Birkenstock (BIRK): Reassessing Valuation After a 26% Year-to-Date Share Price Pullback

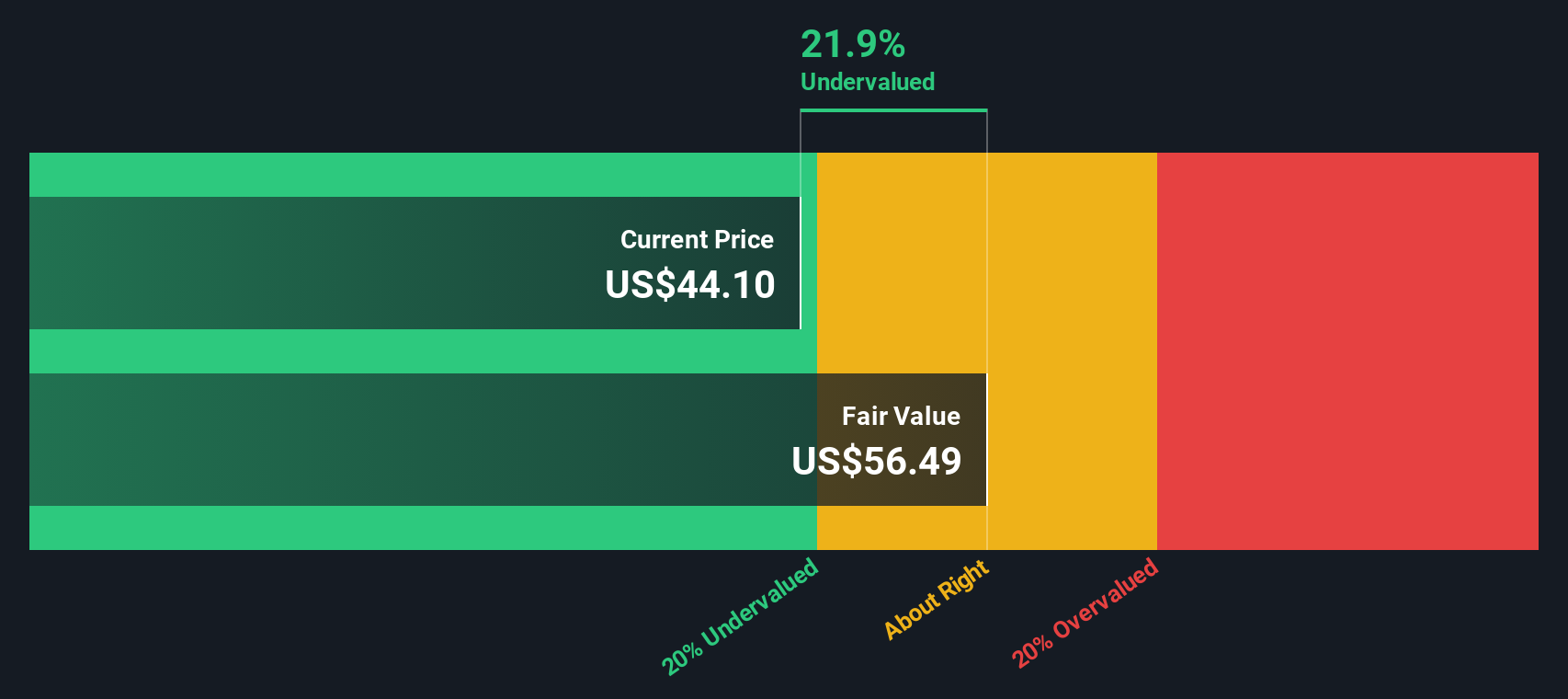

Birkenstock Holding (BIRK) has quietly become a talking point again as the stock tries to claw back from a roughly 26% slide this year, despite double digit revenue and earnings growth.

See our latest analysis for Birkenstock Holding.

The pullback has come as investors reassess how much to pay for Birkenstock’s strong fundamentals. The roughly 26% year to date share price return loss contrasts against still solid growth and keeps the $42.45 share price in a consolidation zone where momentum looks to be stabilising rather than accelerating.

If Birkenstock’s recent volatility has you rethinking where growth might come from next, it could be worth scouting fast growing stocks with high insider ownership as another pocket of opportunity.

With revenue still growing double digits and the share price sitting well below analyst targets, is Birkenstock now trading at a discount to its true potential, or is the market already pricing in years of future growth?

Price-to-Earnings of 19x: Is it justified?

Birkenstock shares trade on a price to earnings ratio of 19 times, which screens as undervalued versus peers despite the recent share price weakness.

The price to earnings ratio compares the current share price to the company’s per share profits and is a common yardstick for branded consumer and luxury names. For Birkenstock, a 19 times multiple suggests the market is not paying a premium for its growth profile relative to comparable luxury peers.

That matters because the company is forecast to grow earnings in the low to mid teens annually, yet the stock is priced below both the US Luxury industry average multiple of 19.9 times and the peer average of 37.5 times. Relative to an estimated fair price to earnings ratio of 19.5 times, today’s valuation also sits slightly below the level our regression work implies the market could move toward if sentiment improves.

Against its sector, Birkenstock is positioned as good value, trading at a discount to luxury peers while still delivering faster earnings growth than the broader industry and maintaining higher profit margins than a year ago.

Explore the SWS fair ratio for Birkenstock Holding

Result: Price-to-Earnings of 19x (UNDERVALUED)

However, sustained volatility, alongside potential consumer slowdown for discretionary footwear, could compress Birkenstock’s valuation multiple before its earnings growth fully materialises.

Find out about the key risks to this Birkenstock Holding narrative.

Another View: DCF Backs Up the Value Case

Our DCF model points to a fair value of $48.89 per share for Birkenstock versus the current $42.45 price, suggesting the stock is about 13% undervalued. If both earnings multiples and cash flows indicate that it is inexpensive, is the market underestimating how durable this brand really is?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Birkenstock Holding for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 903 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Birkenstock Holding Narrative

If you would rather interrogate the numbers yourself and shape your own story in minutes, you can build a personalised narrative even faster. Do it your way.

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding Birkenstock Holding.

Ready for more investment ideas beyond Birkenstock?

If you are serious about levelling up your portfolio, do not stop at one stock. Use the Simply Wall Street Screener to uncover your next opportunity today.

- Capture potential multi-bagger upside by targeting these 3626 penny stocks with strong financials that already show real financial strength instead of relying on hype alone.

- Position your portfolio for the next wave of innovation by focusing on these 24 AI penny stocks shaping everything from automation to intelligent infrastructure.

- Lock in quality at a discount by zeroing in on these 903 undervalued stocks based on cash flows where market pessimism contrasts sharply with strong underlying cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com