American Pacific Mining And 2 Other TSX Penny Stocks To Watch

As the year draws to a close, the Canadian market is navigating through a period marked by encouraging economic indicators and potential shifts in market leadership. Amidst these broader trends, penny stocks remain an intriguing area for investors seeking opportunities beyond the mainstream. Although often associated with smaller or newer companies, these stocks can offer growth potential when backed by strong financials and solid fundamentals.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$2.15 | CA$54.35M | ✅ 3 ⚠️ 4 View Analysis > |

| Canso Select Opportunities (TSXV:CSOC.A) | CA$4.75 | CA$21.97M | ✅ 2 ⚠️ 2 View Analysis > |

| Sailfish Royalty (TSXV:FISH) | CA$3.48 | CA$263.31M | ✅ 1 ⚠️ 4 View Analysis > |

| Zoomd Technologies (TSXV:ZOMD) | CA$1.145 | CA$115.41M | ✅ 4 ⚠️ 2 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.43 | CA$3.59M | ✅ 2 ⚠️ 4 View Analysis > |

| CEMATRIX (TSX:CEMX) | CA$0.335 | CA$50.24M | ✅ 3 ⚠️ 1 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.37 | CA$911.46M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$1.17 | CA$23.19M | ✅ 2 ⚠️ 3 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.20 | CA$162.31M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.97 | CA$186.41M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 394 stocks from our TSX Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

American Pacific Mining (CNSX:USGD)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: American Pacific Mining Corp. focuses on the exploration and development of precious and base metals in the Western United States, with a market cap of CA$40.53 million.

Operations: There are no reported revenue segments for American Pacific Mining Corp.

Market Cap: CA$40.53M

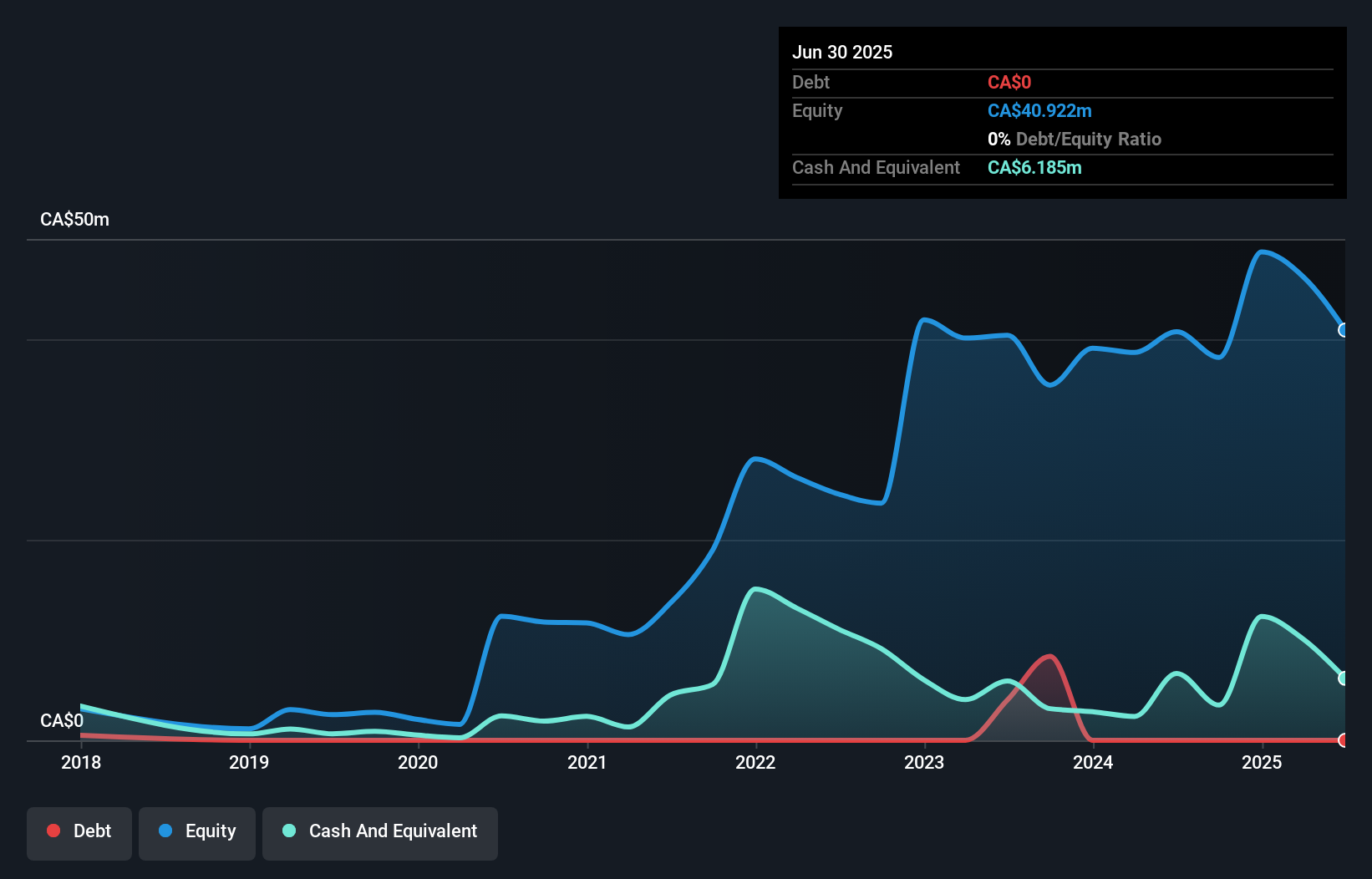

American Pacific Mining Corp., with a market cap of CA$40.53 million, is pre-revenue and currently unprofitable, having reported a net loss of CA$3.71 million for the third quarter of 2025. The company recently expanded its Madison Copper-Gold Project by acquiring strategic claims in Montana, enhancing its exploration potential along the Hudson Fault. Additionally, its Palmer VMS Project in Alaska holds significant barite resources critical to the U.S. supply chain. Despite financial challenges such as limited cash runway and negative equity returns, American Pacific remains debt-free and has not significantly diluted shareholders over the past year.

- Click here and access our complete financial health analysis report to understand the dynamics of American Pacific Mining.

- Examine American Pacific Mining's past performance report to understand how it has performed in prior years.

Alithya Group (TSX:ALYA)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Alithya Group Inc. is an information technology services provider specializing in digital solutions across Canada, the United States, and internationally, with a market capitalization of CA$169.47 million.

Operations: The company's revenue segment includes Management Consulting Services, which generated CA$489.54 million.

Market Cap: CA$169.47M

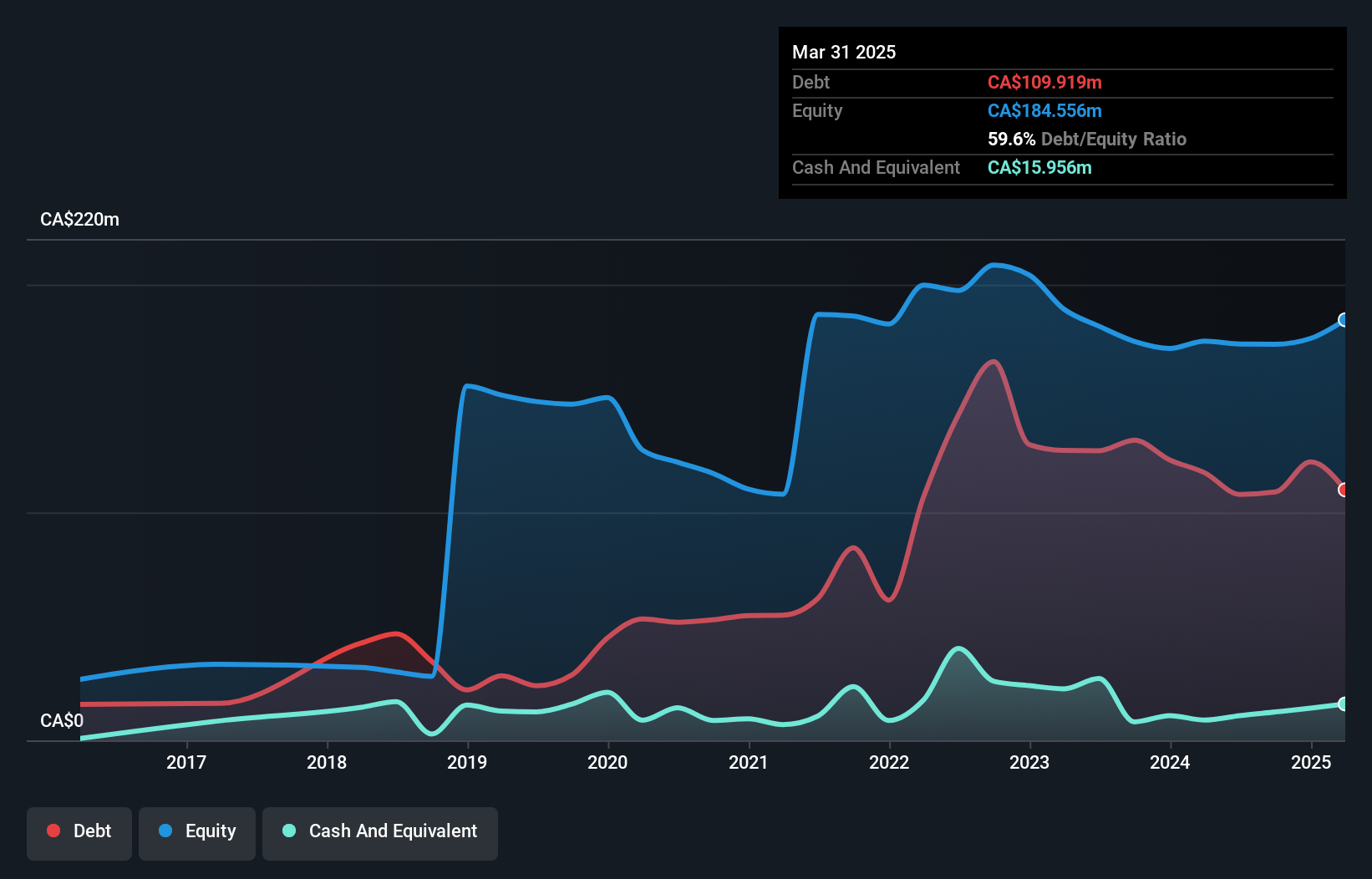

Alithya Group Inc., with a market cap of CA$169.47 million, is navigating financial challenges as it remains unprofitable, reporting significant net losses of CA$30.96 million for the recent quarter despite increased sales to CA$124.29 million. The company's high debt-to-equity ratio of 78.9% reflects substantial leverage, although its short-term assets exceed both short and long-term liabilities, providing some balance sheet stability. Alithya's experienced management team and board may offer strategic direction amid these hurdles, while recent executive changes could bolster its legal and strategic capabilities in executing its growth plans despite ongoing impairments and write-offs impacting financial performance.

- Click here to discover the nuances of Alithya Group with our detailed analytical financial health report.

- Assess Alithya Group's future earnings estimates with our detailed growth reports.

Cathedra Bitcoin (TSXV:CBIT)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Cathedra Bitcoin Inc. operates in the bitcoin mining and hosting sector across North America, with a market capitalization of CA$33.86 million.

Operations: The company generates revenue through two main segments: Hosting, which contributes CA$13.50 million, and Bitcoin Mining, accounting for CA$9.43 million.

Market Cap: CA$33.86M

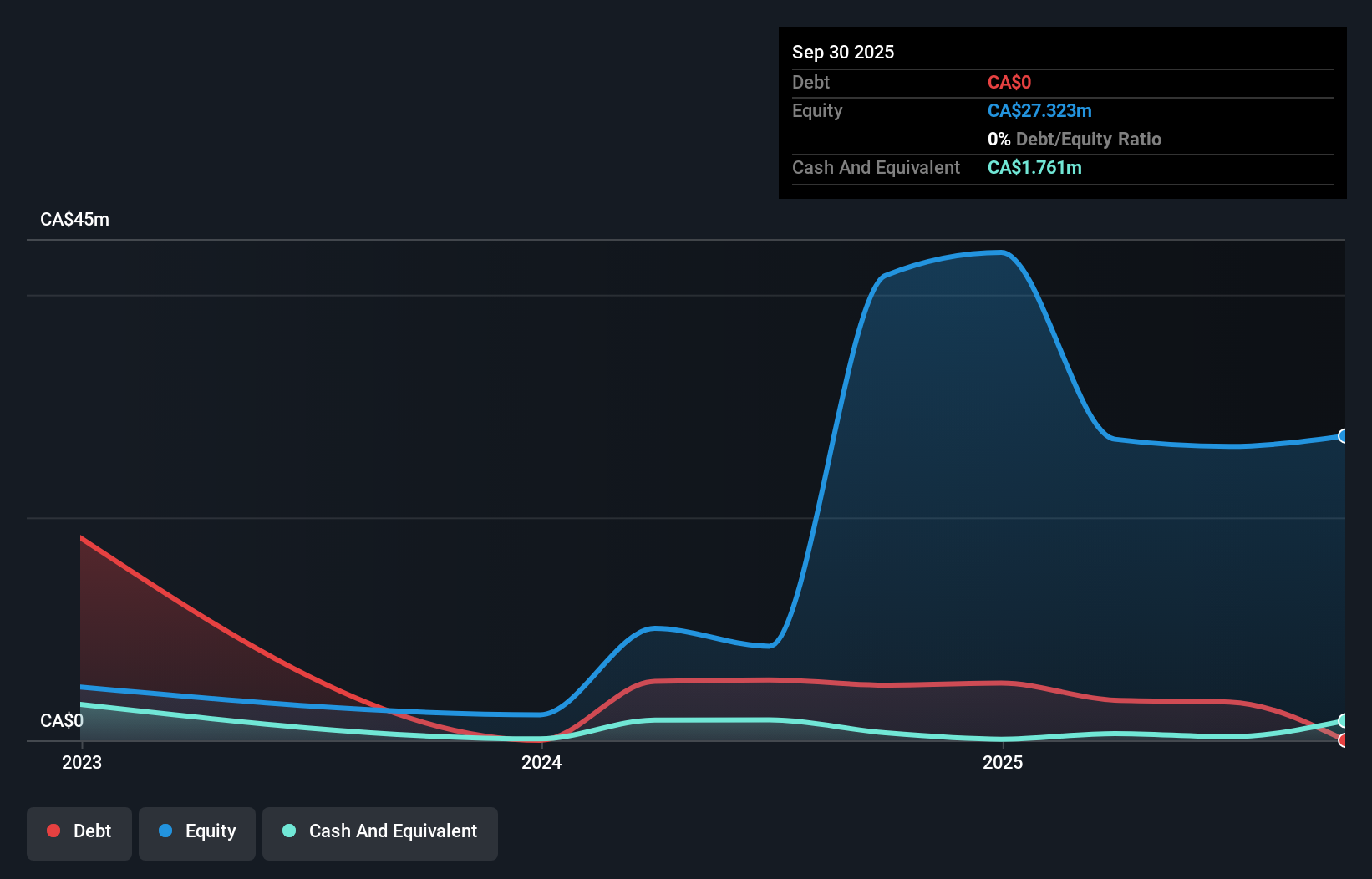

Cathedra Bitcoin Inc., with a market cap of CA$33.86 million, operates in the bitcoin mining and hosting sector, generating revenues primarily from these segments. Despite being debt-free, the company remains unprofitable with a negative return on equity of -14.05%. Recent earnings revealed a net loss reduction to CA$0.78 million for Q3 2025 from CA$3.49 million the previous year, although revenue slightly declined to CA$5.51 million from CA$5.86 million year-over-year. The company's short-term assets exceed its liabilities, providing some financial cushion amid high share price volatility and an inexperienced board with an average tenure of 1.4 years.

- Click to explore a detailed breakdown of our findings in Cathedra Bitcoin's financial health report.

- Gain insights into Cathedra Bitcoin's future direction by reviewing our growth report.

Turning Ideas Into Actions

- Reveal the 394 hidden gems among our TSX Penny Stocks screener with a single click here.

- Seeking Other Investments? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com