Is Vita Coco Still Attractive After a 52% 2025 Rally?

- Wondering if Vita Coco Company at around $53 a share is still a refreshing opportunity or if most of the upside has already been squeezed out? You are not alone, and that is exactly what we are going to unpack here.

- The stock has climbed about 4.3% over the last week and 4.4% over the past month, while racking up a 52% gain year to date and 48.5% over the past year, with a 293.9% return over three years that has put it on growth investors radar.

- Behind these moves is a narrative around Vita Cocos brand strength in the better for you beverage space, including expanding shelf presence and continued traction for coconut water as a mainstream alternative to traditional soft drinks. Investors are also reacting to the companys push into new product formats and markets, which has reinforced the idea that this is more than just a niche hydration play.

- Despite the strong run, Vita Coco scores just 2/6 on our valuation checks, suggesting the market may already be pricing in a lot of optimism. Next we will walk through how different valuation approaches view the stock, then finish with a more nuanced way to think about its value.

Vita Coco Company scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Vita Coco Company Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow model estimates what a business is worth by projecting its future cash flows and then discounting them back to today in $ terms. For Vita Coco Company, the latest twelve month Free Cash Flow stands at about $55.5 million, and analysts expect this to climb meaningfully as the brand scales.

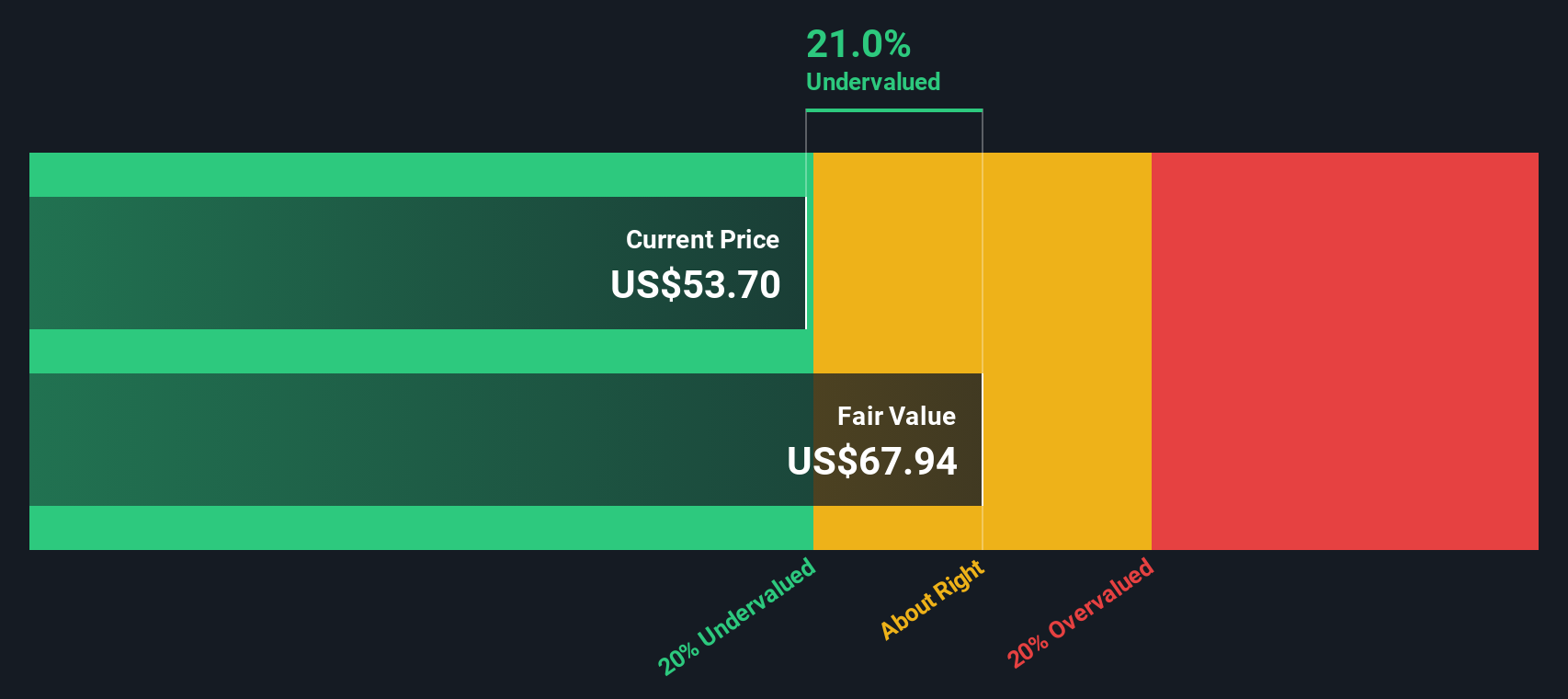

Using a 2 Stage Free Cash Flow to Equity approach, analyst and model projections have Free Cash Flow rising to around $199.7 million by 2035, with the first few years based on analyst estimates and the later years extrapolated by Simply Wall St. These growing cash flows are discounted back to the present to arrive at an intrinsic value of roughly $67.94 per share.

Compared with the current share price around $53, the DCF implies the stock is about 21.4% undervalued. This indicates that the market may not be fully reflecting Vita Coco’s projected cash generation.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Vita Coco Company is undervalued by 21.4%. Track this in your watchlist or portfolio, or discover 901 more undervalued stocks based on cash flows.

Approach 2: Vita Coco Company Price vs Earnings

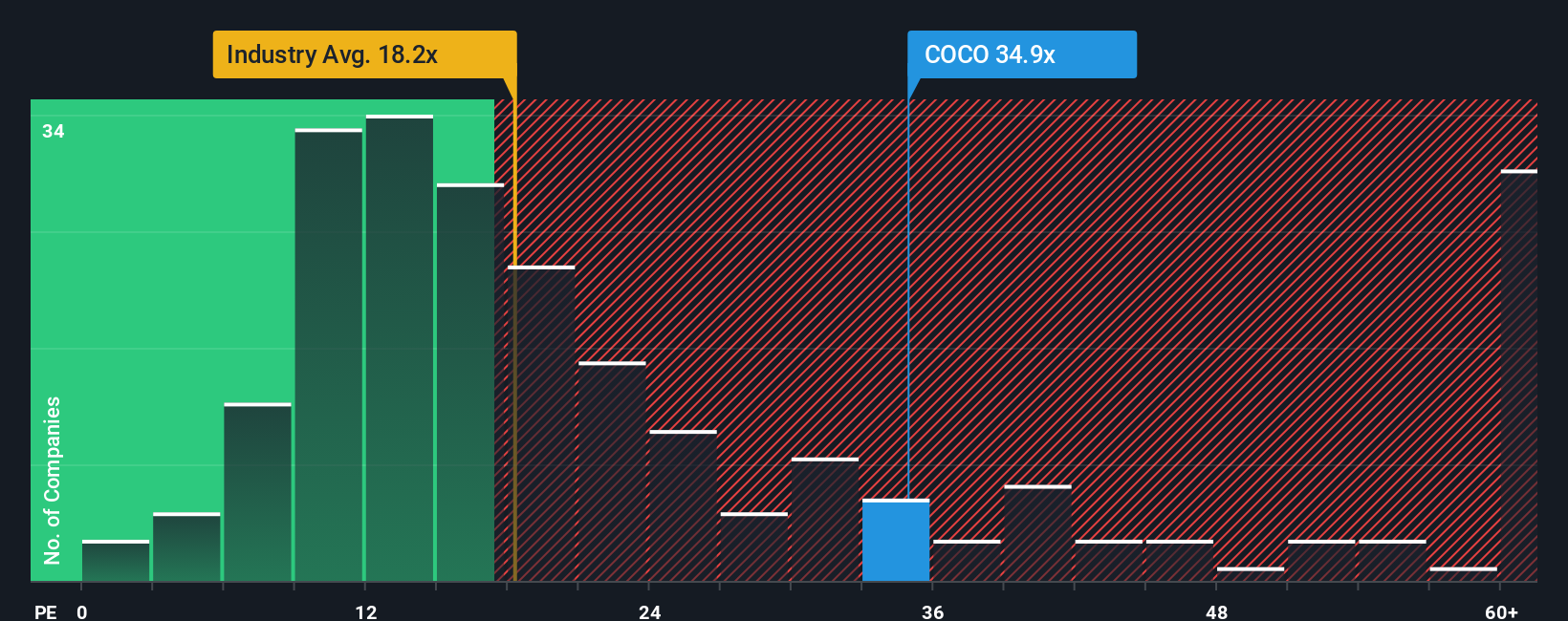

For a profitable, growing business like Vita Coco, the Price to Earnings, or PE, ratio is a useful way to gauge how much investors are willing to pay today for each dollar of current earnings. In general, companies with stronger growth prospects and lower perceived risk can justify a higher PE. Slower growth or higher uncertainty typically calls for a lower, more conservative multiple.

Vita Coco currently trades on a PE of about 43.98x, which is well above the Beverage industry average of roughly 17.50x and also higher than the peer group average of around 19.53x. To move beyond these simple comparisons, Simply Wall St calculates a proprietary Fair Ratio of 21.16x. This is the PE you might expect given Vita Coco’s earnings growth profile, margins, industry, market cap and risk factors. This Fair Ratio is more informative than a plain industry or peer comparison because it adjusts for company specific strengths and weaknesses rather than assuming all beverage stocks deserve the same multiple.

Comparing the current PE of 43.98x with the 21.16x Fair Ratio suggests Vita Coco is trading at a premium that looks stretched on fundamentals.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1459 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Vita Coco Company Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of Vita Coco Company’s story with a financial forecast and a fair value estimate. A Narrative on Simply Wall St is where you spell out the drivers you care about, such as tariff relief, household penetration, margins or freight costs, then link those assumptions to projected revenue, earnings and profit margins, and finally to a Fair Value you can compare with today’s share price to help inform your own decision to buy, hold or sell. Narratives live on the Community page used by millions of investors, are easy to set up or copy, and automatically update when new information such as earnings, guidance or news is released, so your fair value view moves with the facts. For example, one Vita Coco Narrative might assume tariff relief sticks, international growth accelerates and margins expand, which would support a higher fair value in the mid 50 dollar range. A more cautious Narrative might focus on tariff and freight risks, category dependence and premium valuation, which would indicate a fair value closer to the high 30 to low 40 dollar range.

Do you think there's more to the story for Vita Coco Company? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com