Did Morgan Stanley’s Upgrade and Margin Concerns Just Shift Hershey’s (HSY) Investment Narrative?

- Morgan Stanley previously upgraded its rating on The Hershey Company from “Equal Weight” to “Overweight,” highlighting a potential rebound after one of the most significant periods of negative revisions in the company’s history, even as higher input costs continued to weigh on margins.

- This shift in analyst sentiment comes as Hershey leans on its broad global confectionery and snacks portfolio, innovation efforts, and sustainability focus to reinforce its positioning within the consumer staples sector despite ongoing margin pressure.

- With Morgan Stanley’s renewed confidence in Hershey’s recovery prospects, we’ll now examine how this evolving outlook reshapes the company’s investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Hershey Investment Narrative Recap

To own Hershey, you need to believe its global confectionery and snacks brands can keep earning through cycles despite cost inflation and softer consumer demand. Morgan Stanley’s upgrade may boost sentiment, but it does not materially change the near term tension between higher input costs, pressure on earnings guidance and the key catalyst of margin stabilization.

The most relevant recent announcement here is Hershey’s 2025 earnings trajectory, with EPS down sharply year on year despite relatively steady sales. That contrast reinforces how important successful cost management, tariff mitigation and innovation in less cocoa intensive products could be if the company is to translate its strong brands into healthier profitability again.

Yet even with renewed optimism, investors should be aware that rising cocoa prices and potential tariff costs could still...

Read the full narrative on Hershey (it's free!)

Hershey's narrative projects $12.2 billion revenue and $1.8 billion earnings by 2028. This requires 4.3% yearly revenue growth and about a $0.2 billion earnings increase from $1.6 billion today.

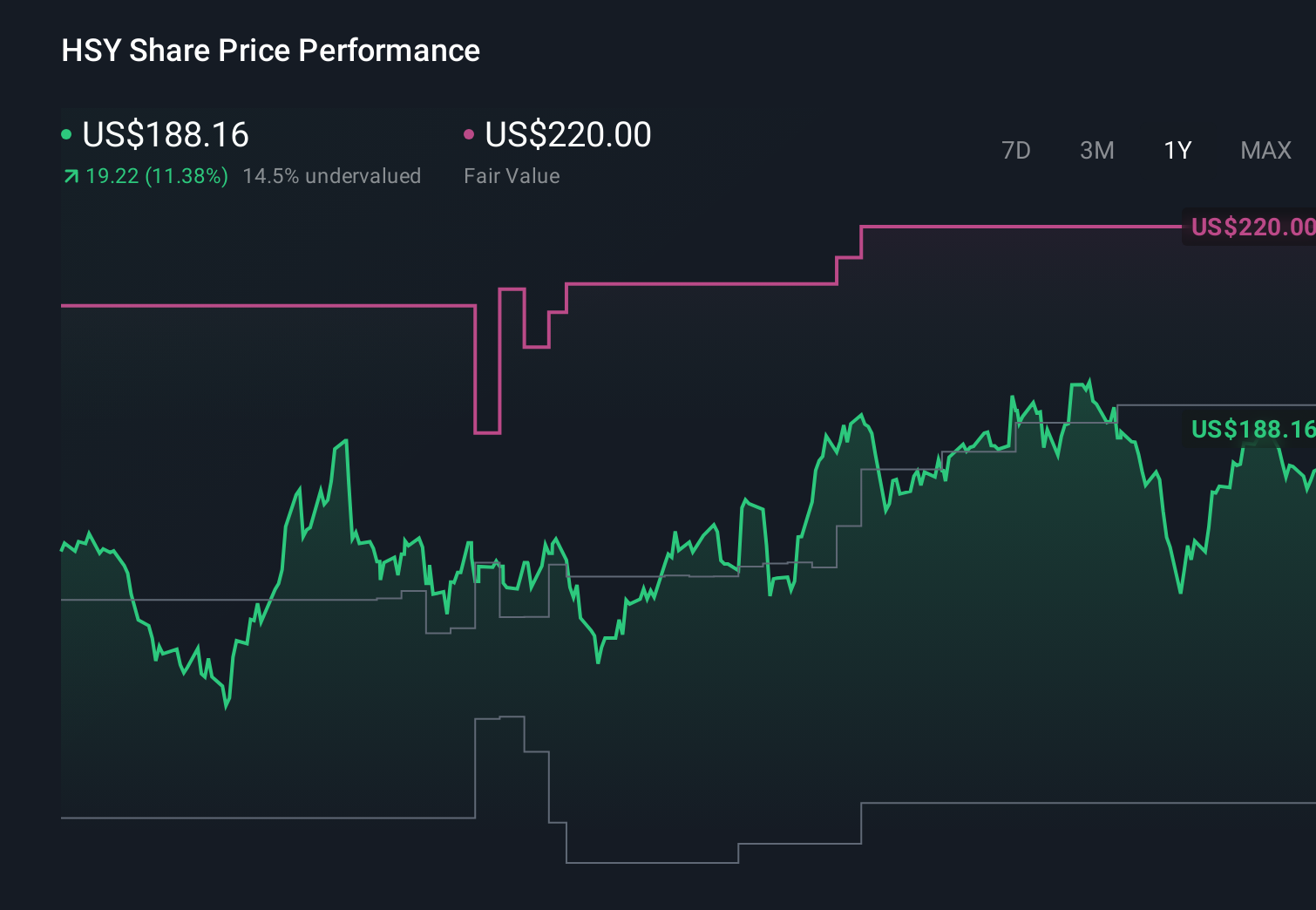

Uncover how Hershey's forecasts yield a $191.95 fair value, a 4% upside to its current price.

Exploring Other Perspectives

Nine fair value estimates from the Simply Wall St Community span roughly US$137.74 to US$191.95, showing how far opinions can stretch on Hershey’s worth. Against that backdrop, ongoing margin pressure from high cocoa prices and weaker EPS guidance reminds you to weigh these views against the company’s cost risks and resilience before deciding which outlook you align with.

Explore 9 other fair value estimates on Hershey - why the stock might be worth as much as $191.95!

Build Your Own Hershey Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hershey research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Hershey research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hershey's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com