A 30-fold increase in three years! Palantir (PLTR.US) has become an “AI faith” for retail investors, and high valuations have not prevented retail investors from going crazy

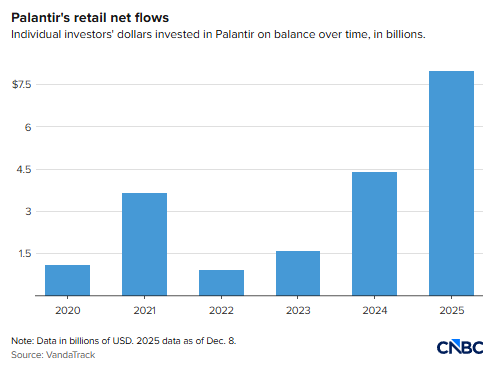

The Zhitong Finance App learned that according to data from VandaTrack, retail investors have invested nearly 8 billion US dollars in Palantir Technologies (PLTR.US) stock since this year as of December 8. This figure increased by more than 80% from the previous year, and surged by more than 400% from 2023. The astonishing rise in recent years fueled by the artificial intelligence (AI) boom has made this stock an undisputed star in the retail investment world — even though Wall Street has always had doubts about its valuation.

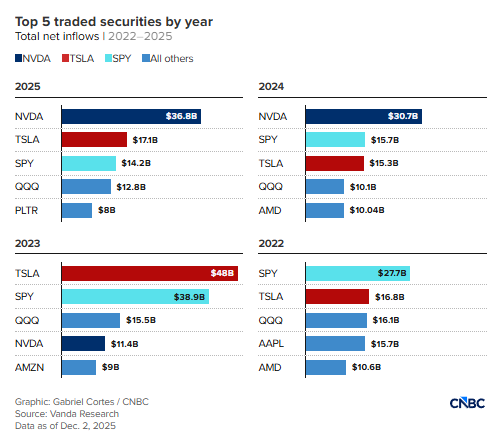

According to Vanda's data, Palantir is expected to become the fifth largest securities by net purchase amount this year, after large market capitalization stocks such as Tesla (TSLA.US) and NVDA.US (NVDA.US), and popular trading funds such as the SPDR S&P 500 ETF (SPY), which tracks the benchmark of the entire US stock market.

Viraj Patel, Vanda's associate research director responsible for tracking retail fund flows, said: “The performance was outstanding. To some extent, Palantir has been included in the ranks of those AI technology 'frontline' players.”

A “crazy” business model

As the stock price took off, Palantir won the favor of a large number of retail investors. Its stock price has accumulated a cumulative increase of more than 150% since 2025, and is expected to achieve a three-digit increase for the third year in a row. Over the past three years, the stock has surged nearly 3000%, far outperforming the S&P 500 index, which rose about 80% during the same period, and the Nasdaq Composite Index, which is dominated by technology stocks, which rose more than 120%.

Since its launch in 2020, Palantir has been regarded as a rather mysterious enterprise due to its services to both public and private institutions. On the face of it, Palantir helps governments and large enterprises organize and manage data. In addition to being seen as a beneficiary of the wave of AI adoption, the company is also seen as a potential winner under the Trump administration's policy approach of emphasizing improving the efficiency of the federal government and strengthening national defense.

Investment banker Paxton Earl, who focuses on software, said, “For a while, people always joked, 'What is Palantir really for? '” To better understand the company, he began studying regulatory documents. After learning more, he recalled his thoughts at the time: “This is actually a really crazy business, and it's really great.”

Through research, Paxton Earl discovered that Palantir's revenue structure was more diverse than he had initially anticipated, and did not rely solely on military business. Additionally, the 23-year-old young investor also discovered that Palantir's customers include familiar consumer-oriented brands such as Ferrari (RACE.US) and WEN.US (WEN.US).

Paxton Earl said he bought more shares after the company released its third-quarter earnings report in early November. In the same month, as investors sold off AI concept stocks due to valuation concerns, Palantir's stock price plummeted 16%, the worst monthly performance in more than two years.

Wall Street generally attributed this round of decline to profit returns and concerns about the overall health of AI transactions. According to Vanda's data, Palantir's retail purchases were mainly concentrated in the first nine months of this year. Afterwards, as concerns about the AI bubble heated up, investors began to have questions about the deal, and buying power cooled down somewhat.

The “romantic complex” of retail investors

Palantir has been deliberately attracting individual traders like Paxton Earl. Although other well-known companies usually leave the Q&A session of earnings calls to Wall Street analysts or reporters, Palantir also accepts questions from retail investors. In an annual video shared late last year, the company's CEO Alex Karp even publicly thanked these minority shareholders on the ski slopes. He said at the time, “I am extremely grateful to all individual investors who are willing to invest time and opportunity and have the courage to break out of the cliché, old, and inflexible clichés.”

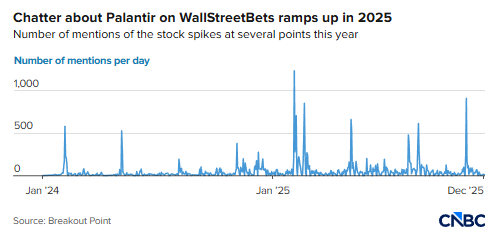

The stock also became the focus of attention on the popular Reddit forum WallStreetBets. According to data from the “meme stock” tracking company Breakout Point, Palantir was the most mentioned stock on this forum in multiple trading days in 2025.

Ivan Ćosović, Managing Director of Breakout Point, said: “Palantir has been WallStreetBets's 'love partner' for a long time and they really enjoyed it.”

Of course, discussions on social media aren't all positive voices. Some investment content creators have questioned whether Palantir is morally appropriate to hold shares in the company, given its links to war technology and its partnership with the US Immigration and Customs Enforcement (ICE).

The hesitation of big money

Compared to the enthusiasm of ordinary retail investors, Wall Street has not followed suit with the same vigor. According to LSEG statistics, the average rating given by analysts is “hold,” and many of them mentioned concerns about the valuation level.

Gil Luria, head of technical research at D.A. Davidson, said Palantir's valuation made its stock “simply impossible” for institutional clients. Currently, the stock's price-earnings ratio is about 450 times the earnings of the past 12 months, while the average of the S&P 500 index is only close to 28 times.

Gil Luria, on the other hand, believes that retail investors may have been impressed by Palantir's “ambitious” mission to play a role in US defense. Also, these regular investors are likely to be attracted to Alex Karp himself. Gil Luria said Alex Karp's ability to market the company's vision is quite similar to Tesla CEO Elon Musk, but much less controversial.

Gil Luria also pointed out that Palantir is reminiscent of Tesla ten years ago, when the car company was drawing a future centered on electric vehicles. Over the past ten years, Tesla's stock price has accumulated a cumulative increase of about 3000%, while the S&P 500 index rose by more than 230% during the same period.

The question is whether the retail investors who bet on Tesla ten years ago will once again be proven right by Palantir. Gil Luria said that Palantir's overall profit performance over the past few years has been quite strong. In the second-quarter earnings report released in August this year, the company's performance not only exceeded Wall Street expectations, but also raised its full-year results guidance driven by the AI boom. It made him reconsider whether it was worth buying the stock despite its high valuation.

Gil Luria said, “Even our most cynical, oldest, and most old-fashioned Wall Street analysts were blown away by how successful it was. This success was so amazing that I had to re-examine everything I had known in the past.”

Scion Asset Management, with Michael Burry, the prototype of “The Big Short” at the helm and now deregistered, revealed shorting bets on Palantir and Nvidia, another AI star stock, in the third quarter. Alex Karp said Michael Burry's move was “just insane.”

Is the valuation too high, or is it doomed?

Retail investors are not deterred by the cautious attitude of institutional investors. As Ivan Ćosović of Breakout Point said, in Michael Burry's eyes, it was “overvalued,” but in WallStreetBets's view, it was “destined for life.”

Since this year, Palantir's stock price has fluctuated quite a bit, falling by more than 10% several times in a single trading day. But for retail investors who hold the shares, these fluctuations instead provide an opportunity to buy the company they believe in at a lower price. Some investors said, “You will slowly get a little numb to price fluctuations” and plan to buy thousands more dollars of stock during the next sharp pullback. “I just have that kind of belief, and I think it will perform very well in the end.”