Harrow (HROW): Assessing Valuation After a 29% One-Month Share Price Surge

Recent momentum in Harrow stock

Harrow (HROW) has quietly strung together a strong run, with the share price up roughly 29% over the past month and nearly 48% over the past year. This performance has put fresh attention on its valuation.

See our latest analysis for Harrow.

With the share price now at about $50.16 and a 1 month share price return close to 29%, that short term surge is adding to an already impressive 1 year total shareholder return of roughly 48%. This suggests momentum is still building rather than fading.

If Harrow’s recent run has you rethinking what else might be gaining traction in healthcare, it could be worth exploring healthcare stocks for more potential opportunities.

With the stock trading around $50 while analyst targets sit meaningfully higher and fundamentals showing rapid growth, is Harrow still flying under the radar as a buy? Or is the market already pricing in its next leg of expansion?

Most Popular Narrative Narrative: 29% Undervalued

Compared with Harrow’s last close at $50.16, the most popular narrative pegs fair value materially higher and frames the stock as mispriced against its future potential.

Operating leverage is set to improve meaningfully as Harrow's scalable commercial infrastructure, already built out and profitable, absorbs additional high-margin revenue from both organic growth (e.g., expanded refill rates, market share gains) and new product launches, likely driving further net margin expansion.

Curious how an eyecare specialist earns a premium valuation tag usually reserved for market darlings? The narrative leans on aggressive revenue, margin and earnings inflection. Want to see the exact glide path those assumptions sketch out?

Result: Fair Value of $70.63 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained outperformance is not guaranteed. Harrow’s dependence on a handful of flagship drugs and ambitious execution targets leaves little room for missteps.

Find out about the key risks to this Harrow narrative.

Another Angle on Value

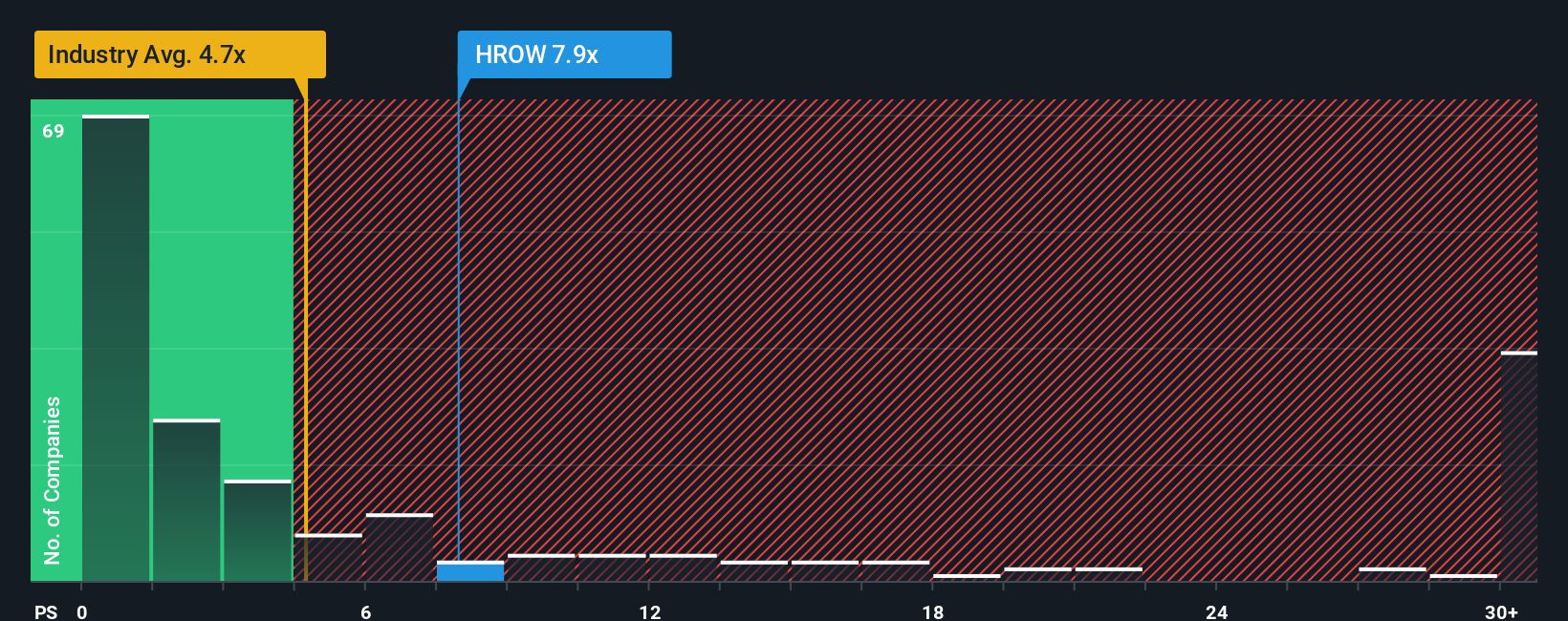

While narratives and fair value estimates point to upside, the market is already paying a steep price based on sales. Harrow trades on a price to sales ratio of 7.4 times, well above the US pharma industry at 4.4 times and peers at 2.8 times, even though our fair ratio suggests 8.9 times.

That gap cuts both ways. It signals potential rerating room if growth delivers, but also real downside risk if expectations cool. Which side of that trade do you think is more likely?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Harrow Narrative

If you see the story differently or want to test your own assumptions against the numbers, you can build a complete narrative in minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Harrow.

Looking for more investment ideas?

Do not stop your research with a single stock. Use the Simply Wall Street Screener to explore additional opportunities that could influence your portfolio’s long term returns.

- Capitalize on mispriced potential by targeting quality companies trading below their estimated worth through these 904 undervalued stocks based on cash flows before the market price adjusts.

- Explore the next wave of innovation by focusing on emerging innovators at accessible price points with these 3629 penny stocks with strong financials while they may still be off most radars.

- Support your income stream by considering reliable payers offering attractive yields using these 10 dividend stocks with yields > 3% so your capital is deployed efficiently.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com