RH (RH): Valuation Check After Earnings Beat and Bearish Options Signal Potential Turbulence

RH, the luxury home furnishings retailer, just posted higher third quarter revenue and earnings, but the story has quickly shifted as big options players position bearishly, hinting at choppier trading ahead.

See our latest analysis for RH.

That backdrop helps explain why, even with improving revenue and earnings, RH’s 30 day share price return of 22.41% looks more like a relief rally within a longer losing streak. The year to date share price return of negative 53.69% and one year total shareholder return of negative 55.77% point to investors still reassessing the brand’s long term risk reward profile.

If RH’s rebound has you rethinking where growth and conviction overlap, this could be a good moment to explore fast growing stocks with high insider ownership.

With earnings ticking higher and the stock still trading at a steep discount to some valuation models, the key question now is whether RH is a contrarian bargain or if the market is already discounting future growth.

Most Popular Narrative: 30.2% Undervalued

With RH last closing at $182.98 versus a most popular narrative fair value of $262.25, the valuation case leans firmly toward a recovery story.

The company's plans to monetize assets, including real estate with an estimated equity value of approximately $500 million and excess inventory valued at $200 million to $300 million, could boost cash flow and help in reducing debt, potentially improving net margins and lowering interest expenses.

Curious how a premium brand with pressured demand still lands a higher fair value than today’s price, the narrative instead focuses on transformed margins, accelerating earnings, and a future valuation multiple that looks relatively modest for this growth path.

Result: Fair Value of $262.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upside depends on housing demand stabilizing and tariffs not escalating. A weaker backdrop or higher costs could quickly erode those margin gains.

Find out about the key risks to this RH narrative.

Another View: Rich On Earnings

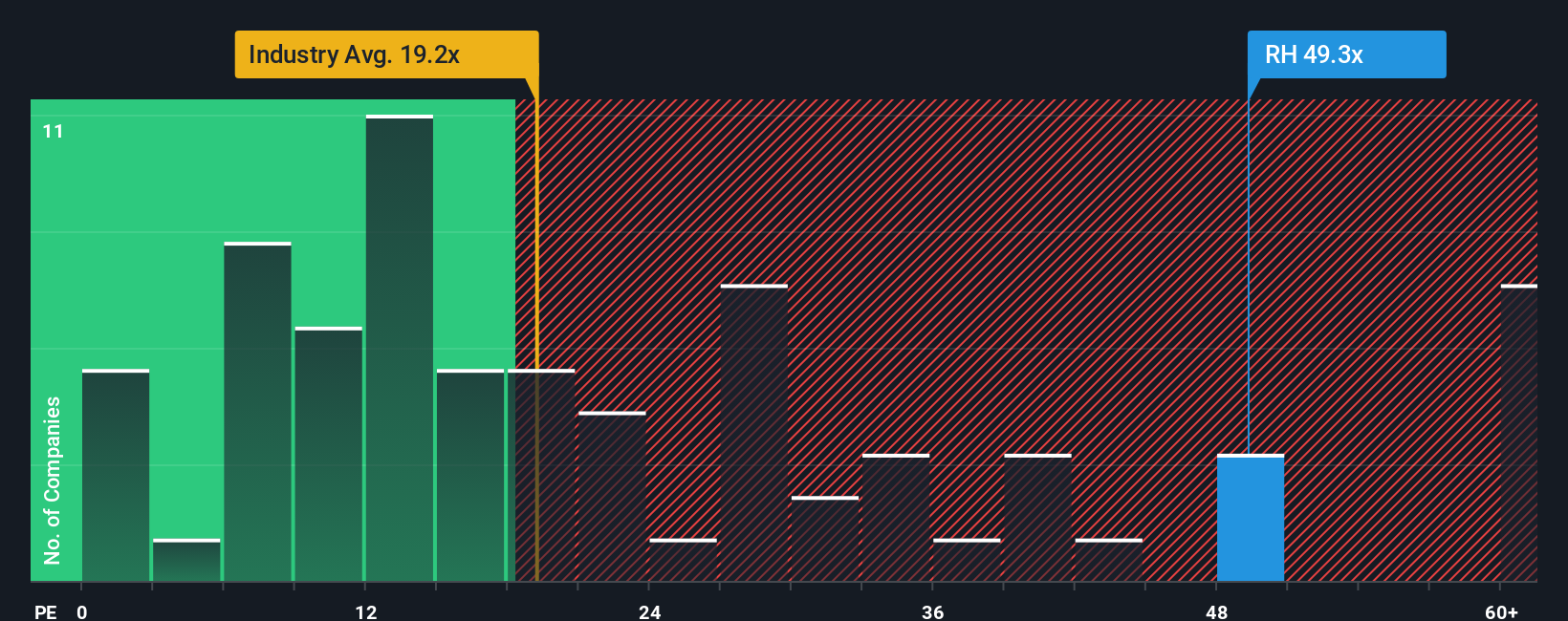

While the most popular narrative points to upside, RH trades on a 31.3x price to earnings ratio versus 19.9x for the US Specialty Retail industry and 17.8x for peers, slightly above its 30.5x fair ratio. Is the market already paying up for that recovery story?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own RH Narrative

If you see the story unfolding differently, or prefer to dig into the numbers yourself, you can build a personalized view in just minutes: Do it your way.

A great starting point for your RH research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Do not stop with a single thesis on RH. Use the Simply Wall St Screener to uncover fresh opportunities that match your strategy before the market moves without you.

- Supercharge your hunt for mispriced opportunities by targeting these 901 undervalued stocks based on cash flows that pair solid fundamentals with a generous margin of safety.

- Capitalize on breakthrough innovation by focusing on these 28 quantum computing stocks positioned at the forefront of next generation computing and infrastructure.

- Strengthen your income stream by locking onto these 10 dividend stocks with yields > 3% that offer attractive yields without sacrificing balance sheet quality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com