UDR (UDR) JV Expansion Prompts Fresh Look at Valuation and Longer-Term Return Potential

UDR (UDR) just expanded its joint venture with LaSalle Investment Management by $230 million, adding four apartment communities and pushing the portfolio to 2,564 homes, a scale and diversification shift investors cannot ignore.

See our latest analysis for UDR.

The joint venture expansion, alongside UDR’s freshly affirmed quarterly dividend, has helped steady sentiment. Yet the share price return is still negative year to date, while multi year total shareholder returns remain modestly positive, suggesting momentum is only cautiously rebuilding.

If this deal has you thinking about where else capital is quietly compounding, it could be worth exploring fast growing stocks with high insider ownership as a fresh pool of ideas beyond REITs.

With UDR trading at a double digit discount to analyst targets yet showing only modest growth, the key question is whether investors are overlooking a steady compounder or correctly pricing in limited upside from here.

Most Popular Narrative Narrative: 9.9% Undervalued

With UDR closing at $36.43 against a narrative fair value near $40, the gap rests on a detailed roadmap of gradual growth and richer margins.

Analysts are assuming UDR's revenue will grow by 3.7% annually over the next 3 years. Analysts assume that profit margins will increase from 7.4% today to 11.9% in 3 years time.

Want to see why a relatively steady rental story commands such a rich future earnings multiple and upgraded margins assumptions? The core of this narrative leans on carefully staged revenue growth, a meaningful lift in profitability, and a valuation framework more often associated with faster growing sectors. Curious which specific earnings path and profit profile need to materialize to justify that price tag? Read on and unpack the precise levers behind this fair value call.

Result: Fair Value of $40.43 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained oversupply in key Sunbelt markets and tougher rent regulations in coastal cities could quickly erode the growth and margin improvements built into forecasts.

Find out about the key risks to this UDR narrative.

Another Angle on Valuation

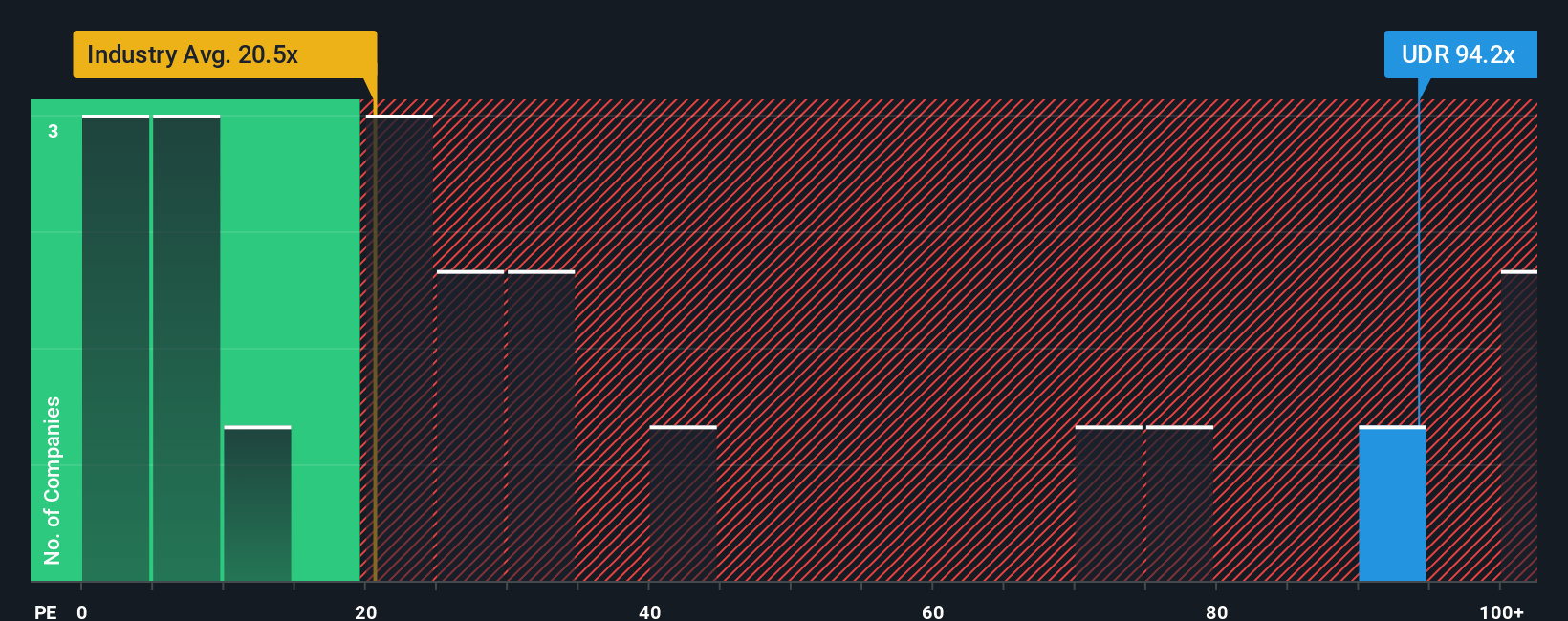

On earnings, the story is much harsher. UDR trades on a P/E of about 83 times, far richer than both the Residential REITs industry at roughly 25 times and peers at about 28 times, and well above a 32.9 times fair ratio that the market could eventually drift toward.

That kind of premium leaves little room for disappointment, raising the risk that multiple compression could offset years of steady earnings growth if sentiment turns. Is this a durable quality premium or a valuation trap in slow growing real estate cash flows?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own UDR Narrative

If this perspective does not fully resonate, or if you prefer reviewing the numbers yourself, you can form a complete view in minutes, Do it your way.

A great starting point for your UDR research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in an edge by using the Simply Wall Street Screener to spot opportunities most investors have not yet uncovered.

- Capture potential multi baggers early by reviewing these 3629 penny stocks with strong financials that already pair tiny share prices with surprisingly solid fundamentals.

- Ride structural growth in automation and data by scanning these 24 AI penny stocks where real revenues, not just hype, support the story.

- Strengthen your portfolio core with these 902 undervalued stocks based on cash flows that our models flag as mispriced relative to future cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com