Promising Middle East Stocks Including Amanat Holdings PJSC And 2 More Hidden Gems

As most Gulf markets experience a downturn due to lower oil prices, investors are carefully navigating the region's financial landscape in search of resilient opportunities. In this environment, identifying stocks with strong fundamentals and growth potential becomes crucial, as they can offer stability amidst broader market fluctuations.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Qassim Cement | NA | 4.02% | -11.40% | ★★★★★★ |

| Baazeem Trading | 10.02% | -1.27% | -1.66% | ★★★★★★ |

| Sure Global Tech | NA | 10.11% | 15.42% | ★★★★★★ |

| MOBI Industry | 18.09% | 6.66% | 22.02% | ★★★★★★ |

| Nofoth Food Products | NA | 15.49% | 26.47% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 3.26% | 17.17% | 23.30% | ★★★★★★ |

| Najran Cement | 14.49% | -4.20% | -30.16% | ★★★★★★ |

| Etihad GO Telecom | 0.85% | 38.36% | 57.78% | ★★★★★☆ |

| National Environmental Recycling | 69.43% | 43.47% | 32.77% | ★★★★☆☆ |

| Birikim Varlik Yonetim Anonim Sirketi | 59.38% | 42.42% | 36.01% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Amanat Holdings PJSC (DFM:AMANAT)

Simply Wall St Value Rating: ★★★★★☆

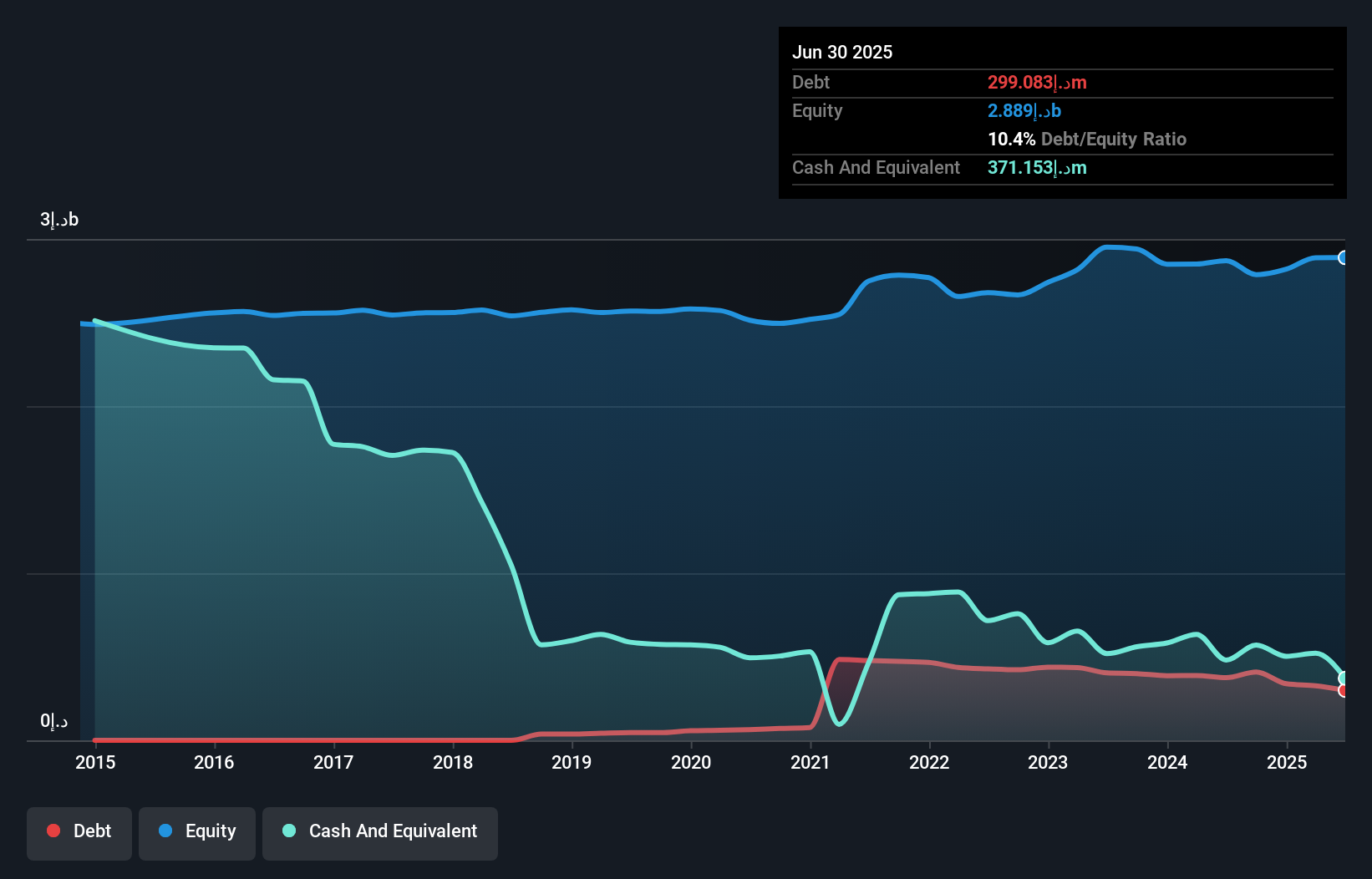

Overview: Amanat Holdings PJSC is an investment company that focuses on the education and healthcare sectors in the United Arab Emirates and internationally, with a market capitalization of AED3.15 billion.

Operations: The company generates revenue primarily from its investments in the education and healthcare sectors, with AED495.94 million coming from education and AED380.40 million from healthcare.

Amanat Holdings PJSC, a small cap entity in the Middle East, has shown significant financial growth over the past year with earnings jumping 330.2%, outpacing the Diversified Financial industry’s 15.4%. The company's net income for Q3 2025 was AED29.22 million, a turnaround from a net loss of AED11.11 million in the same period last year. Despite an increase in debt to equity ratio from 2.8% to 10.9% over five years, Amanat's free cash flow remains strong at AED103 million as of September 2025, indicating robust operational efficiency and effective financial management amidst industry challenges.

Gedik Yatirim Menkul Degerler (IBSE:GEDIK)

Simply Wall St Value Rating: ★★★★☆☆

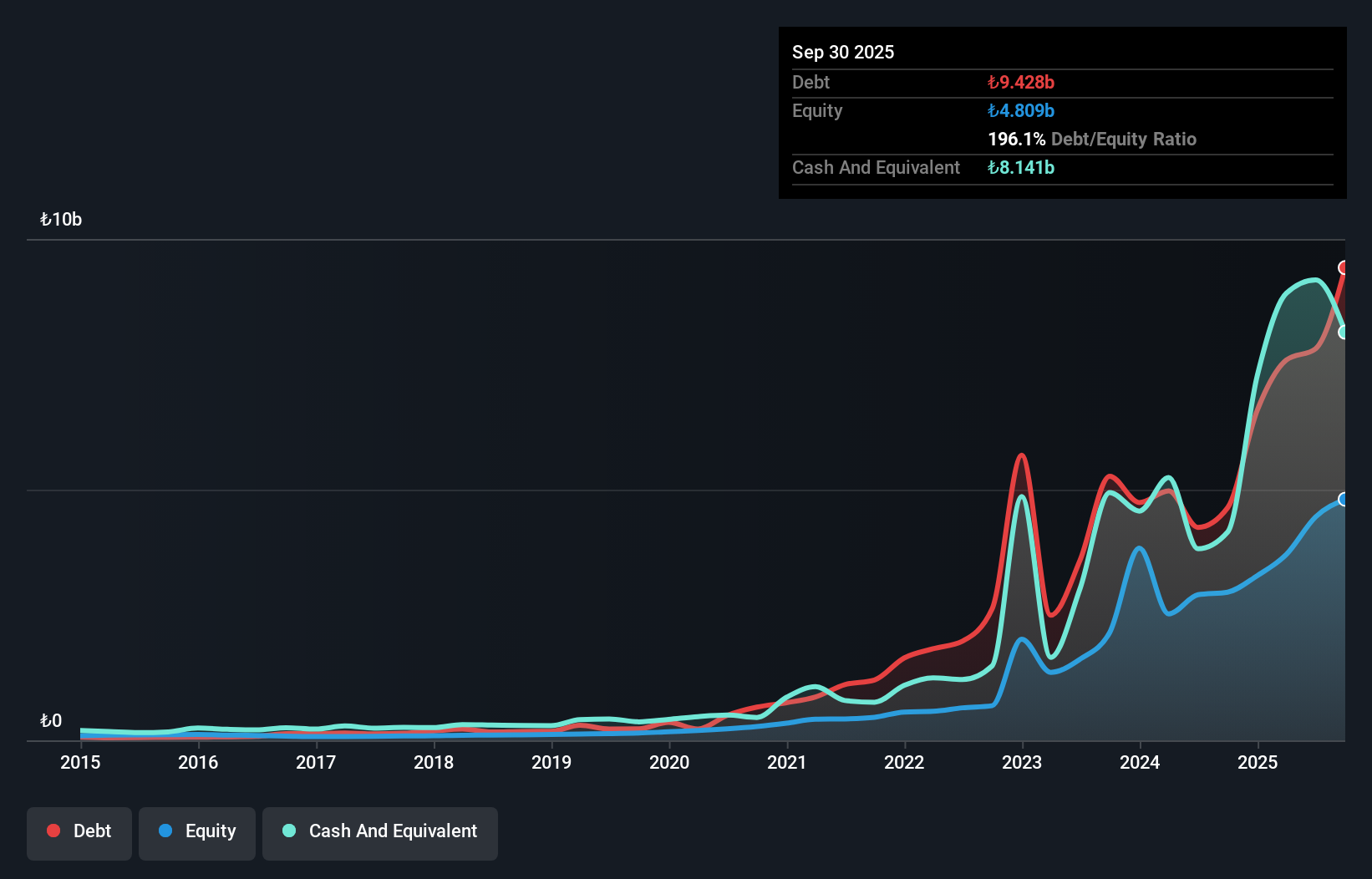

Overview: Gedik Yatirim Menkul Degerler A.S. is an investment banking company operating in Turkey and internationally, with a market capitalization of TRY11.23 billion.

Operations: Gedik Yatirim generates revenue primarily through brokerage activities, amounting to TRY274.80 million. The company's financial performance can be further analyzed by examining its net profit margin trends over time.

Gedik Yatirim Menkul Degerler, a financial entity in the Middle East, showcases impressive growth with a 156% earnings increase over the past year, outpacing its industry. Their debt to equity ratio has improved from 240.1% to 196.1% over five years, indicating better financial health. With a price-to-earnings ratio of 8.8x compared to the TR market's 18.5x, it suggests undervaluation potential for investors seeking value opportunities. Recent results show net income of TRY 118 million for Q3 and TRY 1,206 million for nine months ended September 2025, highlighting significant recovery from previous losses and showcasing robust profitability prospects moving forward.

Delta Israel Brands (TASE:DLTI)

Simply Wall St Value Rating: ★★★★★★

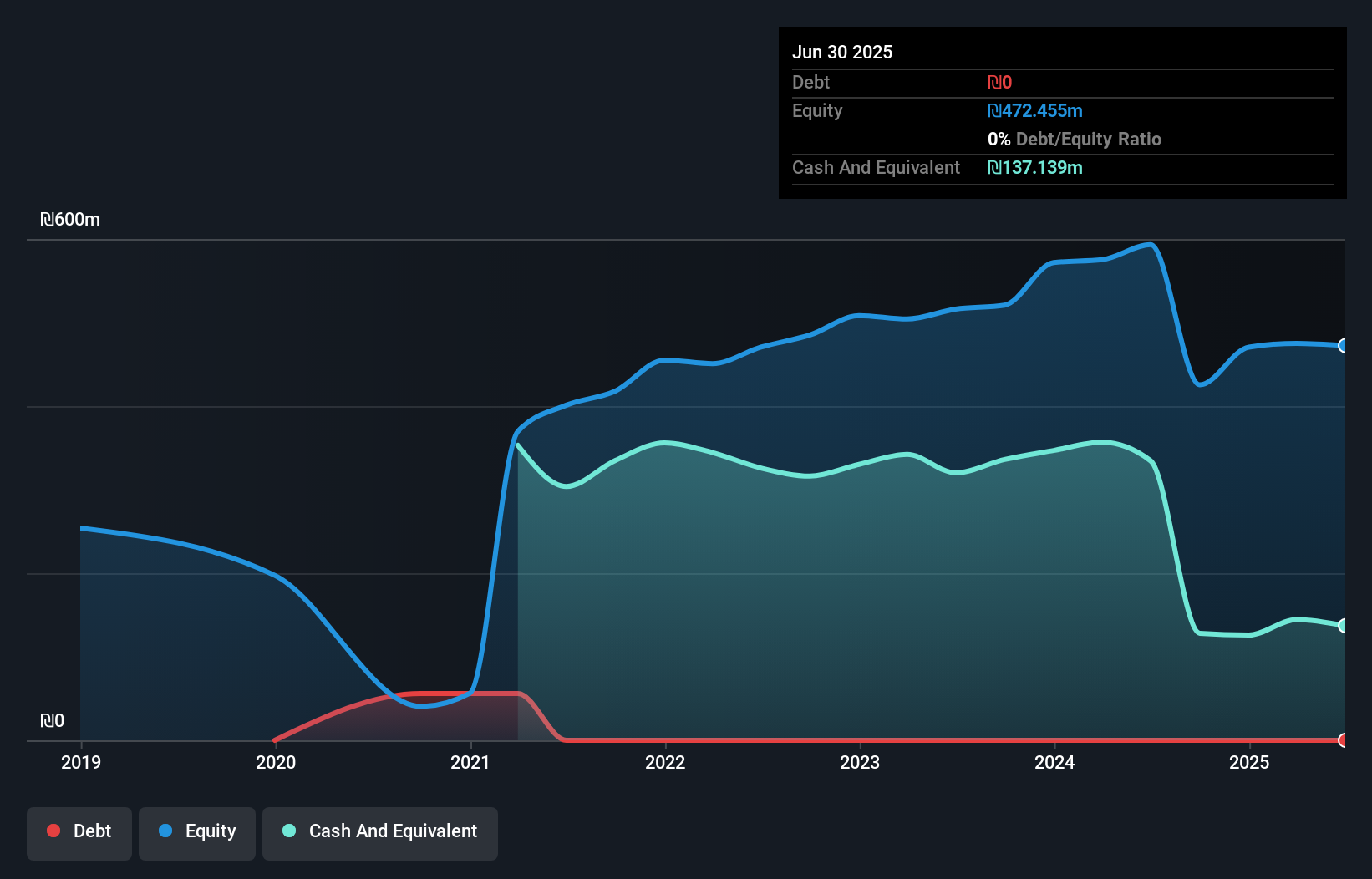

Overview: Delta Israel Brands Ltd. designs, develops, markets, and sells various clothing products in Israel with a market cap of ₪2.83 billion.

Operations: Delta Israel Brands generates revenue primarily from its Owned Brands, contributing ₪1.11 billion, and Franchise Brands, adding ₪181.33 million.

Delta Israel Brands, a nimble player in the market, shows intriguing dynamics with no debt on its books compared to a hefty 137.7% debt-to-equity ratio five years ago. Despite facing a challenging year with earnings growth at -4.2%, lagging behind the Specialty Retail industry's 4.9%, it remains free cash flow positive, indicating operational efficiency. Recent financials highlight sales of ILS 336 million for Q3 2025, up from ILS 289 million last year, and net income increased to ILS 37 million from ILS 31 million. The company declared an upcoming dividend of ILS 1.12 per share, reflecting shareholder value focus amidst fluctuating earnings per share figures over nine months this year compared to last year's period.

- Get an in-depth perspective on Delta Israel Brands' performance by reading our health report here.

Examine Delta Israel Brands' past performance report to understand how it has performed in the past.

Summing It All Up

- Discover the full array of 180 Middle Eastern Undiscovered Gems With Strong Fundamentals right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com