Honeywell (HON): Revisiting Valuation After a Modest Share Price Rebound

Honeywell International (HON) has quietly bounced about 4% over the past month even as its year to date performance remains negative. This setup has some long term investors revisiting the stock’s risk reward.

See our latest analysis for Honeywell International.

The recent 1 month share price return of 4.38 percent, against a negative year to date share price return of 12.68 percent and modest 3 year total shareholder return, suggests sentiment is stabilising as investors reassess Honeywell’s longer term earnings and margin prospects.

If Honeywell’s shift gains your attention, this could be a good moment to explore aerospace and defense stocks for similarly resilient exposure to the aerospace and defense theme.

With earnings still growing, margins holding up, and the share price trading at roughly a 20 percent discount to analyst targets, is Honeywell quietly offering a mispriced entry point, or are markets already baking in tomorrow’s growth?

Most Popular Narrative: 17.7% Undervalued

Against Honeywell International’s last close of $196.93, the most followed narrative implies a noticeably higher fair value, framing the recent pullback as potential opportunity rather than exhaustion.

The analysts have a consensus price target of $252.97 for Honeywell International based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $290.0, and the most bearish reporting a price target of just $210.0.

Want to see what justifies a higher fair value than today’s price? The narrative highlights steadily rising revenues, wider margins, and a future earnings multiple that is presented as more similar to a growth-focused business than a mature industrial company. Curious which specific assumptions are used in this analysis? Explore the full story to review the projections underpinning this valuation.

Result: Fair Value of $239.40 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside view depends on smooth execution of the breakup and resilient global demand, with any missteps or macro shock likely forcing valuation assumptions lower.

Find out about the key risks to this Honeywell International narrative.

Another Angle On Valuation

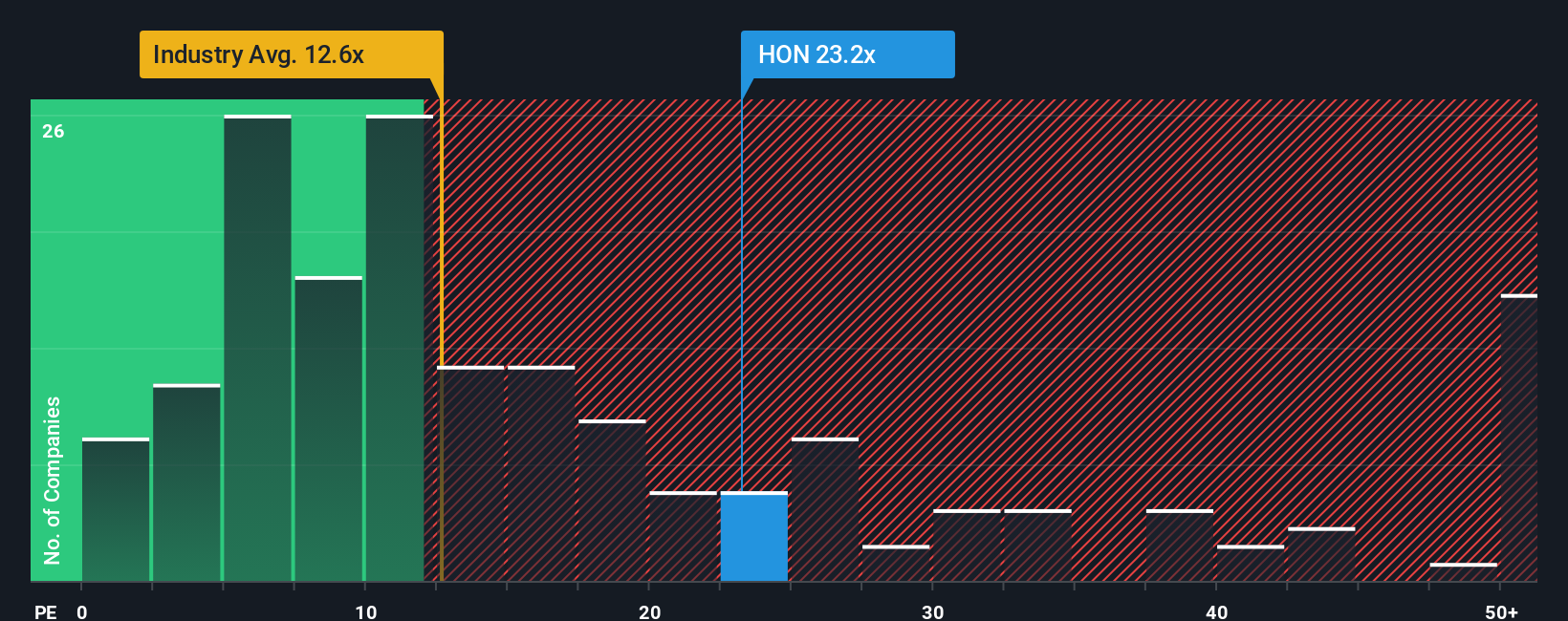

On earnings, Honeywell looks pricey, trading at about 20.4 times earnings versus 12.2 times for the global industrials industry, yet cheaper than peers at 28.6 times and below a fair ratio of 28.4 times. Is that a valuation trap or a patient upside setup?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Honeywell International Narrative

If you would rather challenge these assumptions and dig into the numbers yourself, you can build a personalised Honeywell thesis in just minutes, Do it your way.

A great starting point for your Honeywell International research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing move?

Do not stop at Honeywell, use the Simply Wall Street Screener to uncover fresh opportunities and avoid missing the next wave of high conviction ideas.

- Target reliable cash flow by scanning these 10 dividend stocks with yields > 3% that can help strengthen your portfolio’s income engine while many investors still overlook them.

- Capture structural growth by focusing on these 24 AI penny stocks positioned at the heart of the AI acceleration, before their stories become consensus.

- Lock in potential bargains by filtering for these 901 undervalued stocks based on cash flows that trade below what their cash flows suggest they are truly worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com