Charles Schwab (SCHW): Reassessing Valuation After Technical Breakout and Strategic Platform Overhaul

Charles Schwab (SCHW) just cleared the psychologically important 100 dollar mark, and it did not happen in a vacuum. The move lines up with a broader overhaul of its trading platforms and product lineup.

See our latest analysis for Charles Schwab.

That breakout above 100 dollars is part of a clear upswing, with a roughly 12 percent 1 month share price return and a 5 year total shareholder return above 100 percent. This suggests momentum is firmly rebuilding around Schwab’s repositioning story.

If Schwab’s surge has you rethinking your watchlist, this is a good moment to scout fast growing stocks with high insider ownership as potential next tier candidates for your research queue.

With the shares now above 100 dollars, analyst targets clustered well higher, and earnings growing double digits, investors face a key question: Is Schwab still trading below its true potential or already pricing in the next leg of growth?

Most Popular Narrative Narrative: 10% Undervalued

With Charles Schwab closing at 101.85 dollars against a narrative fair value near 112.79 dollars, the story leans toward upside embedded in long term earnings power.

Ongoing digital transformation and operational enhancements (e.g., AI powered efficiency and automation) are expected to sustainably reduce cost to serve and improve client experience at scale, underpinning long term operating margin expansion.

Want to see how margin expansion, double digit growth, and a re rated earnings multiple all combine into that higher fair value? The full narrative unpacks the exact assumptions driving this gap.

Result: Fair Value of $112.79 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upside depends on continued execution, as rising fintech competition and regulatory scrutiny around cash management could both undermine margin expansion.

Find out about the key risks to this Charles Schwab narrative.

Another Angle on Valuation

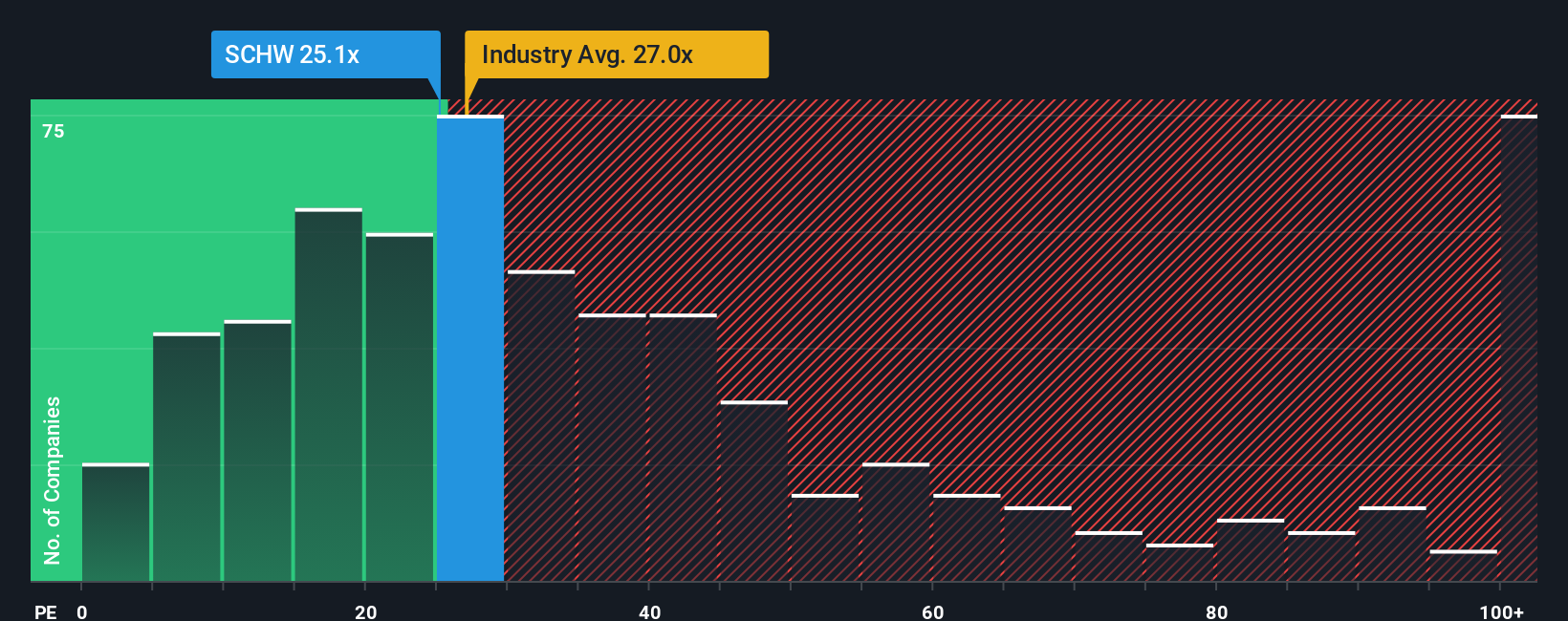

On earnings, Schwab looks less of a bargain. The current price to earnings ratio of 23.3 times is cheaper than the Capital Markets industry at 25.7 times and peers at 29.5 times, but still above a fair ratio closer to 18.5 times. This points to valuation risk if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Charles Schwab Narrative

If you see the numbers differently or want to stress test your own assumptions, you can build a personalized Schwab storyline in just minutes: Do it your way.

A great starting point for your Charles Schwab research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not stop at Schwab when the broader market is full of opportunities. Use targeted screeners on Simply Wall St to uncover your next potential winner today.

- Capture potential mispricings by scanning these 901 undervalued stocks based on cash flows that could offer stronger upside than well known blue chips.

- Ride powerful technology trends by targeting these 24 AI penny stocks positioned at the forefront of intelligent automation and data driven business models.

- Strengthen your passive income game through these 10 dividend stocks with yields > 3% that may provide attractive yields and resilient cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com