Will FDA’s Rapid-Delivery Lunsumio VELO Approval Reshape Roche Holding's (SWX:ROG) High-Value Biologics Narrative?

- Earlier this month, Genentech, a member of the Roche Group, received U.S. FDA accelerated approval for Lunsumio VELO, a subcutaneous formulation of mosunetuzumab for adults with relapsed or refractory follicular lymphoma after at least two prior systemic therapies, cutting administration time from hours to about one minute.

- This approval not only broadens Roche’s oncology offering but also highlights how treatment convenience and clinic efficiency are becoming core differentiators in cancer care.

- We’ll now examine how Lunsumio VELO’s rapid subcutaneous delivery could influence Roche’s broader investment narrative around high-value biologics.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Roche Holding Investment Narrative Recap

To own Roche, you need to believe in its ability to keep refreshing a high-value biologics and diagnostics portfolio while managing pricing and biosimilar pressures. Lunsumio VELO’s rapid subcutaneous delivery fits that story, but its approval does not materially change the near term focus on managing China pricing headwinds and execution risk in late stage oncology trials.

The most relevant related development is Roche’s launch of cobas 6800/8800 version 2.0, which materially boosts molecular lab throughput and flexibility. Together with Lunsumio VELO, it underlines how efficiency and workflow advantages across both diagnostics and therapy could support Roche’s push toward higher value, stickier customer relationships as competition and cost pressures build.

Yet beneath these efficiency gains, investors still need to watch how China’s healthcare pricing reforms could...

Read the full narrative on Roche Holding (it's free!)

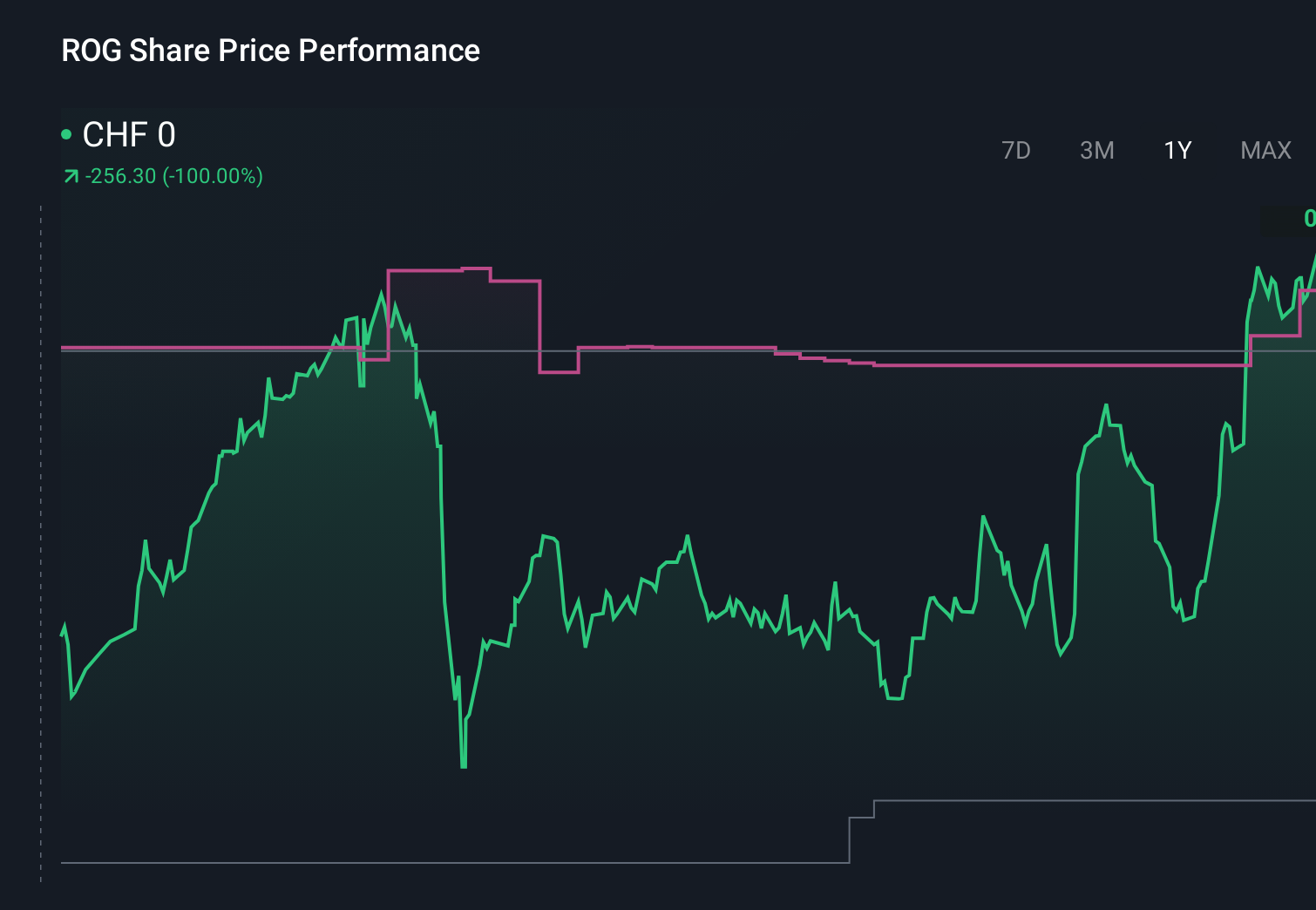

Roche Holding's narrative projects CHF67.3 billion revenue and CHF16.8 billion earnings by 2028. This requires 1.9% yearly revenue growth and a CHF7.4 billion earnings increase from CHF9.4 billion today.

Uncover how Roche Holding's forecasts yield a CHF323.28 fair value, in line with its current price.

Exploring Other Perspectives

Nine fair value estimates from the Simply Wall St Community span roughly CHF295 to CHF742, showing how far apart individual views on Roche’s potential can be. Some of these investors focus heavily on Roche’s push into higher value biologics and diagnostics, which may matter even more if pricing pressure in key markets tightens over time.

Explore 9 other fair value estimates on Roche Holding - why the stock might be worth 10% less than the current price!

Build Your Own Roche Holding Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Roche Holding research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Roche Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Roche Holding's overall financial health at a glance.

No Opportunity In Roche Holding?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 10 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com