Southwest Airlines (LUV): Evaluating Valuation After Strategy Shift, New Fees, and Turkish Airlines Partnership

Southwest Airlines (LUV) is in the middle of a strategy reboot, from adding bag fees and assigned seating to striking a new transatlantic partnership with Turkish Airlines, and investors are taking notice.

See our latest analysis for Southwest Airlines.

Those shifts are already showing up in the tape, with a roughly 25% year to date share price return and a three year total shareholder return of about 38%. This signals that investors see the model reset and new partnerships as a genuine momentum turn, not just a short term bounce.

If Southwest’s reboot has you rethinking the travel space, it might be worth seeing what else is taking off across aviation and defense by exploring aerospace and defense stocks.

Yet with shares already topping analysts’ targets and profits still catching up to the narrative, the real debate is simple: is Southwest still an overlooked value play, or has the market already priced in the reboot?

Most Popular Narrative: 18.6% Overvalued

With Southwest closing at $41.48 against a narrative fair value near the mid $30s, the story leans rich and hinges on execution and industry support.

The analysts have a consensus price target of $32.06 for Southwest Airlines based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $46.0, and the most bearish reporting a price target of just $19.0.

Curious how modest revenue growth, rising margins and shrinking share count can still justify a richer future earnings multiple than today. Wonder which assumptions really carry this valuation story.

Result: Fair Value of $34.97 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, softer leisure demand and ongoing Boeing delivery delays could quickly blunt Southwest’s margin recovery story if capacity and pricing plans slip.

Find out about the key risks to this Southwest Airlines narrative.

Another View: Rich Earnings Multiple Raises the Bar

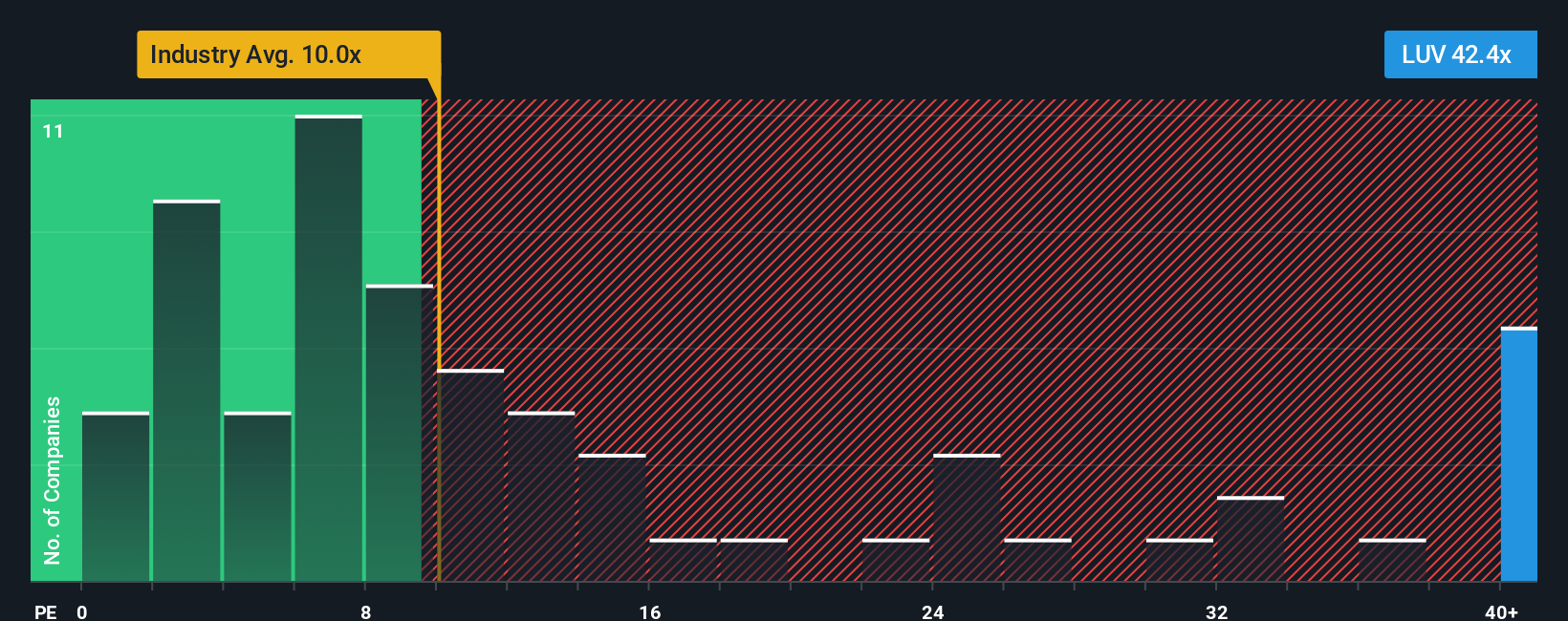

While the narrative fair value suggests Southwest is only moderately overvalued, its current price to earnings ratio near 56.6 times towers over the Global Airlines average of 9.5 times and even a fair ratio of 30.2 times. This leaves little room for execution missteps before sentiment swings.

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Southwest Airlines for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 901 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Southwest Airlines Narrative

If this perspective does not quite fit your view, or you prefer to lean on your own analysis, you can build a custom thesis in minutes: Do it your way.

A great starting point for your Southwest Airlines research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas beyond Southwest?

Consider expanding your search beyond a single airline so you can scan the market for fresh opportunities, refine your watchlist, and stay prepared for potential changes.

- Look for possible mispricings by reviewing these 901 undervalued stocks based on cash flows that the market may be overlooking despite solid underlying cash flows.

- Explore powerful innovation themes by targeting these 24 AI penny stocks that are involved in the growing use of artificial intelligence across industries.

- Seek potential income streams by focusing on these 10 dividend stocks with yields > 3% that may help diversify your portfolio with regular cash distributions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com