Global Value Stock Picks Including 3 Companies That Investors Might Be Undervaluing

In the current global market landscape, investors are navigating a mixed bag of economic signals, from Japan's highest interest rate hike in 30 years to a cooling U.S. inflation report that has buoyed some indices. Amid these fluctuations, identifying undervalued stocks can be an attractive strategy for those looking to capitalize on discrepancies between market price and intrinsic value, particularly when broader concerns about valuations and spending in sectors like AI persist.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Takara Bio (TSE:4974) | ¥791.00 | ¥1575.00 | 49.8% |

| Shuangdeng Group (SEHK:6960) | HK$14.97 | HK$29.65 | 49.5% |

| Sanoma Oyj (HLSE:SANOMA) | €9.21 | €18.38 | 49.9% |

| Redelfi (BIT:RDF) | €11.70 | €23.31 | 49.8% |

| Outokumpu Oyj (HLSE:OUT1V) | €4.278 | €8.48 | 49.6% |

| LINK Mobility Group Holding (OB:LINK) | NOK32.95 | NOK65.81 | 49.9% |

| cyan (XTRA:CYR) | €2.26 | €4.50 | 49.8% |

| Cowell e Holdings (SEHK:1415) | HK$27.98 | HK$55.43 | 49.5% |

| Artifex Mundi (WSE:ART) | PLN12.20 | PLN24.34 | 49.9% |

| Allcore (BIT:CORE) | €1.345 | €2.66 | 49.4% |

Let's uncover some gems from our specialized screener.

Saudi Paper Manufacturing (SASE:2300)

Overview: Saudi Paper Manufacturing Company, with a market cap of SAR2.20 billion, produces and distributes paper pulp and tissue products within Saudi Arabia, the Gulf Cooperation Council countries, and internationally.

Operations: The company's revenue is primarily derived from its Manufacturing segment, which accounts for SAR918.01 million, complemented by the Trading and Others segment contributing SAR59.85 million.

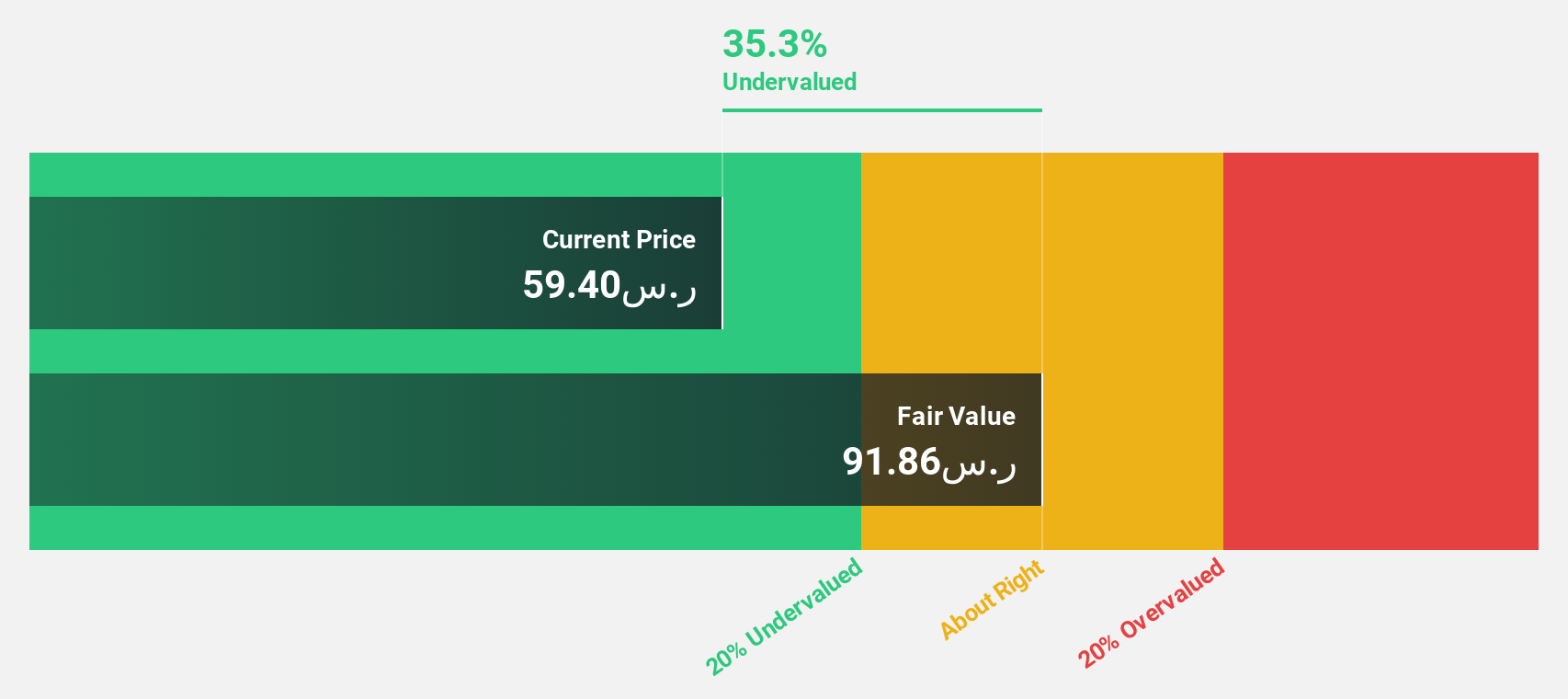

Estimated Discount To Fair Value: 35.4%

Saudi Paper Manufacturing is trading 35.4% below its estimated fair value of SAR91.96, with a current price of SAR59.4, indicating it may be undervalued based on cash flows. Despite recent declines in sales and net income, the company expects significant earnings growth of 32.3% annually over the next three years, outpacing the Saudi market's average growth rate. However, profit margins have decreased from 12.4% to 5.2%, and interest payments are not well-covered by earnings.

- Our comprehensive growth report raises the possibility that Saudi Paper Manufacturing is poised for substantial financial growth.

- Get an in-depth perspective on Saudi Paper Manufacturing's balance sheet by reading our health report here.

Hangzhou SF Intra-city Industrial (SEHK:9699)

Overview: Hangzhou SF Intra-city Industrial Co., Ltd. is an investment holding company offering intra-city on-demand delivery services in the People’s Republic of China, with a market cap of approximately HK$10.16 billion.

Operations: The company generates revenue of CN¥19.10 billion from its intra-city on-demand delivery service business in the People’s Republic of China.

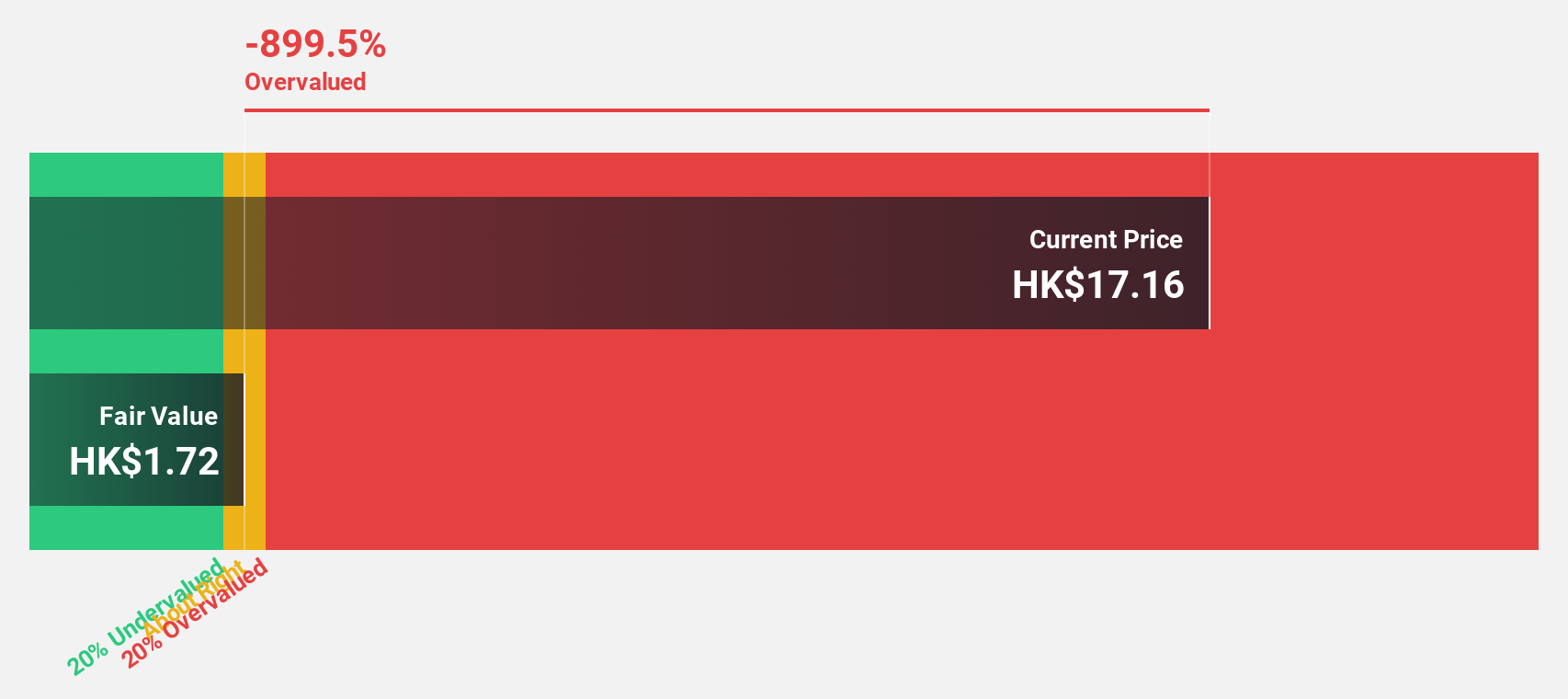

Estimated Discount To Fair Value: 32.2%

Hangzhou SF Intra-city Industrial is trading at HK$11.11, well below its estimated fair value of HK$16.38, suggesting it could be undervalued based on cash flows. With earnings growth forecasted at 53.6% annually, significantly above the Hong Kong market average, the company demonstrates strong potential despite a low future return on equity of 16.6%. Recent proposed amendments to its Articles of Association may impact governance but don't directly affect valuation metrics.

- Insights from our recent growth report point to a promising forecast for Hangzhou SF Intra-city Industrial's business outlook.

- Dive into the specifics of Hangzhou SF Intra-city Industrial here with our thorough financial health report.

Kakaku.com (TSE:2371)

Overview: Kakaku.com, Inc., with a market cap of ¥436.72 billion, offers purchase support and restaurant review services in Japan through its subsidiaries.

Operations: The company's revenue is primarily derived from its segments: Tabelog (¥36.75 billion), Kakaku.Com (¥24.04 billion), Kyujin Box (¥17.31 billion), and Incubation (¥8.91 billion).

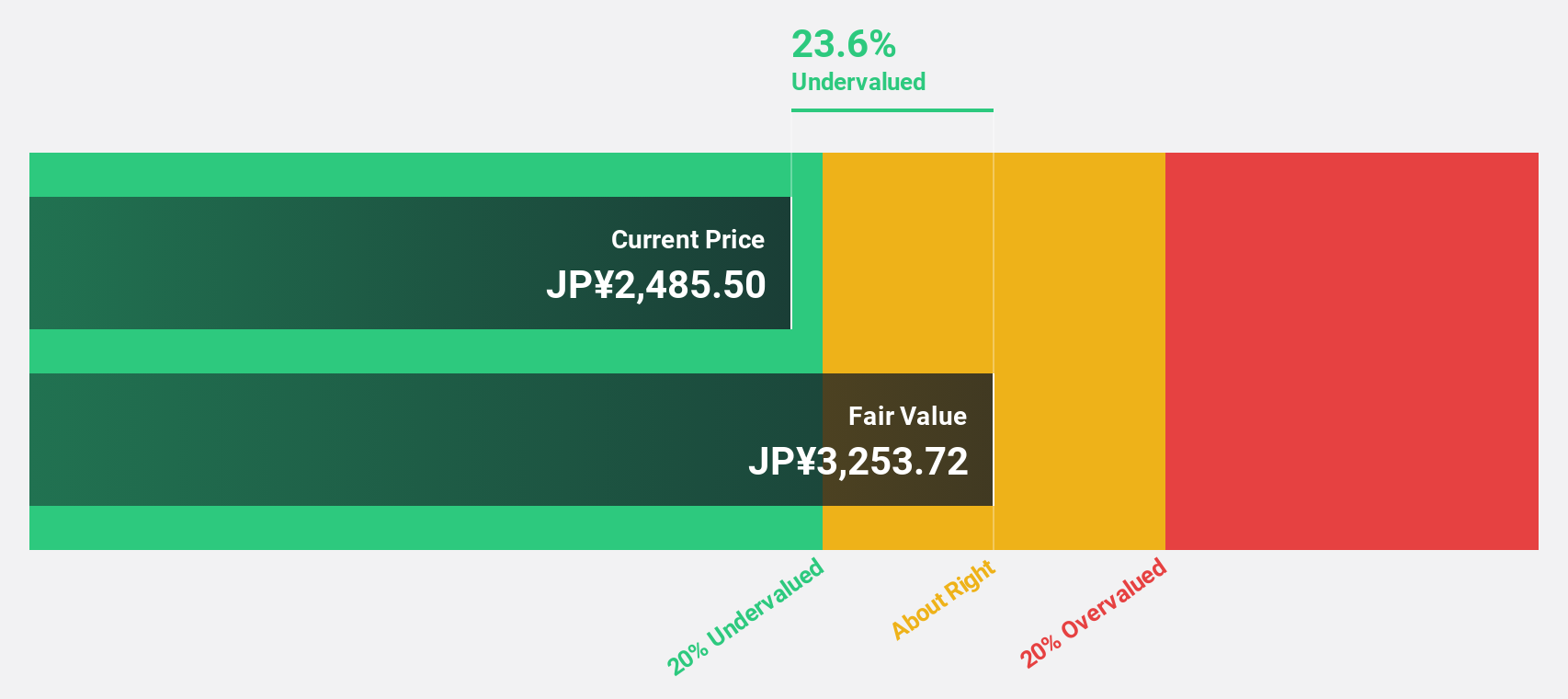

Estimated Discount To Fair Value: 32.3%

Kakaku.com is trading at ¥2355, significantly below its estimated fair value of ¥3476.04, indicating potential undervaluation based on cash flows. While earnings are forecasted to grow at 12.64% annually, outpacing the Japanese market average of 8.6%, revenue growth remains moderate at 11.7%. The company maintains a high projected return on equity of 40.1% in three years, though its dividend history is unstable and recent payouts remain unchanged from last year.

- The growth report we've compiled suggests that Kakaku.com's future prospects could be on the up.

- Navigate through the intricacies of Kakaku.com with our comprehensive financial health report here.

Taking Advantage

- Discover the full array of 485 Undervalued Global Stocks Based On Cash Flows right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com