Is Chemours A Bargain After PFAS Headwinds And A 55% Three Year Share Price Slide?

- Wondering whether Chemours at around $12 is a bargain or a value trap? You are not alone, and this breakdown is designed to help you decide with a clear, valuation-first lens.

- Despite a tough longer-term picture, with the stock still down 29.0% over the past year and 55.1% over three years, it has shown some short-term life, rising 3.4% in the last week and 4.3% over the past month, even though it remains down 28.2% year to date.

- Recent moves have been shaped by ongoing headlines around Chemours exposure to legacy environmental liabilities and regulatory scrutiny of PFAS chemicals, alongside management efforts to streamline the portfolio and focus on higher-margin specialty products. Together, these factors have shifted how investors are weighing long-term risks against potential upside if the transition strategy gains traction.

- Chemours currently scores a strong 6/6 on our valuation checks, suggesting it screens as undervalued across all our standard tests. Next, we will unpack what that means under different valuation approaches, before finishing with a more holistic way to think about what the market might really be missing.

Find out why Chemours's -29.0% return over the last year is lagging behind its peers.

Approach 1: Chemours Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth by projecting its future cash flows and discounting them back to today in $ terms. For Chemours, the 2 Stage Free Cash Flow to Equity model starts from a weak base, with last twelve month free cash flow of about $54 million in the red, reflecting recent operational and legal headwinds.

Analysts expect cash generation to improve meaningfully, with free cash flow projected to reach roughly $430 million by 2028. Beyond the explicit analyst window, Simply Wall St extrapolates further growth, with annual free cash flow projections rising toward the high hundreds of millions of $ over the next decade as margins and volumes normalize.

When all of these projected cash flows are discounted back, the analysis produces an intrinsic value estimate for Chemours of about $41.45 per share. Compared with the current share price near $12, the DCF output suggests the stock may be roughly 71.0% undervalued, indicating a substantial margin of safety if the cash flow recovery occurs as projected.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Chemours is undervalued by 71.0%. Track this in your watchlist or portfolio, or discover 901 more undervalued stocks based on cash flows.

Approach 2: Chemours Price vs Sales

For a business like Chemours, where earnings can swing with commodity cycles and one off charges, price to sales is a useful way to value the stock because it focuses on how the market is valuing each dollar of revenue rather than volatile profits.

In general, companies with stronger growth prospects and lower perceived risk can justify higher sales multiples, while slower growing or riskier names usually trade at a discount. Chemours currently trades at about 0.31x sales, well below both the Chemicals industry average of roughly 1.08x and the peer group average of around 0.84x.

Simply Wall St also calculates a Fair Ratio of 0.80x for Chemours, a proprietary estimate of what its sales multiple should be once factors such as its earnings growth outlook, industry, profit margins, market cap and specific risks are considered. This Fair Ratio can be more informative than simple peer or industry comparisons because it adjusts for Chemours unique profile rather than assuming all chemical companies deserve the same multiple. With the actual price to sales ratio at 0.31x compared to a Fair Ratio of 0.80x, the stock appears materially undervalued on this metric.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1459 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Chemours Narrative

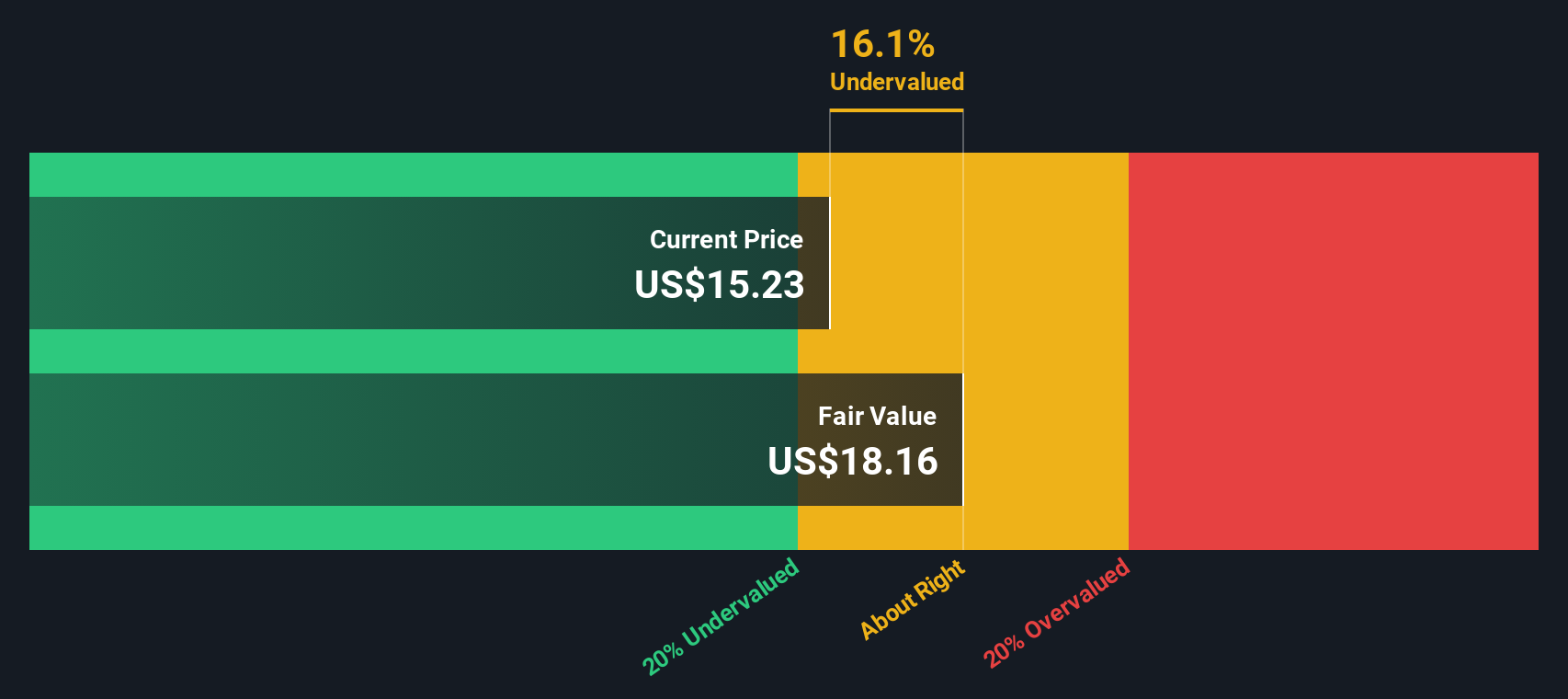

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple framework where you describe the story you believe about Chemours future, translate that story into expectations for revenue, earnings and margins, and then see the fair value that naturally follows. On Simply Wall St, Narratives live in the Community page and are used by millions of investors to link a company’s qualitative story, like stronger demand for low emission refrigerants or lingering PFAS risks, directly to a quantified forecast and a clear fair value that you can compare with today’s share price to help inform whether Chemours is a buy, hold or sell. Because Narratives on the platform update dynamically when new information arrives, such as litigation settlements, supply agreements or revised guidance, they give you a living valuation that evolves with the news instead of a static target. For example, one Chemours Narrative might lean toward the higher fair value around $18 if you believe in sustained margin expansion and litigation de-risking, while another might sit closer to $11 if you expect weaker growth and heavier long-term legal headwinds.

Do you think there's more to the story for Chemours? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com