Assessing AAR (AIR) Valuation After Its Strong 40% Year‑to‑Date Share Price Run

AAR (AIR) has quietly built a strong track record in aviation services, and its stock performance over the past year reflects that momentum, with shares significantly outpacing the broader market.

See our latest analysis for AAR.

That strength mirrors the stock’s run, with a near 40% year to date share price return and an almost 42% one year total shareholder return, signaling that momentum is still firmly building.

If AAR’s steady climb has your attention, this might be a good moment to scan for other aerospace names using our screener for aerospace and defense stocks.

Given that track record, a key question now is whether AAR’s valuation still leaves room for upside, or if the market has already priced in the company’s impressive growth and future runway for investors.

Most Popular Narrative Narrative: 6.7% Undervalued

With AAR last closing at $86.03 against a narrative fair value of $92.25, the story centers on whether its expansion can keep powering earnings.

AAR's strong growth in new parts Distribution (25%+ organic, significantly above market) directly aligns with increasing demand for resilient supply chains and more diversified inventory management from both commercial and government customers, indicating sustained future revenue expansion and potential for higher margins.

Curious how steady mid single digit revenue growth could translate into far higher profits and a richer earnings multiple than today? Discover the assumptions driving that jump.

Result: Fair Value of $92.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upbeat scenario could be derailed if OEMs intensify aftermarket competition or if AAR struggles to execute and scale its Trax digital platform.

Find out about the key risks to this AAR narrative.

Another Angle On Valuation

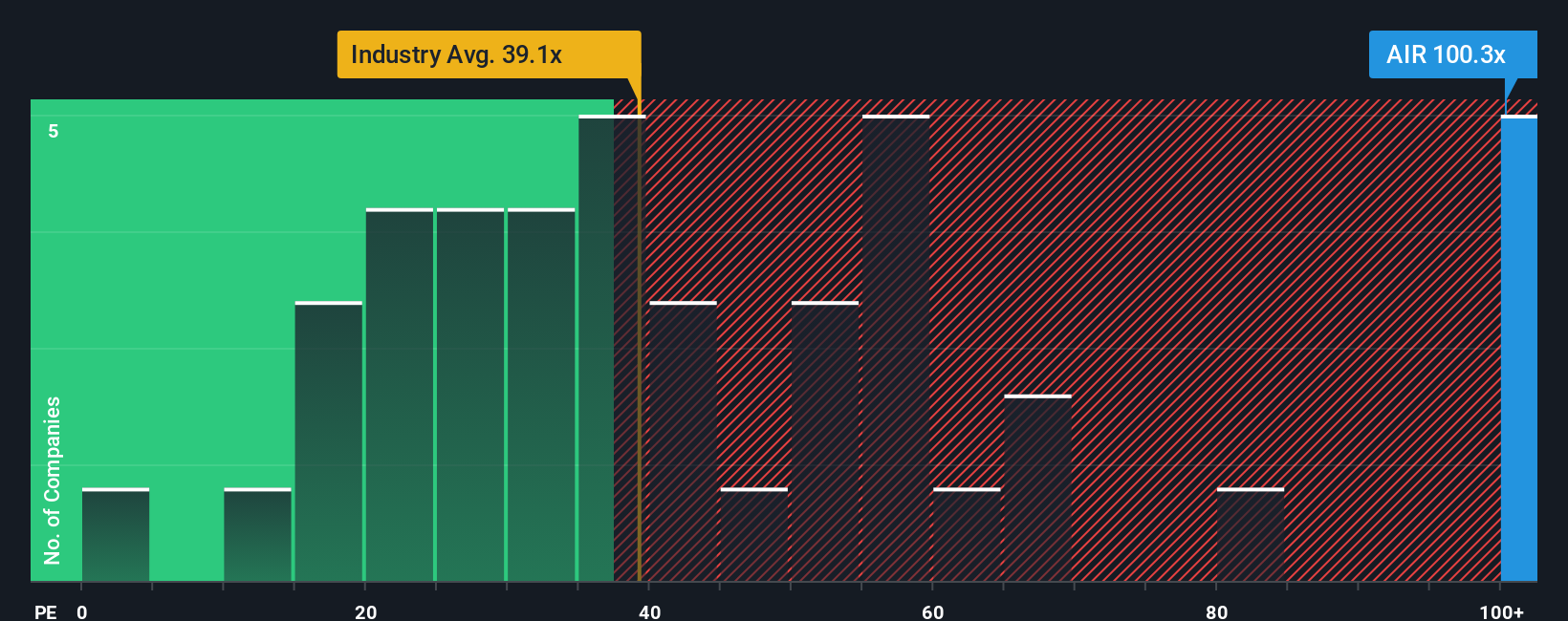

While the narrative points to AAR being modestly undervalued, its current price to earnings ratio near 118 times looks stretched versus the industry at roughly 38 times and a fair ratio of about 53 times, suggesting meaningful downside risk if sentiment or growth expectations cool.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own AAR Narrative

If you would rather test the assumptions yourself and dig into the numbers directly, you can build a complete view in just minutes: Do it your way.

A great starting point for your AAR research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not stop with AAR when the market is full of overlooked opportunities. Use the Simply Wall Street Screener to uncover stocks that match your strategy.

- Capture potential market mispricings by scanning these 902 undervalued stocks based on cash flows that strong cash flow analysis suggests the market has not yet fully appreciated.

- Explore technology trends by targeting these 24 AI penny stocks that are exposed to the adoption of artificial intelligence in business models and earnings generation.

- Strengthen your income strategy by focusing on these 10 dividend stocks with yields > 3% that provide regular cash payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com