CAVA (CAVA): Reassessing Valuation After a Sharp Short-Term Rebound and Deep Year-to-Date Losses

CAVA Group (CAVA) has quietly climbed over the past week, even though the stock is still down sharply this year. That disconnect naturally raises a key question for investors: what has really changed?

See our latest analysis for CAVA Group.

The recent 1 month share price return of 31.88 percent at a last close of 61.72 dollars caps a sharp near term rebound. However, it sits against a much weaker backdrop, with the year to date share price return at negative 46.41 percent and 1 year total shareholder return at negative 47.92 percent, suggesting momentum is improving but long term holders are still under water.

If CAVA has you rethinking where growth could come from next, it might be worth exploring fast growing stocks with high insider ownership as another way to spot emerging opportunities.

With CAVA’s rebound outpacing its still bruising longer term returns, investors face a crucial question: are they looking at an undervalued growth story in recovery, or a stock where future expansion is already priced in?

Most Popular Narrative Narrative: 9.1% Undervalued

With CAVA last closing at 61.72 dollars versus a narrative fair value of 67.89 dollars, the most followed perspective sees modest upside still on the table.

Rapid geographic expansion into new and underserved markets, supported by strong new unit performance and a robust target of at least 1,000 restaurants by 2032, is likely to accelerate systemwide sales and drive higher topline revenue growth.

Curious how a fast growing restaurant chain can justify a premium valuation even as margins cool and earnings flatten out? The narrative leans on powerful revenue compounding, ambitious store growth, and a future earnings multiple that looks more like a high flying growth name than a typical hospitality stock. Want to see exactly which assumptions turn today’s share price into that higher fair value target?

Result: Fair Value of $67.89 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent macro pressures and aggressive expansion risks, ranging from softer discretionary spending to potential market saturation, could quickly challenge the current recovery narrative.

Find out about the key risks to this CAVA Group narrative.

Another View On Valuation

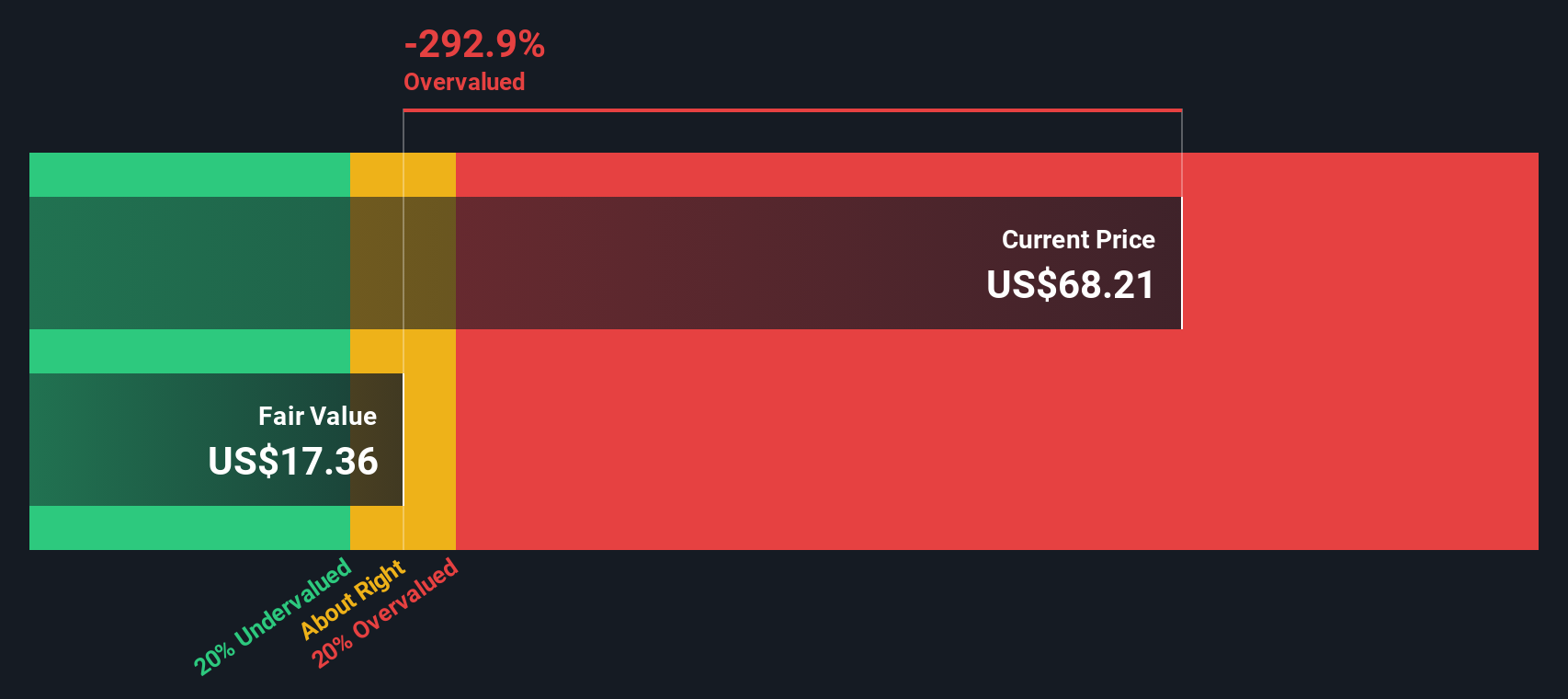

While the narrative fair value suggests CAVA is modestly undervalued, our DCF model paints a very different picture. Based on those cash flow assumptions, fair value sits closer to 37.98 dollars. This implies the current 61.72 dollar price leaves little margin of safety.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out CAVA Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 901 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own CAVA Group Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom view in just a few minutes, starting with Do it your way.

A great starting point for your CAVA Group research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas you do not want to miss?

Before you move on, give yourself the edge by scanning fresh opportunities through the Simply Wall Street Screener, so your next move feels deliberate, not lucky.

- Target steady income first by using these 10 dividend stocks with yields > 3% to filter for companies paying meaningful yields that can support long term cash flow needs.

- Ride structural tech tailwinds by checking out these 24 AI penny stocks, where innovative businesses are pushing real world AI adoption instead of just talking about it.

- Position ahead of the next digital shift with these 80 cryptocurrency and blockchain stocks, focusing on listed companies building core infrastructure around blockchain and crypto ecosystems.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com