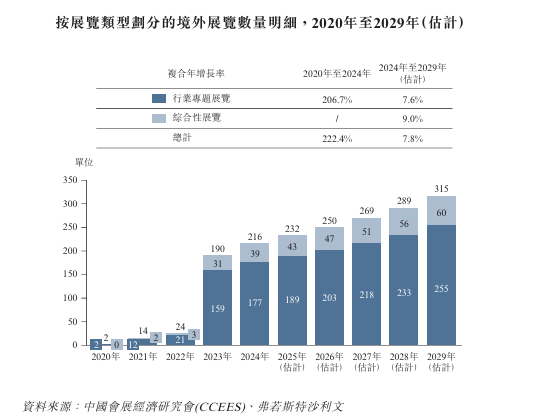

The overseas exhibition market continues to show a strong growth trend, mainly driven by the country's strategy to support Chinese enterprises to expand the international market, diversify trading partners, and enhance the global competitiveness of Chinese products. This expansion has contributed to an increase in the scale of events, and the total number of overseas exhibitions is expected to increase from 216 in 2024 to 315 in 2029.

The competitive landscape

According to Frost & Sullivan, the company ranked first among all overseas exhibition organizations in China based on the number and area of overseas exhibitions held in 2024.

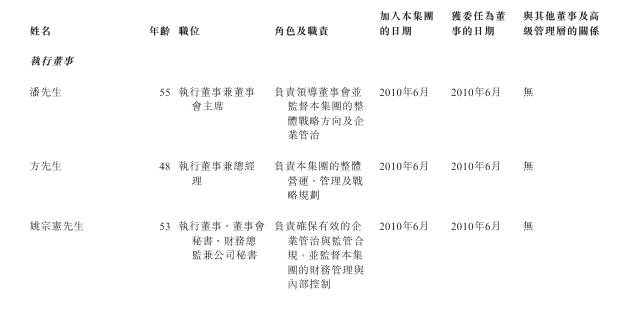

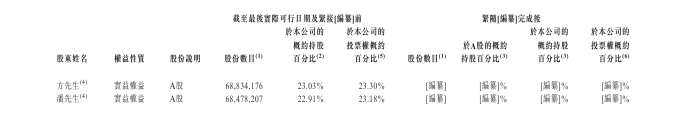

Board Information

The board of directors of the company consists of 7 directors, including 3 executive directors, 1 non-executive director and 3 independent non-executive directors. The term of directors is 3 years, and they can be re-elected.

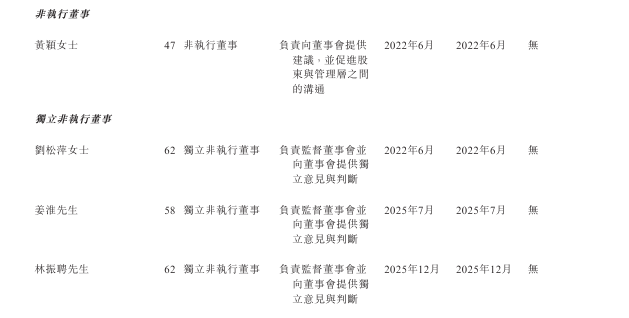

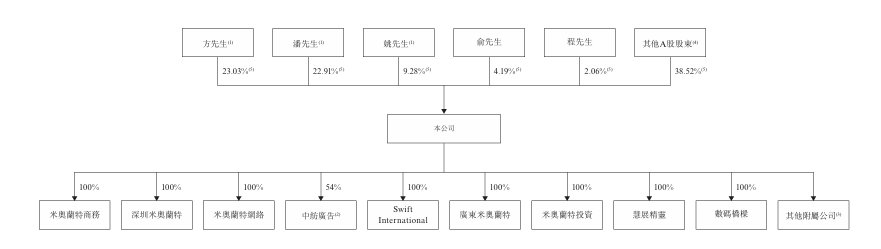

Shareholding structure

As of December 14, 2025, Mr. Fang, the company's executive director and general manager, directly owned a total of 68,834,176 A-shares, accounting for 23.30% of the company's voting rights. Mr. Pan holds 22.91% of the company's shares.

Intermediary team

Sole sponsor: China Merchants Securities (Hong Kong) Limited

Company Legal Adviser: Hong Kong Law: Tianyuan Law Firm (Limited Liability Partnership); Related Chinese Law: Beijing Deheng Law Firm

Sole sponsor's legal adviser: Related to Hong Kong law: Chow Chun Hsuen & Commerce Law Firm in partnership; relating to Chinese law: Jingtian Gongcheng Law Firm

Independent Auditor and Reporting Accountant: Tianjian International Certified Public Accountants Limited

Industry Advisor: Frost & Sullivan (Beijing) Consulting Co., Ltd. Shanghai Branch

Compliance Advisor: Chuangsheng Finance Co., Ltd.