Is Burlington (BURL) Still Undervalued After Its Recent Share Price Rebound?

Burlington Stores (BURL) has quietly outperformed many retail peers lately, with shares up about 11% over the past month and 9% in the past 3 months, drawing fresh attention to its valuation.

See our latest analysis for Burlington Stores.

Zooming out, the recent 30 day share price return of about 11% and 3 year total shareholder return above 40% suggest momentum is rebuilding as investors warm to Burlington’s growth and margin story at around $288 a share.

If Burlington’s rebound has you thinking more broadly about consumer trends, it could be worth exploring fast growing stocks with high insider ownership as another way to spot emerging opportunities with aligned management incentives.

With sales and profits growing double digits and the stock still trading at a notable discount to analyst targets, investors now face a key question: Is Burlington still undervalued, or is the market already pricing in its next leg of growth?

Most Popular Narrative Narrative: 14.3% Undervalued

With Burlington Stores closing at $288.24 versus a most popular narrative fair value near $336, the story leans toward upside supported by improving profitability.

The ongoing upgrades to merchandising and store operations (Burlington 2.0 initiatives), including modernized layouts and improved associate engagement, have produced measurable improvements in sales productivity and margin control, indicating potential for further net margin expansion as these initiatives scale across the chain.

If you want to see what kind of earnings power those margin gains could unlock, and what profit multiple is reflected in this outlook, explore the full narrative.

Result: Fair Value of $336.2 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution is not risk free, as heavier store expansion and limited digital investment could leave earnings exposed if consumer demand or shopping behavior shifts.

Find out about the key risks to this Burlington Stores narrative.

Another Take on Valuation

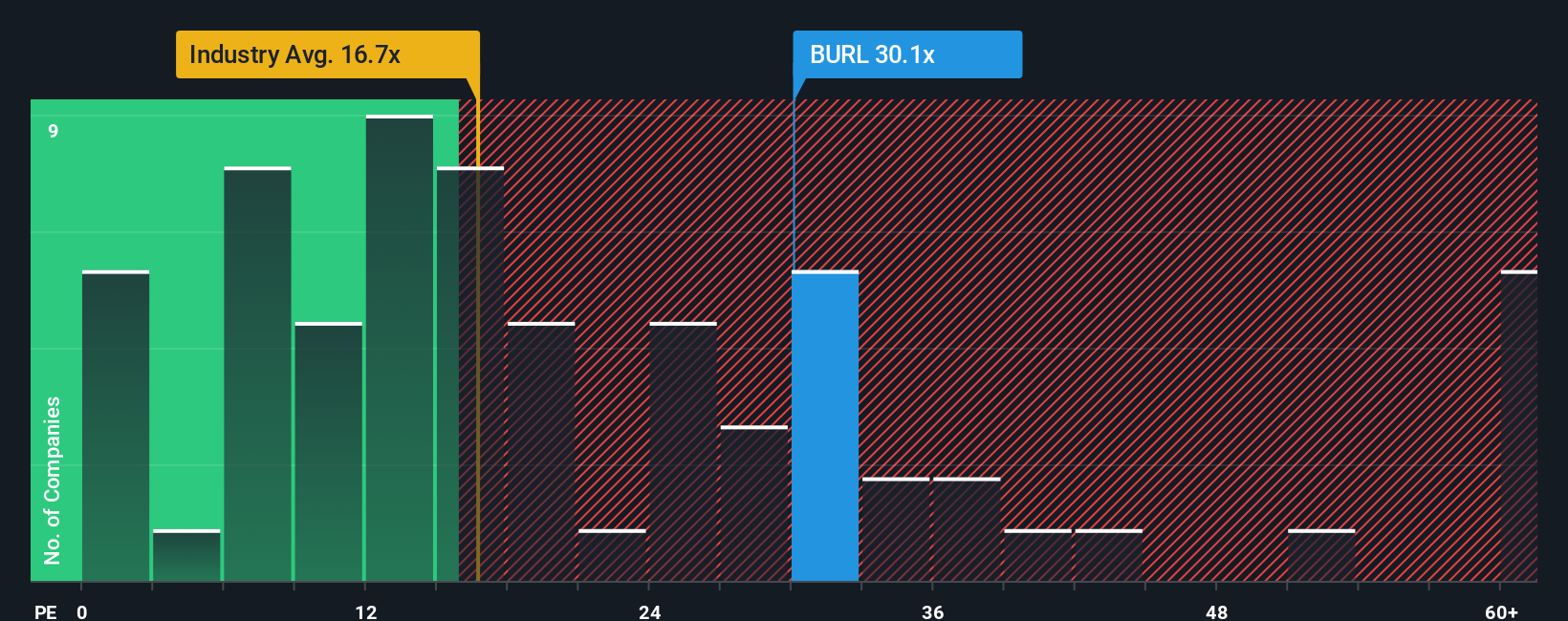

While the popular narrative and analyst targets suggest upside, a simple earnings multiple comparison sends a cooler signal. Burlington trades on about 32 times earnings versus a 19.9 times industry average and a fair ratio near 23.6 times, which implies investors are already paying up for execution.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Burlington Stores Narrative

If you see the story differently or would rather test your own assumptions against the numbers, you can build a custom view in under three minutes: Do it your way.

A great starting point for your Burlington Stores research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not stop at Burlington alone. Use the Simply Wall Street Screener to uncover stocks that could sharpen your portfolio and help you stay one step ahead.

- Capture powerful secular trends by reviewing these 24 AI penny stocks that may benefit most from the accelerating adoption of machine learning and automation.

- Strengthen long term income potential by targeting these 10 dividend stocks with yields > 3% that combine meaningful yields with sustainable payout profiles.

- Position yourself for market mispricing opportunities by scanning these 901 undervalued stocks based on cash flows where cash flow strength is not yet fully reflected in share prices.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com