Asian Growth Companies With Strong Insider Backing In December 2025

As December 2025 unfolds, the Asian markets are navigating a complex landscape marked by Japan's significant interest rate hike, the highest in three decades, and China's mixed economic signals highlighting sluggish growth. In this environment, companies with strong insider ownership can be particularly appealing to investors seeking stability and confidence amid fluctuating market conditions.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| UTI (KOSDAQ:A179900) | 25% | 120.7% |

| Streamax Technology (SZSE:002970) | 32.5% | 33.1% |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 78.8% |

| Novoray (SHSE:688300) | 23.6% | 31.4% |

| Loadstar Capital K.K (TSE:3482) | 31% | 23.6% |

| Laopu Gold (SEHK:6181) | 34.8% | 34.3% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 31.6% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 37.2% |

| Ganfeng Lithium Group (SZSE:002460) | 26.7% | 46.5% |

| Fulin Precision (SZSE:300432) | 10.6% | 55.2% |

Let's review some notable picks from our screened stocks.

Horizon Robotics (SEHK:9660)

Simply Wall St Growth Rating: ★★★★☆☆

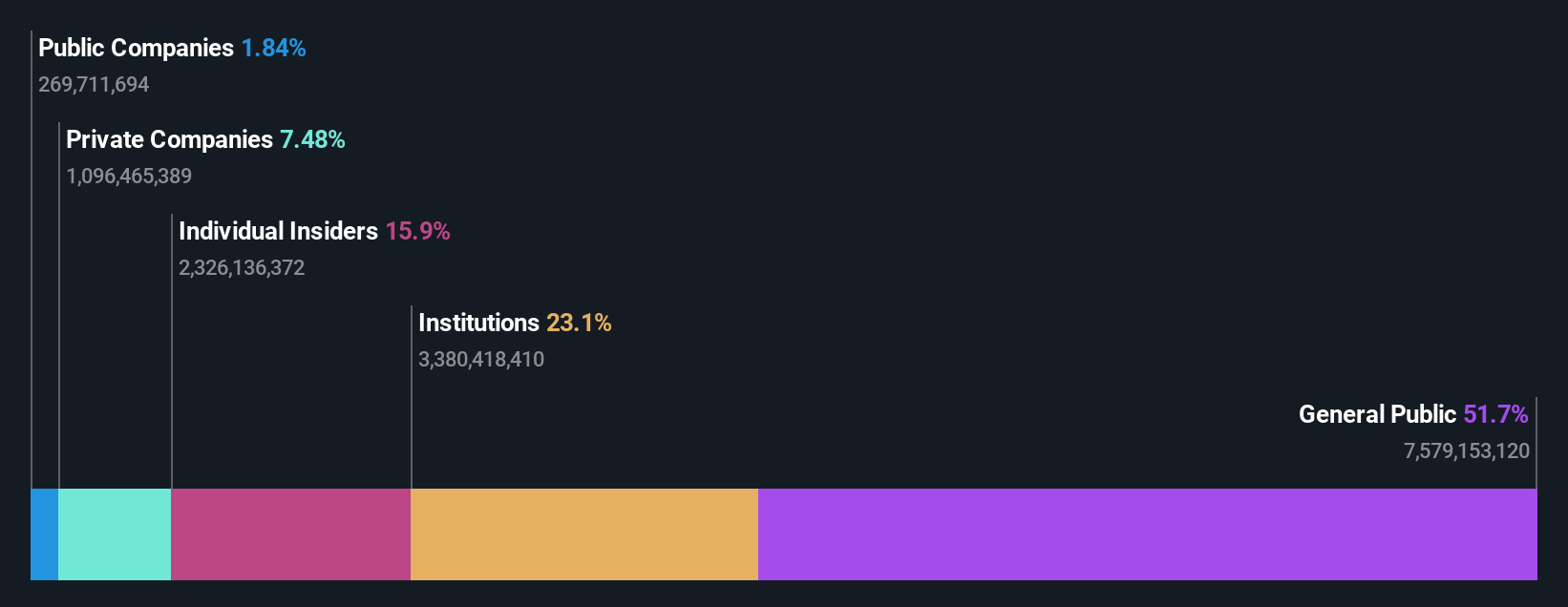

Overview: Horizon Robotics, an investment holding company, offers automotive solutions for passenger vehicles in China and has a market cap of approximately HK$128.20 billion.

Operations: The company's revenue is primarily derived from its automotive solutions segment, which generated CN¥2.91 billion, while the non-automotive solutions segment contributed CN¥100.77 million.

Insider Ownership: 15.9%

Revenue Growth Forecast: 31.6% p.a.

Horizon Robotics, with high insider ownership and recent insider buying, is poised for significant revenue growth at 31.6% annually, outpacing the Hong Kong market. Despite becoming profitable this year, its earnings growth of 14% annually is moderate compared to significant benchmarks. The company recently raised HK$6.38 billion through a follow-on equity offering, indicating strong market interest and potential for future expansion despite being forecasted as unprofitable in three years.

- Get an in-depth perspective on Horizon Robotics' performance by reading our analyst estimates report here.

- Our valuation report unveils the possibility Horizon Robotics' shares may be trading at a premium.

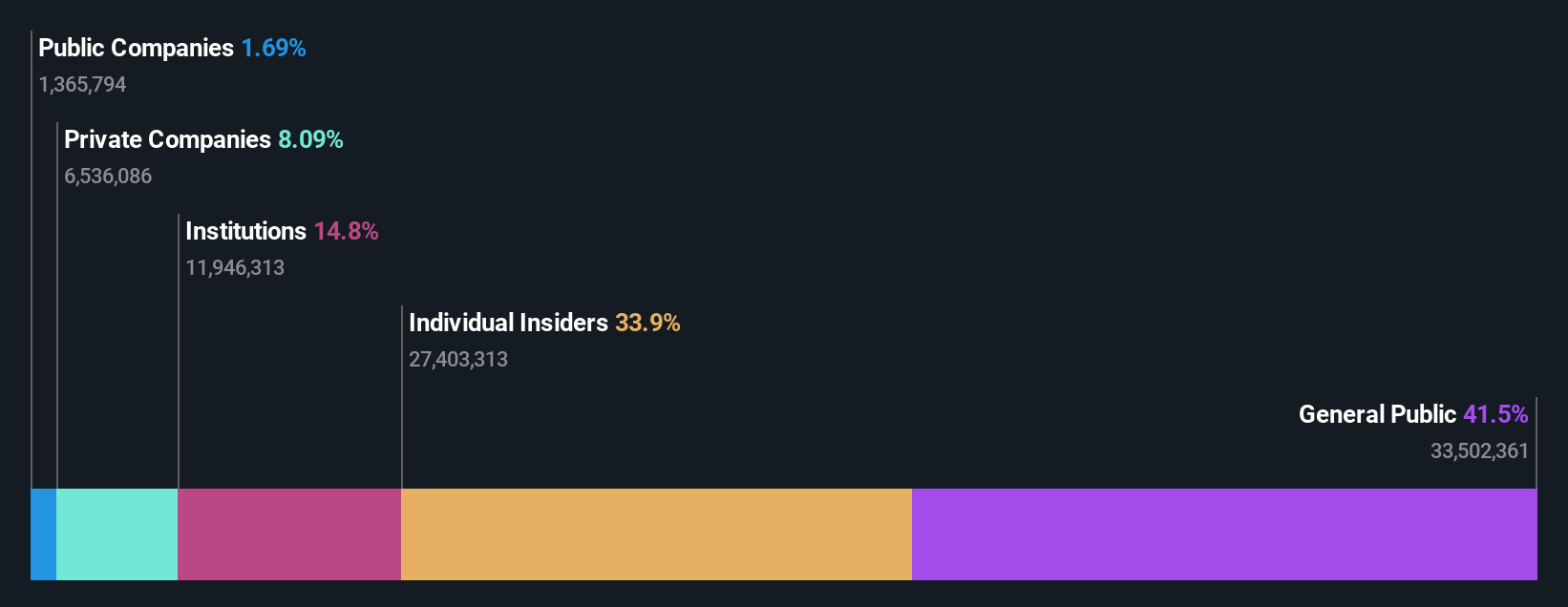

Zhejiang Leapmotor Technology (SEHK:9863)

Simply Wall St Growth Rating: ★★★★★★

Overview: Zhejiang Leapmotor Technology Co., Ltd. focuses on the research, development, production, and sale of new energy vehicles in Mainland China and internationally, with a market cap of HK$71.01 billion.

Operations: The company generates revenue of CN¥47.57 billion from its activities in the production, research and development, and sales of new energy vehicles.

Insider Ownership: 14.9%

Revenue Growth Forecast: 30.5% p.a.

Zhejiang Leapmotor Technology, with substantial insider buying and high insider ownership, is expected to see robust revenue growth of 30.5% annually, surpassing the Hong Kong market's growth. Analysts agree on a potential 64% stock price increase as the company aims for profitability in three years. Recent board changes include replacing Mr. Douglas Ostermann with Mr. Davide Mele as a non-executive director, reflecting strategic shifts amid amendments to company bylaws approved in December 2025.

- Unlock comprehensive insights into our analysis of Zhejiang Leapmotor Technology stock in this growth report.

- Our expertly prepared valuation report Zhejiang Leapmotor Technology implies its share price may be lower than expected.

GuangDong Suqun New MaterialLtd (SZSE:301489)

Simply Wall St Growth Rating: ★★★★★☆

Overview: GuangDong Suqun New Material Co., Ltd. is involved in the research, development, production, and sales of electronic and electrical functional materials in China, with a market cap of CN¥17.97 billion.

Operations: GuangDong Suqun New Material Co., Ltd. generates its revenue through the research, development, production, and sales of electronic and electrical functional materials within China.

Insider Ownership: 33.9%

Revenue Growth Forecast: 25.9% p.a.

GuangDong Suqun New Material Ltd. demonstrates significant growth potential, with earnings projected to rise 44% annually, outpacing the Chinese market's 27.5%. The company's revenue is also set to increase by 25.9% per year, faster than the market average of 14.6%. Recent earnings reports show a strong performance, with net income rising from CNY 41.72 million to CNY 63.49 million year-on-year, despite a highly volatile share price and low forecasted return on equity at 14.3%.

- Navigate through the intricacies of GuangDong Suqun New MaterialLtd with our comprehensive analyst estimates report here.

- Insights from our recent valuation report point to the potential overvaluation of GuangDong Suqun New MaterialLtd shares in the market.

Key Takeaways

- Dive into all 631 of the Fast Growing Asian Companies With High Insider Ownership we have identified here.

- Want To Explore Some Alternatives? We've found 10 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com